Retirement countdown milestones: 4 strategic actions

This key pre-retirement planning checklist may potentially help you boost your future income.

One day you’re celebrating the first day at a new job. The next thing you know, toasts are being raised at your retirement party.

Taking action at these important milestones can help ensure that your post-work life is more relaxing than taxing. Here are four pre-retirement milestones and some strategic steps to consider taking at these stages.

What to do 10 years before retirement: Revisit tax diversification

At this stage of planning, it’s time to ramp up your savings and ask your Ameriprise financial advisor how you could allocate your assets across three tax-related categories to help manage your tax burden in retirement:

- Tax-deferred

- Tax-free

- Taxable

Tax diversification can help you:

- Keep more of your savings: When you carefully choose the assets you will use to generate retirement income, you could pay less in taxes.

- Maintain control of your withdrawals: Taxable and tax-free accounts, other than the Roth 401(k), do not have distribution requirements, allowing you to control when and how much you take. Tax-deferred qualified accounts generally require distributions at age 73, but you control distributions from tax-deferred accounts before age 73 and amounts you take over the RMD.

- Adapt for unexpected life events: For example, to pay for unexpected medical costs, you could adjust the timing or amount of withdrawals from taxable investments.

What to do 5 years before retirement: Bring your retirement goals into focus

In the five years leading up to your retirement, ask yourself: What’s important to you? What would you like to do with the additional freedom and flexibility in your life?

Maybe you want to volunteer, focus on a hobby or work part-time. As part of ongoing retirement planning, it’s important to clarify how you will fund the activities that bring you joy and fulfillment. For example, at the 5 year milestone before retirement, you may want to include maximizing contributions to your retirement plans or paying down unsecured debt, such as credit cards.

What to do 2-5 years before retirement: Plan for Social Security

Unlike other income sources, Social Security is income you cannot outlive. It also has the backing of the federal government and is protected against inflation.

Deciding when to file for it is a critical step in retirement planning. Although you can start collecting benefits at age 62, you may want to consider delaying, depending on your circumstances. With each year you delay, your overall benefit increases until reaching the maximum amount at age 70.

Your Ameriprise financial advisor will help you evaluate the Social Security benefit options that support your financial goals. They will account for your personal situation and factors such as:

- Varying tax rates on Social Security income.

- Capital gains and IRA withdrawals.

- Health issues and life expectancy in your family history.

Your pre-retirement planning checklist may also include these additional financial steps that are vital as you approach this important milestone:

- Maximizing contributions to your retirement plans to meet federal limits.

- Paying down unsecured debt, such as credit cards.

1 year out: Monitor your expenses

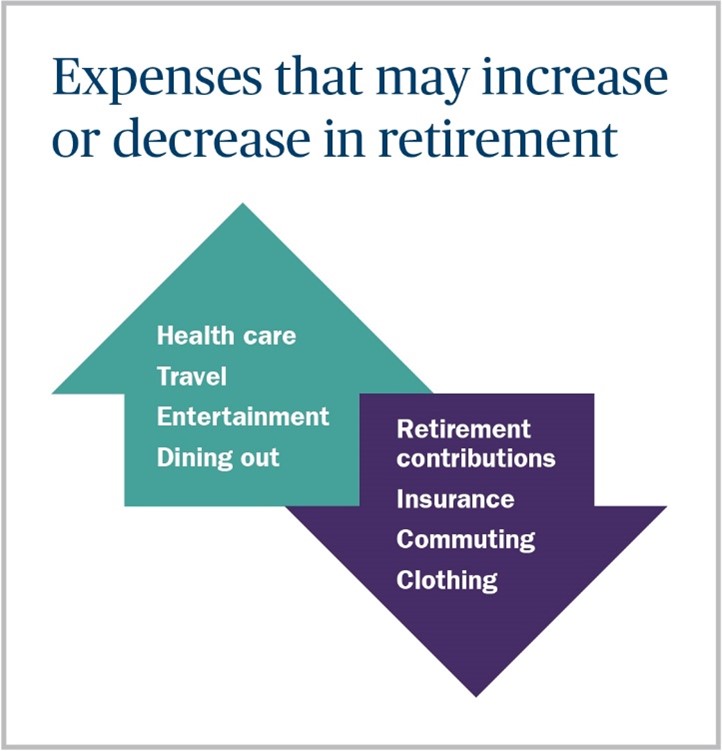

During the 12-month countdown to retirement, it’s important to appraise your monthly expenses. Consider keeping two running lists — either conceptually or literally using separate credit cards and checking accounts — to quantify two types of expenses:

- Essential needs, such as housing, groceries, utilities and health care.

- Lifestyle spending, such as travel, hobbies and dining out.

After a year you should have a good idea of how much income you’ll need for necessities, with extra money reserved for leisure and other lifestyle expenses.

Nearing a retirement milestone? Connect with us today

Your Ameriprise financial advisor will help you determine the appropriate steps to take now — before you stop working — to support your retirement income later. Reach out to them to factor tax diversification, Social Security income and lifestyle expenses into your financial picture.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

Diversification does not assure a profit or protect against loss.

Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SPIC.

Return to My Accounts

Return to My Accounts