2026 fixed income playbook: The case for ‘carry and roll’

Brian Erickson, Fixed Income Strategist – Ameriprise Financial

January 16, 2026

As we enter 2026, fixed income markets present compelling opportunities for investors seeking stability and income. With the Federal Reserve shifting toward a neutral policy stance and inflation moderating, investors may be uniquely positioned to benefit from intermediate-term bonds and a “carry and roll” fixed income strategy in 2026.

Here’s our 2026 outlook and an overview of the fixed income strategies to consider in the new year:

What is the bond market outlook for 2026?

For 2026, we believe the bond market outlook is positive, driven by stabilizing interest rates and attractive real yields. Here are the key takeaways:

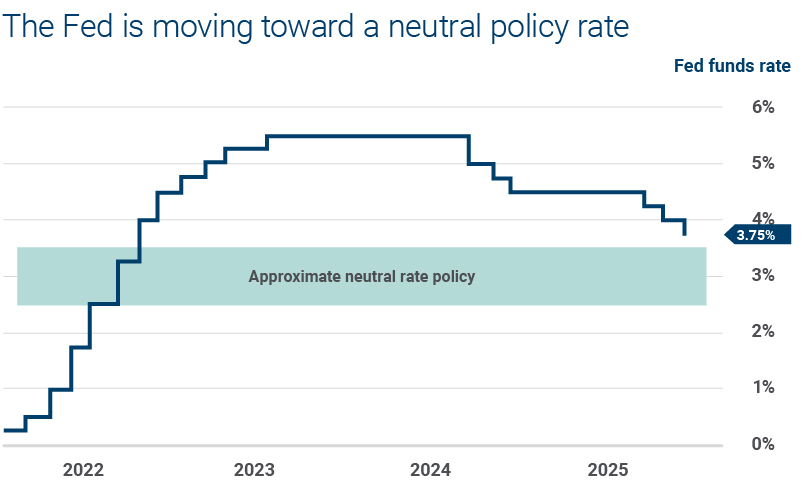

- Fed policy: The Fed’s recent rate cuts place policy rates between 3.50% and 3.75%, approaching what is generally considered a “neutral” position. Inflation is trending toward the 2% target, creating room for additional easing if labor market slack persists.

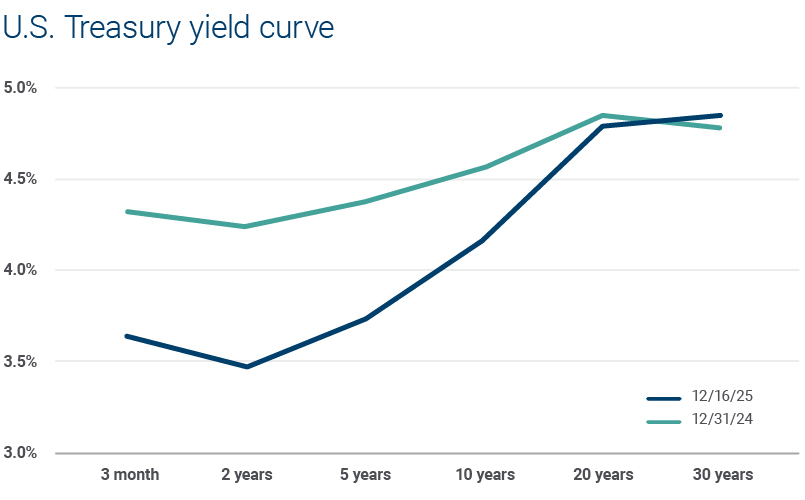

- Yield expectations: We project short-term yields to decline modestly and 10-year Treasury yields to end the year near 4.0%.

Ameriprise Financial experts explore key economic drivers, stock market trends and fixed income strategies to help you navigate the year ahead. (08:44)

Why intermediate-term bonds may shine in 2026

The interest rate cycle is a critical driver of fixed income opportunities, influencing both yield potential and price performance. In 2026, the neutral stance of the Fed may create a favorable environment for intermediate-term bonds, especially those in the 5- to 10-year range. Here’s why:

- When policy rates are elevated, as they were in 2023 and 2024, short-term instruments typically offer attractive yields, though changes in price may be either additive or a drag on performance.

- When policy rates are low for prolonged periods, such as the decade following the global financial crisis, the interest a bond pays is modest, offering little advantage over more volatile price movements.

- When Fed policy becomes balanced or neutral — like current conditions — intermediate maturities typically become increasingly appealing. These bonds tend to benefit investors with steady interest payments and incremental price gains as yields decline and maturities roll down the curve over time.

Source: Bloomberg L.P. and American Enterprise Investment Services, Inc.

How investors may benefit from the ‘carry and roll’ strategy in 2026

The “carry and roll” strategy combines reliable income with the opportunity for rising prices. In 2026, with interest rates expected to settle into neutral territory, this approach may be especially effective when applied to intermediate-term bonds (those maturing in 5 to 10 years).

Here’s how it works:

- Carry (income): “Carry” is the steady income investors receive from bond interest payments. Intermediate-term bonds begin with healthy coupon returns in 2026, with real yields projected to outpace inflation by about two percentage points.

- Roll (price gains): “Roll” refers to the potential for a bond’s value to increase as it gets closer to maturity. As time passes, these bonds can increase in value as they are repriced at shorter maturities, which often have lower yields.

Source: Bloomberg L.P.

2026 fixed income investment strategies

For investors considering portfolio rebalancing or incremental investment, bonds remain a cornerstone for stability and resilience. Beyond executing the “carry and roll” strategy with intermediate-term bonds, here are a few other investment considerations for 2026:

- Be mindful of overexposure to long-duration bonds given global indebtedness risks. With increased concerns about elevated debt and deficits, we expect longer-term fixed income, most notably U.S. Treasuries, to exhibit above-normal volatility in 2026.

- Review your cash allocation. With the Fed likely to continue lowering its policy rate in 2026, the window for robust yields within cash investments may be winding down. Consider reducing excess cash investments and looking for fixed-rate investments over floating-rate investments.

- Consider the benefits of municipal bonds. Municipals remain attractive further out on the curve for investors in taxable accounts looking to draw long-term income from investment portfolios.

Bottom line

Today’s environment is distinct: Policy rates remain above neutral but are trending lower, creating a potentially favorable backdrop for fixed income investors. This combination of declining rates and attractive real yields underscores why bonds continue to offer compelling value, even as valuations in riskier asset classes remain elevated.

Position your portfolio for 2026

Talk to your Ameriprise financial advisor about how to appropriately position your fixed income investments for the new year and put these insights into action.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.