Job market outlook: Will hiring recover in 2026?

Russell Price, Chief Economist – Ameriprise Financial

February 13, 2026

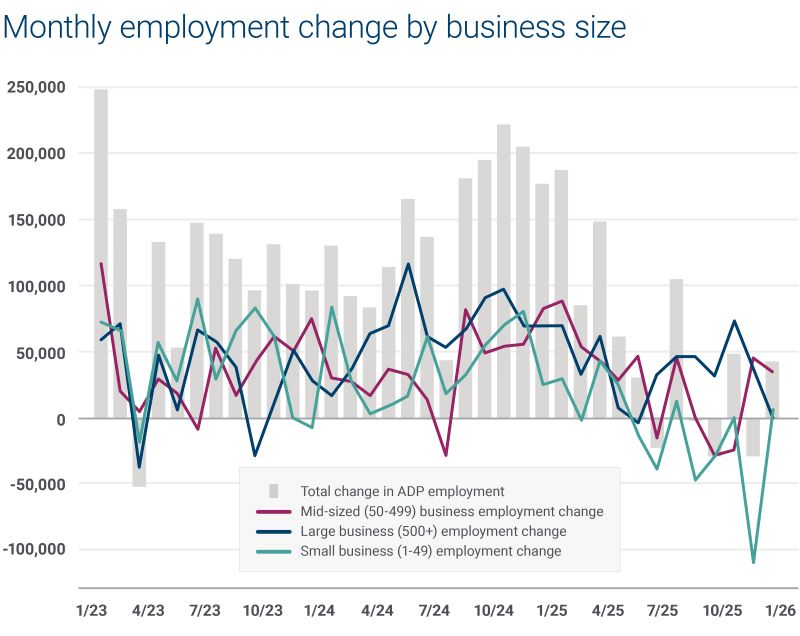

The job market is challenging for many Americans right now. Hiring was weak through much of 2025, and even after a solid start to 2026, it remains a key risk to the economic outlook.

So, what caused this weakness and can conditions improve? Here’s our 2026 labor market outlook:

Why did hiring “stall” in 2025?

The sharp deceleration in hiring in 2025 was an unusual phenomenon, since labor markets typically do not weaken significantly during periods of relatively strong economic growth.

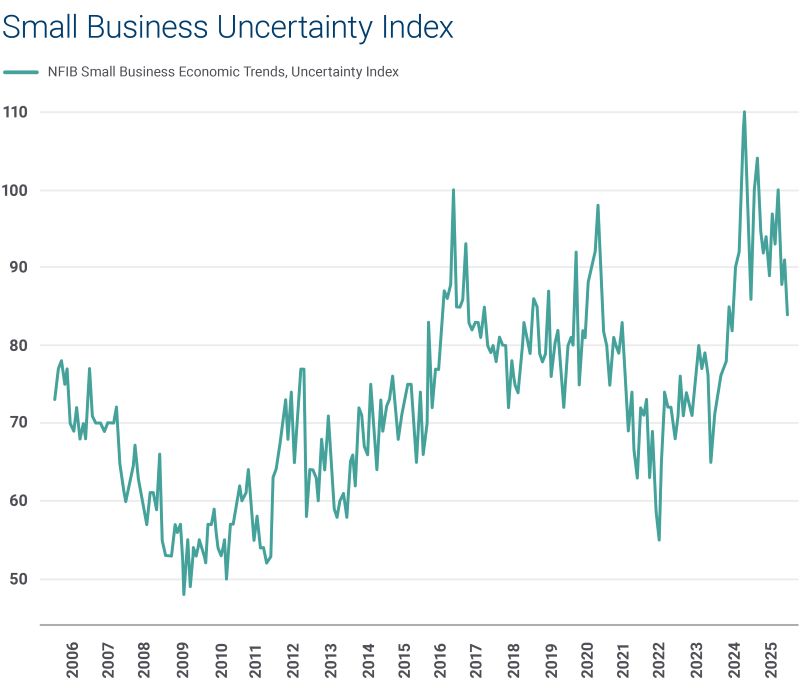

As such, job growth could have “stalled” due to several factors: tariff-related uncertainties, artificial intelligence-created redundancies or simply weak economic demand. But a broad measure of data appears to suggest that most of the slowdown was due to small business uneasiness related to tariffs.

According to government data, the pace of new jobs began to stall in May 2025 — right after the White House announced broad-scale tariffs on imported goods from across the globe. Over the first four months of 2025, net new job growth averaged 123,000 per month. Over the remaining eight months, job growth averaged just 12,000, with three months showing net job losses.

Source: FactSet

As the chart above shows, small businesses (50 or fewer employees) responded to tariffs with a much more significant pullback in labor demand. Hiring at medium (50 to 499 employees) and large businesses (500+) also slowed after tariffs were announced, but not to the same degree as their smaller counterparts. This response seems reasonable, in our view, since small businesses likely have fewer resources to handle the sudden implementation of broad-scale tariffs.

Are conditions finally looking up?

The worst of the hiring slowdown may be behind us as small businesses become more acclimated to the tariff environment. Consider these promising signs:

- Small business engagement with outside hiring firms surged in the final months of 2025, according to the Bank of America Institute.

- Net new hiring in the space grew in December for the first time since May, according to payroll provider ADP.

- Economic uncertainty is fading among small businesses. After jumping to multi-decade highs in the lead up to tariff announcements, the Small Business Uncertainty Index has meandered lower, reaching 84 in December, a level last seen in June 2024.

These are tentative developments, but trends that we believe can be maintained and built upon in the months and quarters ahead, as a steady pace of economic expansion should further build on the demand for labor.

Source: FactSet

Bottom line: Our 2026 job market outlook

We expect the job market to slowly improve as 2026 progresses. Overall, the hiring slowdown appears mostly due to small business challenges related to tariffs, and recent data shows small business hiring improving and uncertainty falling.

Total hiring also improved markedly in January. The Labor Department reported 172,000 net new private sector jobs to have been created and the unemployment rate ticked down to 4.3%, its lowest level since August.

However, if aggregate hiring were to remain soft or weaken — due to AI productivity enhancements or other factors — it would very likely slow consumer income growth. This could negatively impact consumer spending, slowly diminish overall consumer financial health over time and, ultimately, lead to an economic slowdown. These are factors that we are watching closely.

Your advisor is here to help you navigate economic uncertainty

If you’re concerned about the challenging job market, reach out to your Ameriprise financial advisor. They can help you prepare for the unexpected and identify other financial strategies to help you navigate uncertainty with more confidence.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.