Market and economic outlook: 6 investment strategies for 2026

Anthony Saglimbene, Chief Market Strategist – Ameriprise Financial

Russell Price, Chief Economist – Ameriprise Financial

January 9, 2026

After three years of strong U.S. stock gains, an AI boom and sometimes dramatic shifts in economic conditions, the financial outlook for 2026 suggests a more measured and steady path forward for the U.S. economy and markets.

Overall, we believe macroeconomic conditions have an opportunity to build on an already solid foundation in 2026. And while challenges persist and surprises are likely to emerge, the year ahead offers opportunities for investors who stay focused and disciplined.

Here’s our 2026 market and economic outlook, along with six investment strategies to consider to start the year:

Key takeaways for 2026

- Economic growth: The U.S. economy should be supported by strong infrastructure, technology and manufacturing investments in 2026. Healthy consumer trends, moderating inflation and fiscal tailwinds could enable gradual Federal Reserve rate cuts and sustained domestic growth.

- Stock market: Despite elevated valuations and concentrated gains in Big Tech, the U.S. stock market could deliver another year of positive returns if fundamental conditions hold. Returns will likely hinge on companies converting AI investments into measurable profit growth, margin expansion and productivity gains, as well as broader levels of earnings participation across industries.

- Portfolio positioning: Although our outlook for this year is generally favorable, investors should expect periods of volatility during 2026 and temper return expectations after three years of strong gains across broad stock averages. Prioritize active management, diversification and quality-focused strategies to mitigate concentration risk and enhance opportunities.

Ameriprise Financial experts explore key economic drivers, stock market trends and fixed income strategies to help you navigate the year ahead. (08:44)

The 2026 economy

Overall, we have a positive view of U.S. economic prospects in the year ahead. Stable economic conditions and a balanced pace of growth in 2026 may be an optimal mix after economic conditions have endured notable challenges over the last several years. In total, we believe the year ahead could be a solid, foundational year for economic growth.

Here are the key takeaways for investors:

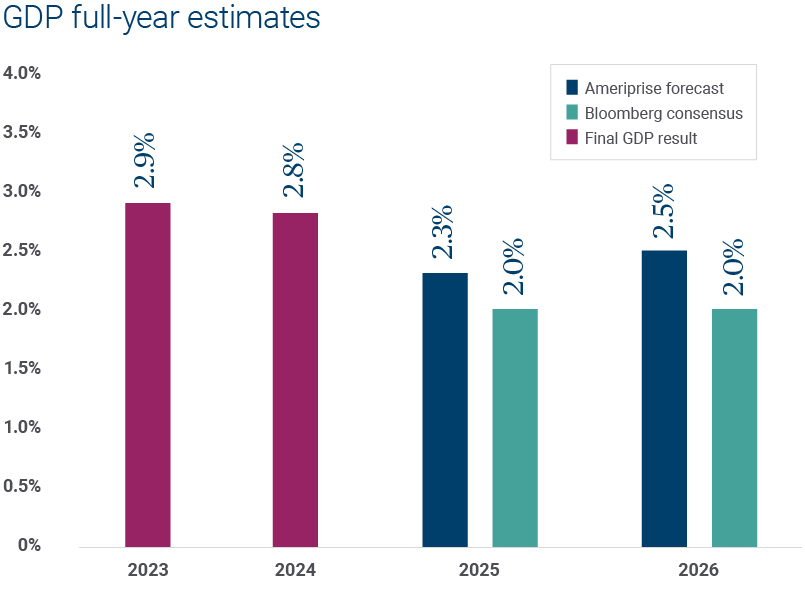

- We forecast U.S. real gross domestic product (GDP) to show full-year growth of +2.5% in 2026. Economic fundamentals sit on sound footing at the start of 2026, supported by solid infrastructure, technology and manufacturing investments alongside healthy consumer trends that could extend beyond high-income earners over the coming quarters. Fiscal policy, including the One Big Beautiful Bill Act, should add tailwinds this year through tax relief for some while incentivizing domestic capital spending.

Source: Ameriprise and Bloomberg.

-

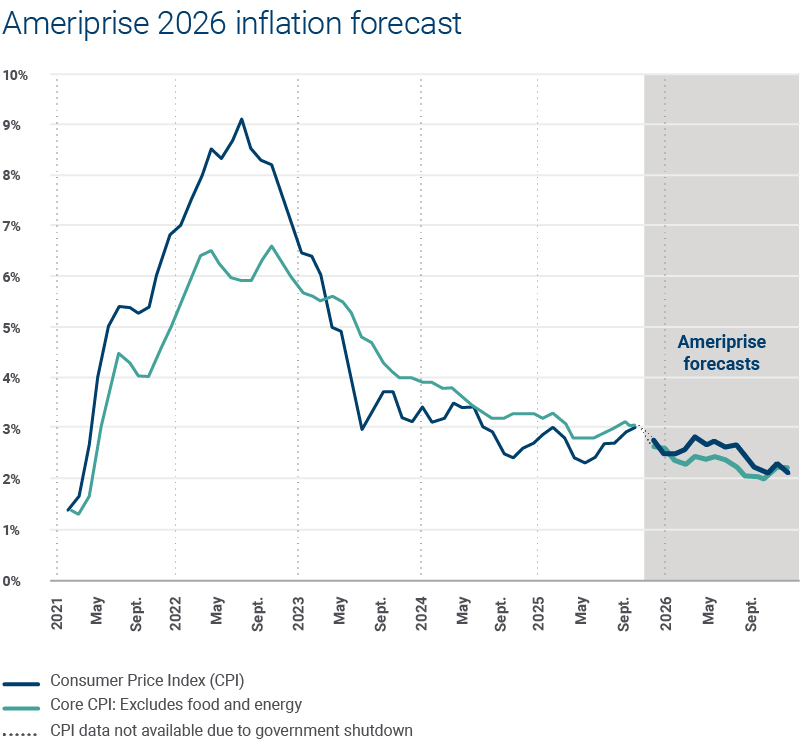

Inflation should finally moderate to the Fed’s +2.0% target by year-end. Recent inflation trends have been almost exclusively a reflection of higher tariffs, a factor that should diminish considerably as we reach the anniversary of tariff rate implementations, starting in the second quarter. The “shelter” component of the Consumer Price Index (CPI), which accounts for a hefty 35% of the Index, has also been decelerating more rapidly in recent months. Furthermore, inflation could face additional downside if the U.S. Supreme Court were to rule that tariffs enacted under the International Emergency Economic Powers Act (IEEPA) are illegal.

Source: U.S. Labor Department and AEIS Inc. For illustrative purposes and is not guaranteed.

- The job market is the most significant risk to the economic outlook for 2026. While there have been high-profile layoff announcements in recent months, the primary problem has been a lack of new hiring. Labor markets have largely been in a “no hire /no fire” position since reciprocal tariffs were announced in April. Data indicates that most of the hiring weakness has been in the small business sector, which is less equipped to deal with the burden of sharply higher tariffs. As the tariff situation matures, we believe such pressures should ease, allowing job market conditions to slowly rebound.

- Labor conditions and inflation trends will likely dictate the pace of interest rate cuts. A combination of easing inflation and stabilizing labor conditions could allow the Fed to further cut short-term interest rates as necessary. That said, longer-term interest rates may remain firm in 2026, given persistent U.S. deficit dynamics, as well as growing Treasury supply.

The 2026 markets

While U.S. stocks are likely to experience bouts of volatility this year as markets digest evolving profit dynamics, it’s our view that U.S. financial markets could see further tailwinds in 2026.

Here are the key takeaways for investors:

- AI spending should continue to underpin growth, but the narrative will likely focus on results. In our view, the next phase of the bull market will rely less on expanding valuations and more on evidence that recent investments, particularly in AI, are translating into improved corporate margins, cash flow and productivity. Bottom line: AI will need to transition from “hype” to “proof” over the course of the year. Companies that demonstrate improved operating margins, higher revenue per employee and faster cycle times will likely be rewarded in an environment where there is more scrutiny around capital expenditure. In our view, “stealth winners” of AI — or the companies embedding advanced tools into logistics, manufacturing, finance and select industry sectors — could outperform those companies chasing headline-grabbing consumer applications and AI hype.

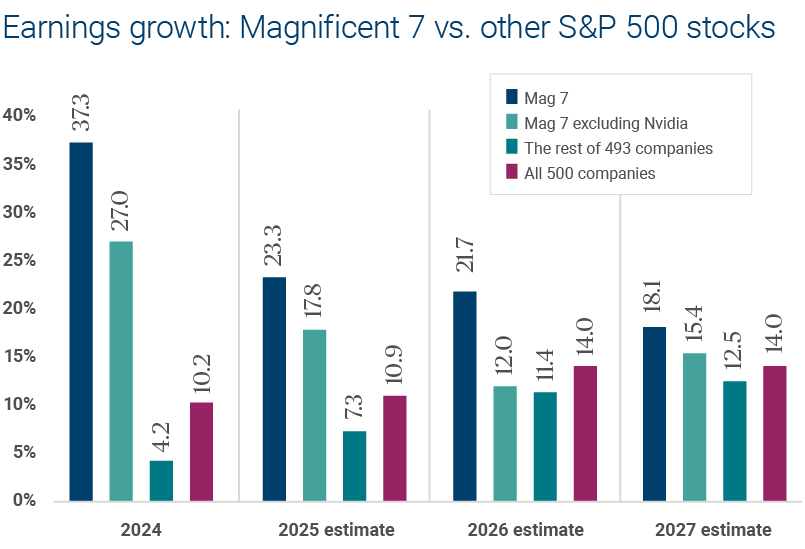

- More industries will need to deliver profit gains to sustain the rally. It’s no surprise that Big Tech and AI drove major U.S. indexes to new highs in 2025, but what is less widely reported is that much of the market’s gains were fueled by expanding profits across a broader set of industries in 2025. That trend will likely need to continue in 2026 for stocks to press higher. We expect S&P 500 Index earnings per share to grow by double-digits in 2026, with profit gains anticipated across most major sectors. Moderating inflation, combined with already strong margins and healthy consumer and business conditions, could also leave multiple industries well-positioned for growth in the coming year.

- Mega-cap tech companies will likely continue to deliver strong profits and cash flow in 2026. The past three years of strong equity gains have been primarily fueled by Big Tech firms, specifically the Magnificent 7 group. In 2026, we expect Big Tech’s secular drivers to remain a source of strength for major benchmarks, such as the S&P 500 and the NASDAQ Composite. However, elevated stock valuations and aggressive growth expectations for these companies do present risks to investors.

Source: FactSet, American Enterprise Investment Services, Inc. Data as of 11/30/2025. Earnings growth rates are calculated by aggregated net income of each group of stocks. This example is shown for illustrative purposes only and is not guaranteed.

- U.S. midterm elections may contribute to bouts of uncertainty. The 2026 U.S. midterm elections are likely to generate headlines and possibly brief periods of market volatility later in the year. However, it’s important to remember that temporary fluctuations in stock prices or bond yields around election events are typically resolved within weeks.

6 investment strategies for 2026

Overall, 2026 should be a constructive year for asset prices and economic conditions. However, investors should expect fits and starts during the year that will likely challenge their conviction and test their patience.

Here are six key investment strategies to consider in 2026:

- Consider active management to identify new opportunities. Leaning on strong active management can help you uncover opportunities beyond the Magnificent Seven.

- Lean into high-quality investments. We believe maintaining exposure to quality-focused approaches can help mitigate concentration risk.

- Use downturns to your advantage. Consider using temporary drawdowns in the stock market to invest excess cash in high-quality growth-focused equity strategies or rebalance portfolios back to strategic targets.

- Diversify to mitigate risk. Diversification strategies across international markets, alternatives and real assets (which proved effective in 2025) should remain critical levers to mitigate U.S. valuation risk and potential pullbacks in Big Tech.

- Be selective. After three years of strong gains across major U.S. stock averages, investors would be wise to temper return expectations, take a more selective approach to their investments and look for company profits to do more of the heavy lifting in driving stock returns in 2026.

- Stay the course. Bouts of market volatility may resurface in 2026, but periods of uncertainty don’t have to derail your progress. When markets get choppy, tune out the noise and focus on your long-term investment strategy.

Start the new year with more confidence

Connecting with your Ameriprise financial advisor in the new year can help give you more confidence as you navigate what's ahead. They can help you make sense of economic and market developments and provide personalized recommendations to take advantage of the current environment.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.