3 strategies to help reduce investment risk

Learn these time-tested ways to help reduce investment risk and feel more confident about your financial future.

When markets start to fluctuate, it may be tempting to make changes to your investment portfolio. But history shows that those who stay invested throughout market and economic cycles are more likely to earn positive returns in the long run.

So how can you avoid making emotional investing decisions? Consider these three time-tested strategies that — coupled with personalized financial advice — can help mitigate risk, reduce volatility in your portfolio’s value and potentially earn more consistent returns over time.

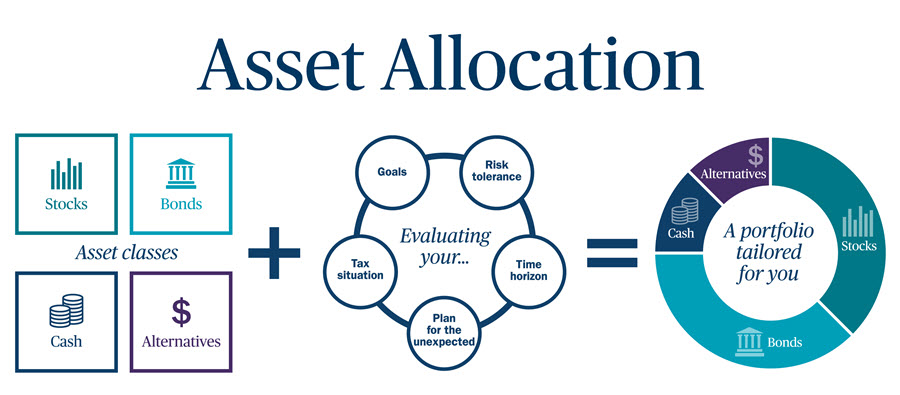

Strategy 1: Asset allocation

Asset allocation refers to the way you weight the investments in your portfolio to meet your financial goals. It's the act of investing in different asset classes — such as stocks, bonds, alternative investments and cash — that should also take your risk tolerance, tax situation and time horizon into account.

For example, if your goal is to pursue growth, and you're willing to take on market risk to reach that goal, you may decide to place as much as 80% of your assets in stocks and as little as 20% in bonds. Before you decide how you'll divide the asset classes in your portfolio, make sure you know your investment timeframe and the possible risks and rewards of each asset class.

Different asset classes offer varying levels of potential return and market risk. For example, unlike stocks and corporate bonds, government T-bills offer guaranteed principal and interest—although money market funds that invest in them do not. As with any security, past performance doesn't necessarily indicate future results. And asset allocation does not guarantee a profit.

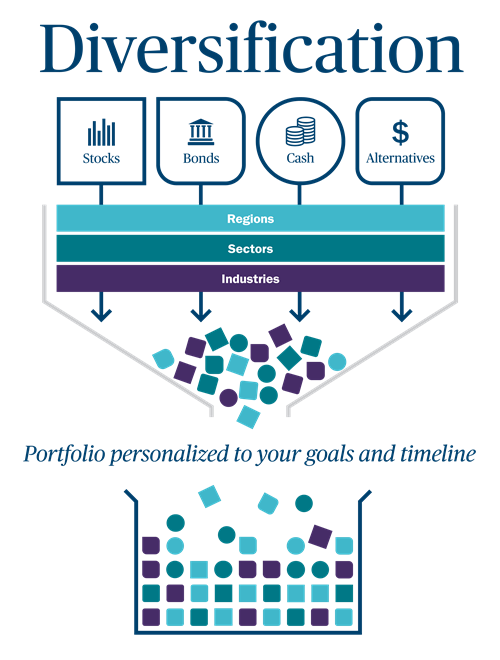

Strategy 2: Portfolio diversification

Asset allocation and portfolio diversification go hand in hand.

Portfolio diversification is the process of selecting a variety of investments within each asset class, which can help those looking to reduce their investment risk. Diversification across asset classes may also help lessen the impact of major market swings on your portfolio.

How portfolio diversification aims to reduce your risk in investments

If you were to invest in the stock of just one company, you'd be taking on greater risk by relying solely on the performance of that company to grow your investment. This is known as "single-security risk"—the risk that your investment will fluctuate widely in value with the price of one holding.

But if you instead buy stocks in 15 or 20 companies across several different industries, you can reduce the potential for a substantial loss. If the return on one investment is falling, the return on another may be rising, which may help offset the poor performer.

Keep in mind, this doesn’t eliminate risk, and there is no guarantee against investment loss.

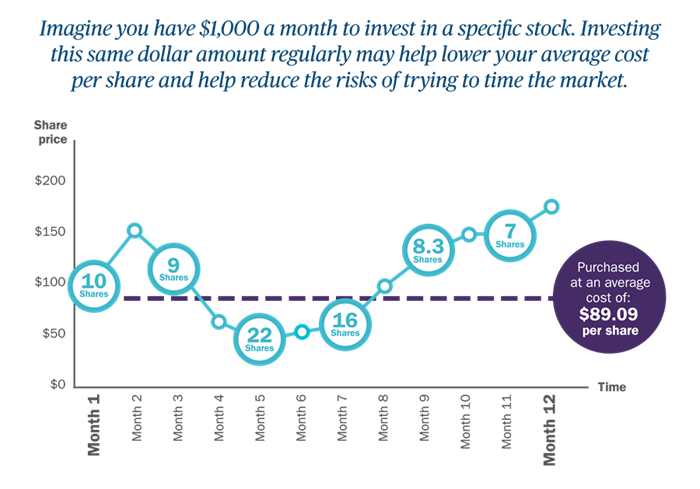

Strategy 3: Dollar-cost averaging

Dollar-cost averaging is when you invest a fixed amount of money into the same investment vehicle(s) on a regular basis — such as monthly or quarterly, for example — regardless of how the market is performing.

This illustration is hypothetical and is not meant to represent any specific investment or imply any guaranteed rate of return.

How dollar-cost averaging can help reduce investment risk

With dollar-cost averaging, you naturally buy fewer shares when the market is high and more shares when the market is low. This systematic approach can help you gradually build wealth by diversifying the prices at which you buy more shares of a stock, for example. (Neither price appreciation nor profit is guaranteed, however.) And because this strategy is systematic, it can help you avoid making emotional investment decisions (thus potentially reducing investment risk).

Have questions? Seek out personalized advice from your financial advisor

If you have questions about these ways to reduce investment risk, consider reaching out to your Ameriprise financial advisor for perspective unique to your financial goals and portfolio. Their personalized advice can help give you more confidence to stay the course to your financial goals.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

This information is being provided only as a general source of information and is not a solicitation to buy or sell any securities, accounts or strategies mentioned. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as a recommendation or advice designed to meet the particular needs of an individual investor. Please seek the advice of a financial advisor regarding your particular financial situation.

Asset allocation, diversification and dollar-cost averaging do not assure a profit or protect against loss.

Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

Ameriprise Financial cannot guarantee future financial results.

There are risks associated with fixed income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities.

Stock investments have an element of risk. High-quality stocks may be appropriate for some investments strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with stocks before investing, as they can lose value.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Ameriprise Financial Services, LLC. Member FINRA and SIPC.

Return to My Accounts

Return to My Accounts