Understanding your Social Security benefits

When it comes to Social Security, there is a lot to consider. Social Security is often associated with a retirement program, but you may enroll if you become disabled or lose a family member. Take a look at the diagrams below for information on how to make the right choices for you and your family.

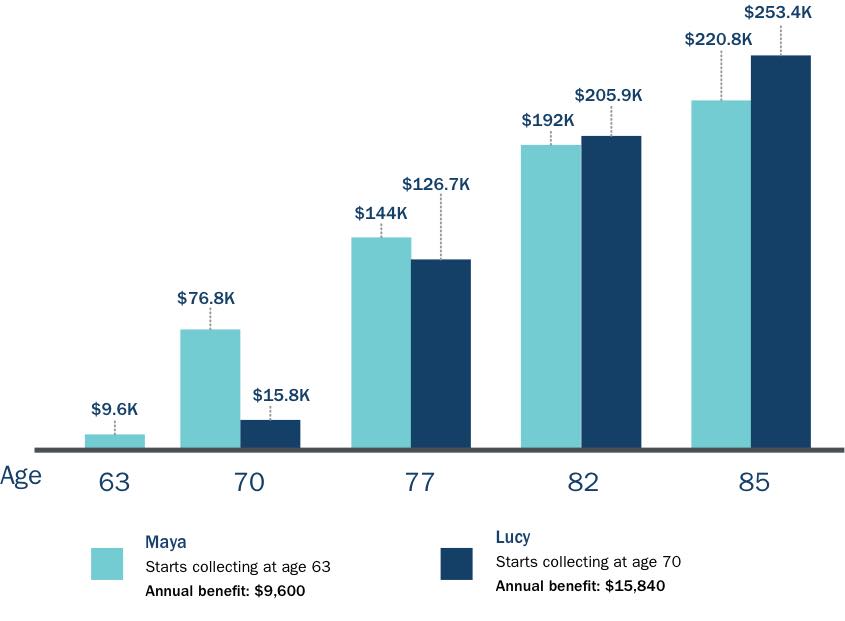

When should I start collecting Social Security benefits?

The answer is different for every person and depends on many individual factors like your date of birth, marital status and financial position.

The longer you wait to start collecting Social Security, the higher your monthly benefit will be. An Ameriprise financial advisor can help you determine an appropriate time for you based on your financial situation and goals.

Year of birth |

Retirement Age |

|---|---|

| 1943-1954 | 66 years old |

| 1955 | 66 +2 months years old |

| 1956 | 66 +4 months years old |

| 1957 | 66 +6 months years old |

| 1958 | 66 +8 months years old |

| 1959 | 66 +10 months years old |

| 1960 | 67 years old |

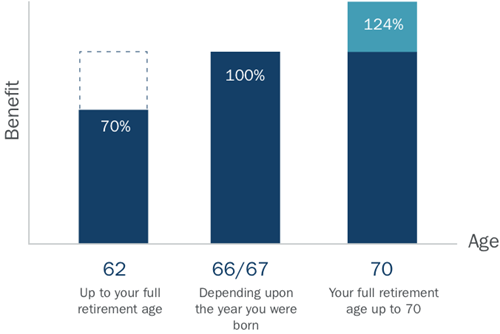

How do my Social Security benefits change if I retire early or late?

As life changes and priorities shift, you may wish to retire before or after your full retirement age. Your Ameriprise financial advisor can help you determine an appropriate choice for you. Retiring early locks you into lower monthly payments and will decrease your lifetime benefit amount. Retiring later increases your monthly payment and the amount you will receive over your lifetime.

Can I collect benefits on behalf of my child?

You may be able to claim benefits if the child you are caring for fits the following criteria:

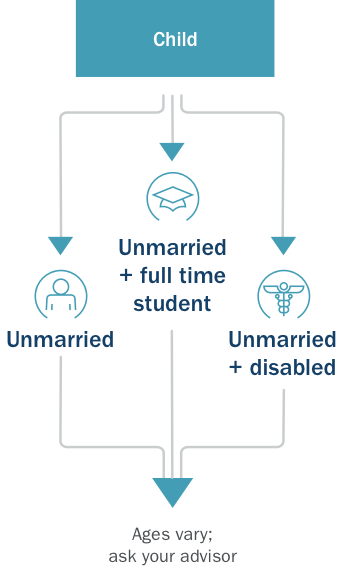

Can my children receive Social Security benefits?

A child who has a parent who is disabled or retired and entitled to Social Security benefits may also be eligible for benefits if they are:

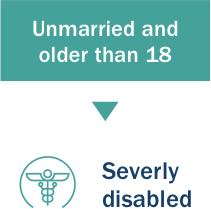

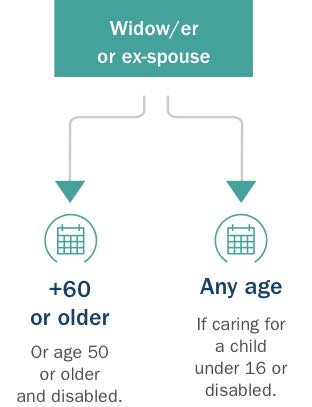

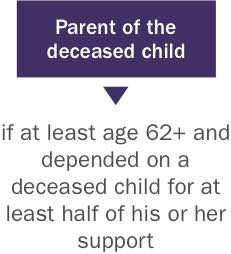

Am I eligible for survivor’s benefits?

You may be eligible for survivor's benefits if you are:

How does my military service or government employment affect my Social Security?

As a veteran or government employee, your Social Security benefits may differ from others:

Can I still work and collect Social Security benefits?

You can collect Social Security benefits while working, starting at age 62. However, your age and earnings may impact the amount of benefits you receive during that time. Working won't permanently reduce the Social Security benefits you receive, nor will your withheld benefits disappear.

Once you reach full retirement age:

- Your monthly benefit will increase, taking into account prior benefits detained due to earnings.

- Extra income no longer decreases your benefits.

If you work and collect Social Security when you are:

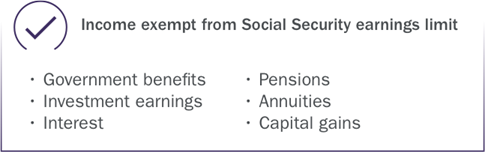

These types of income are exempt from the Social Security earning limit:

*If you work for someone else, only your wage amount applies to earnings limits. If you're self-employed, only your net earnings count.

Does Social Security allow for inflation or cost of living increases?

The Social Security Administration can enact yearly benefit increases called cost-of-living adjustments (COLA) based on inflation. Since 1975, COLAs have ranged from 14.3% (1980) to 0.0% (2009, 2010, 2015). Your financial advisor can help you identify other sources of income when Social security inflation adjustments are low.

Year |

Cost of Living Adjustment |

|---|---|

| 2022 | 8.7% |

|

2021 |

5.9% |

| 2020 | 1.3% |

| 2019 | 1.6% |

| 2018 | 2.8% |

| 2017 | 2.0% |

You can currently apply for Social Security in the following ways:

Our advisors can help

If you have any questions about Social Security, your Ameriprise financial advisor can help you understand all aspects of your benefits and help you live more confidently so if your life changes, your plan can too.

Social Security

Social Security benefit calculator

Social Security benefits can be an important factor to consider in your future retirement income. Use this calculator to estimate what your retirement benefit amount could be.

Learn MoreOr, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

1Source: Social Security Administration https://www.ssa.gov/benefits/retirement/planner/agereduction.html

This information is being provided only as a general source of information and is not intended to be used as a primary basis for investment decisions, nor should it be construed as advice designed to meet the particular needs of an individual investor.

Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax adviser or attorney regarding their specific situation.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Ameriprise Financial Services, LLC. Member FINRA and SIPC.

Return to My Accounts

Return to My Accounts