Financial steps to buying a house

Buying a house or other property is one of the biggest investments you’ll ever make. Understanding how to successfully finance a house, can help you enjoy the exciting homebuying process.

These five financial steps can help you feel more confident when navigating how to purchase a home:

1. Organize your finances

Save for a down payment

- Conventional loans usually require a 5% - 20% down payment. If you put less than 20% down, conventional loans require you to pay private mortgage insurance (PMI), which is an extra cost on top of your principal and interest, until you have 20% equity in your house.

- If you already own a home and are planning to buy a second home or vacation house, you may be able to tap into your existing home equity for use towards a down payment.

- Banks tend to offer lower interest rates to borrowers who can offer a larger down payment, so you may be able to save money over the long run if you can provide more up front.

- In addition, closing costs will average 3% of the total price. These costs include the loan, underwriting, and other fees associated with the purchase.

Your credit score

You can check your credit report online without an impact to your credit score – this is known as a “soft inquiry”. Further along during the mortgage application process, however, the lender will perform a credit check that results in what is known as a “hard inquiry” on your credit report. This is a required part of the process. If you are exploring rates across multiple lenders, multiple inquiries from mortgage lenders within a short period of time are treated as a single inquiry and will have little impact on your credit score, according to Fair Isaac Corporation (FICO).

If you’re planning on taking the financial steps towards buying a second or vacation home, banks will typically require that you have a higher credit score than if you were applying for a primary residence loan. They may also require a larger down payment.

2. Determine how much house you can afford

How is my mortgage payment calculated?

Your mortgage payment typically consists of the following:

- The principal payment, which goes toward paying back the amount you borrowed.

- Interest

- Additionally, your monthly payment often includes a consolidated payment into an escrow account to cover property taxes, homeowner’s insurance and, if applicable, mortgage insurance or other fees associated with your specific mortgage. Your lender then pays those on your behalf throughout the year, when due.

There can be other costs to keep in mind, too. For example, many owners of second or vacation homes rent out their property. If the owner uses a property management company, this can add an extra 8-12% per month on top of regular expenses.

An online mortgage calculator can give you a basic view of how much house you can afford. This tool will show you your estimated mortgage payment for different loan amounts, interest rates and loan terms.

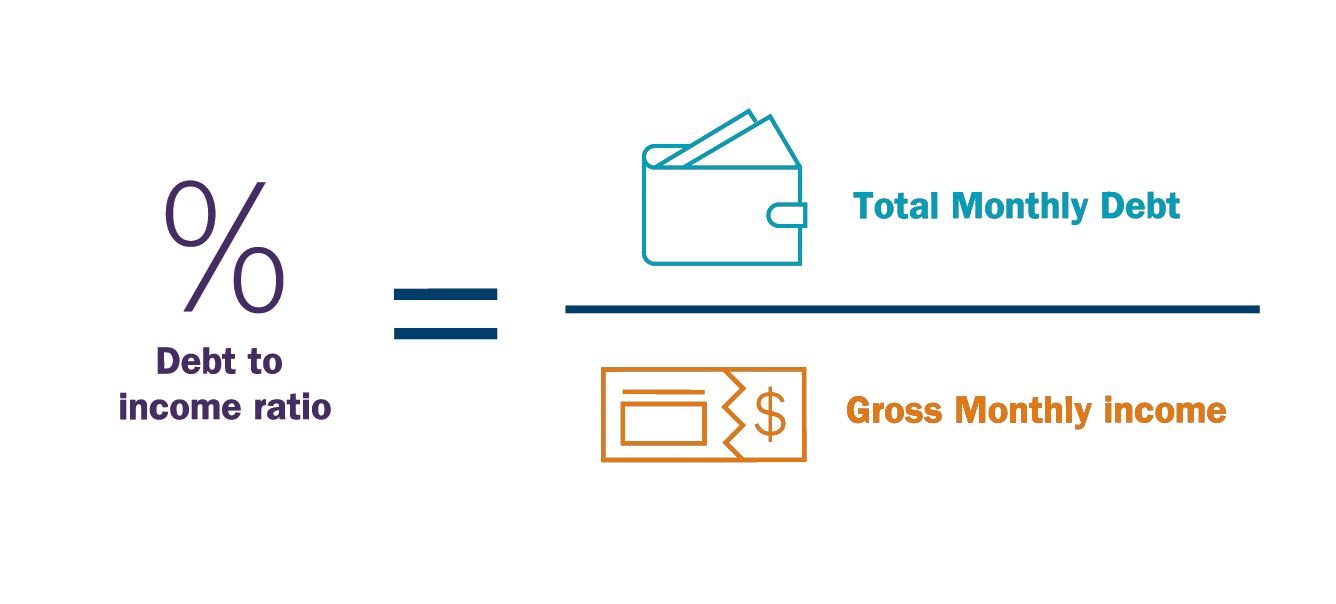

Debt-to-income ratio

When lenders review your loan application, they’ll compare your monthly income to your debt — both current and anticipated. The amount of debt as a percentage of monthly income is called the debt-to-income ratio (DTI), and generally must fall below 43% to qualify for a mortgage.

For example, if your monthly debt payments for mortgages, car payments and a school loan total $3,000 and your monthly income is $10,000, then your DTI is 30%. While you may qualify for a mortgage if your DTI ratio is near 43%, a general guideline is to keep the ratio below 36% for your own financial stability. For second homes, the lender may require your DTI to be even lower – at or below 36%.

| A higher credit score may provide you with a lower interest rate | Choosing a 15-year loan over a 30-year loan can help you secure a lower interest rate | The federal funds rate, which banks charge other banks for overnight lending, influences mortgage interest rates | Different lenders offer different rates | If you’re planning to buy a second home or an investment property, you’ll likely face higher interest rates |

3. Understand your mortgage

How do lenders determine the interest rate on your mortgage?

- Your credit score: In general, the higher your credit score, the lower your interest rate, and vice versa. Someone with a low credit score could have an interest rate that’s more than 1% higher than someone with a high credit score, which can add up substantially over the duration of the loan. If you have good credit, moving into the exceptional or excellent range may help you secure a lower interest rate.

- Length of loan: Lenders consider longer loans, such as a 30-year term, to be riskier, so 15-year loans generally have lower interest rates.

- Federal funds rate: A lower federal funds rate means it’s cheaper for banks to borrow money. To remain competitive with other lenders, banks will pass those savings onto you in the form of lower interest rates on your mortgage. On the other hand, when the federal funds rate increases, banks will have to pay more to borrow money. As a result, mortgage interest rates will increase.

- The lender: When you search for mortgage rates, you’ll notice that different lenders offer different interest rates. Shop around for the best rate and discuss your options with your Ameriprise financial advisor. A slightly lower rate can save you thousands of dollars over the life of your loan.

- Residence classification: Borrowers seeking funds to purchase a primary residence typically receive more favorable interest rates than those purchasing an investment or rental property.

Federal Housing Administration vs conventional loans

If you don’t meet the credit requirements of a conventional loan or prefer a smaller down payment than what conventional loans require, you might want to consider an FHA loan.

An FHA loan is insured by the Federal Housing Administration, and generally has less-stringent qualification criteria than conventional loans, making it a popular way to finance a house for first-time homebuyers. These loans are specifically designed to finance a primary residence. Therefore, you wouldn’t be able to use an FHA loan for a rental property, investment unit or vacation home.

| Minimum credit score | Minimum down payment | |

|---|---|---|

| Conventional loan1 | 620+ | 3-20% |

| FHA loan (higher credit score)2 | 580+ | 3.5% |

| FHA loan (lower credit score)2 | 500-579 | 10% |

Mortgage insurance

- As noted, you can avoid mortgage insurance by providing a 20% down payment.

- With conventional loans, you may be able to remove your mortgage insurance when you have accumulated 20% equity in your house.

- With FHA loans, you’ll need to continue paying mortgage insurance for either 11 years or the life of your home loan, depending on the:

- Loan amount

- Length of the loan

- Loan-to-value ratio (LTV) ratio

- FHA loans require an additional type of mortgage insurance known as Up Front Mortgage Insurance (UFMI).

- Homebuyers using the FHA loan program must pay 1.75% of the base loan amount in UFMI.

- You can pay this amount at closing or roll it into your mortgage.

4. Get pre-qualified or pre-approved for a mortgage

What’s the difference between pre-qualification and pre-approval?

- Pre-qualification is a quick process that tells you roughly how much you can afford to spend on a home, based on your self-reported income, debts and assets.

- To obtain pre-approval, you’ll have to provide verifiable financial documents to the lender. The lender will review your credit report, financial history, income statements and more to determine how much they would be willing to lend you.

The two are not equivalent. When submitting an offer on a property, pre-approval is usually required by the seller’s agent.

5. Find a property and make an offer

When you’ve reached the financial step of finally buying a house, you may want to work with a real estate agent. An agent can show you homes and guide you through the homebuying process, including closing.

Typically, the seller pays the commission for both the seller’s agent and buyer’s agent, but not always. Be sure to inquire about fee structure before signing a contract with an agent.

A real estate agent can:

- Help you determine your housing needs

- Show you homes and neighborhoods in your price range

- Suggest financing sources and options

- Prepare a purchase offer

- Negotiate a purchase price for you

- Recommend resources you may need such as mortgage brokers, title companies and inspectors

- Give you an appraisal of comparable homes you're considering

- Arrange details of the closing after the seller accepts your offer

Make an offer and close the deal

The planning process for home buying can be lengthy. But, once you have saved enough for a down payment, decided what you can afford in mortgage payments and found the home of your dreams, it’s time for you and your agent to submit an offer. Your agent can help you determine a reasonable offer based on the current market and comparable home sales, which can help you make a competitive offer.

It’s not uncommon for the seller to make a counteroffer, especially if your initial offer was below asking price. Your real estate agent will discuss the offer and the counteroffer with you, and together you can decide on your next steps.

After the seller accepts your offer, you’ll sign a contract to buy the house contingent on criteria such as passing an inspection. You’ll also give the seller earnest money as a symbol of good faith that you intend to follow through with the purchase. The seller typically asks for about 1% - 2% of the home price in earnest money. This money will reside in an escrow account until you close on the house. After closing, the earnest money will go toward your down payment.

After you sign the initial contract, it’s a good idea to schedule an inspection. If major repairs are needed, your real estate agent may be able to help you negotiate that the cost of repairs be paid by the seller or subtracted from the purchase price.

Are you ready to make the move?

An Ameriprise financial advisor can discuss with you the implications of purchasing a home to help you fit it into your long-term financial goals. Personalized advice can help you stay on track to achieve your other financial goals, today and tomorrow.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

Return to My Accounts

Return to My Accounts