Long-term investment strategies

Staying the course with these long-term investment strategies can pay off over time.

If you are in retirement or near retirement, it may be tempting to place your savings into low-return conservative investments. However, you should also consider the risk that you may outlive your assets or that your assets will not keep pace with inflation.

When you are further away from retirement, time is your most powerful asset. It may be tempting to pull out of the market if you need extra cash or when the market is shaky, but being out of the market can cause you to miss valuable opportunities if stocks should rise.

Choose long-term investment plans for retirement considering inflation

Inflation has been one of the consistent facts of life in our economy. If the current inflation rate is 2%, over 20 years, it would raise the price of a $.42 postage stamp to $.62. How would it increase more expensive purchases?

- A $1,000 refrigerator would cost a little over $1,450.

- A $23,000 car would sell for a bit more than $34,000.

The longer you live, the more these kinds of price increases could affect your retirement lifestyle choices — unless your investment portfolio is designed to keep up with inflation.

Even at a moderate 2% rate, inflation can cut the purchasing power of your retirement savings almost in half over 20 years. If you're entirely invested in cash and short-term investments, these assets are likely to shrink in "real" value during a long retirement.

By comparison, stocks have historically outpaced inflation and provided strong returns over long terms. If you are concerned about losses in the stock market, consider long-term investment strategies in stocks and adjust your asset allocation to help manage volatility in your overall portfolio – without giving up all of its growth potential.

Investing

6 key investment principles

Learn how to become a more successful investor with the time-tested investment strategies of dollar-cost averaging, asset allocation, diversification and more.

Read MoreEnjoying a longer life with long-term investing

People are living longer these days, meaning your retirement savings may have to last a long time as well. How long? According to the Social Security Administration1:

- A 65-year-old man can expect to live, on average, to 84.2.

- A 65-year-old woman can expect to live, on average, until age 86.8.

Longevity trends suggest that these remarkable numbers will continue to rise.

Your total investment time horizon is longer than you may have thought. Depending on your age today, you could be creating and managing a long-term investment strategy for 20 years or more to ensure you don't outlive your retirement savings.

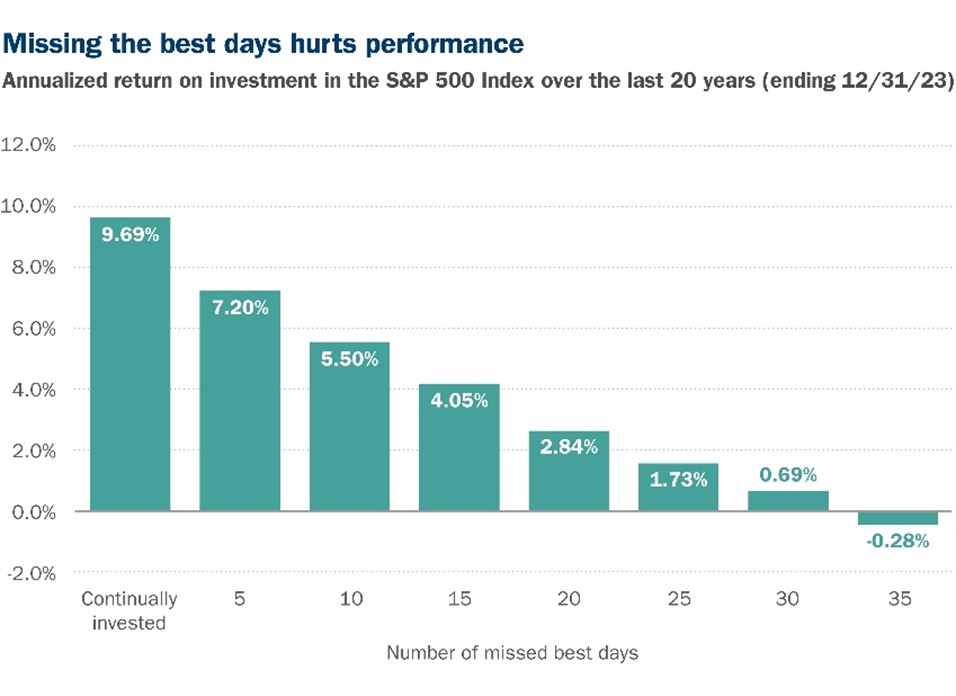

Market timing can be costly

It pays to stay with long-term investment strategies. History shows the markets have bounced back after losing value and it's likely this will happen again should major dips occur in the future. As the chart below shows, missing even a handful of days can have a long-term impact on your savings.

Source: Bloomberg, S&P Dow Jones Indices, American Enterprise Investment Services, Inc,

S&P 500 Total Return Index over the last 20 years as of 12/31/2023.

The returns do not include any potential fees or expenses.

Past performance is not a guarantee of future results.

Markets tend to recover

History is on the side of investors with a long-term stock investment strategy.

Be patient and stay invested. Markets tend to bounce back from downturns, typically with a healthy revival. An Ameriprise financial advisor will help you define and create a strategy to help you work toward long-term success.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

1 Information based on Retirement & Survivors Benefits: Life Expectancy Calculator (https://www.ssa.gov/oact/population/longevity.html)

This information is being provided only as a general source of information and is not a solicitation to buy or sell any securities, accounts or strategies mentioned. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as a recommendation or advice designed to meet the particular needs of an individual investor. Please seek the advice of a financial advisor regarding your particular financial situation.

Stock investments involve risk, including loss of principal. High-quality stocks may be appropriate for some investment strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with investing in stocks, as they can lose value.

There are risks associated with fixed-income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer term securities.

No investing strategy can overcome all market volatility or guarantee future results.

Past performance is not a guarantee of future results.

Neither asset allocation nor diversification can assure a profit or protect against loss.

The S&P 500 Index is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value (shares outstanding times share price), and its performance is thought to be representative of the stock market as a whole. The S&P 500 index was created in 1957 although it has been extrapolated backwards to several decades earlier for performance comparison purposes. This index provides a broad snapshot of the overall US equity market. Over 70% of all US equity value is tracked by the S&P 500. Inclusion in the index is determined by Standard & Poor’s and is based upon their market size, liquidity, and sector.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SPIC.

Return to My Accounts

Return to My Accounts