How to sign up for Medicare the first time: A step-by-step guide to enrollment

Apply for Medicare with more confidence by understanding the financial implications of enrollment decisions and common mistakes to avoid.

Enrolling for Medicare isn’t difficult, but understanding the coverage and eligibility options can be complex if you’re not familiar with how the program works.

Whether you’re preparing to enroll in Medicare for the first time or are a few years away, an Ameriprise financial advisor is here to help you factor in the costs of health care into your financial strategy to help you stay on track toward your financial goals.

Here’s a step-by-step guide for how to sign up for Medicare:

1. Think about your health care needs

Turning 65 can be a milestone for many reasons, but among the most significant is that it marks the date when most people become eligible for Medicare.

In the period leading to enrollment, familiarize yourself with the basics of Medicare and how it's structured. As you explore your options, consider your health care needs, your budget and your lifestyle in retirement, such as how much you’ll be traveling and whether you plan to move.

Learn more: Medicare basics: What it is and how it works

2. Consider your potential costs

Medicare isn’t free. What you pay each month will depend on the following factors:

- Your income

- If you sign up for prescription drug coverage

- Whether you choose Original Medicare or Medicare Advantage

As you prepare to enroll in Medicare, consider the costs of different coverage options:

|

What it is |

What it covers |

What you pay |

|---|---|---|

|

Original Medicare Part A: Hospital insurance |

|

|

|

Original Medicare Part B: Medical insurance |

|

|

|

Medicare Advantage Part C: Alternative to Original Medicare |

|

|

|

Part D: Prescription drug coverage |

|

|

|

Medigap (also known as Medicare Supplement Insurance) |

|

|

For more on Medicare premiums and surcharges, review our downloadable guide to Medicare.

3. Decide when to apply for Medicare

Medicare has several enrollment periods you must be aware of to avoid coverage gaps and late-enrollment penalties:

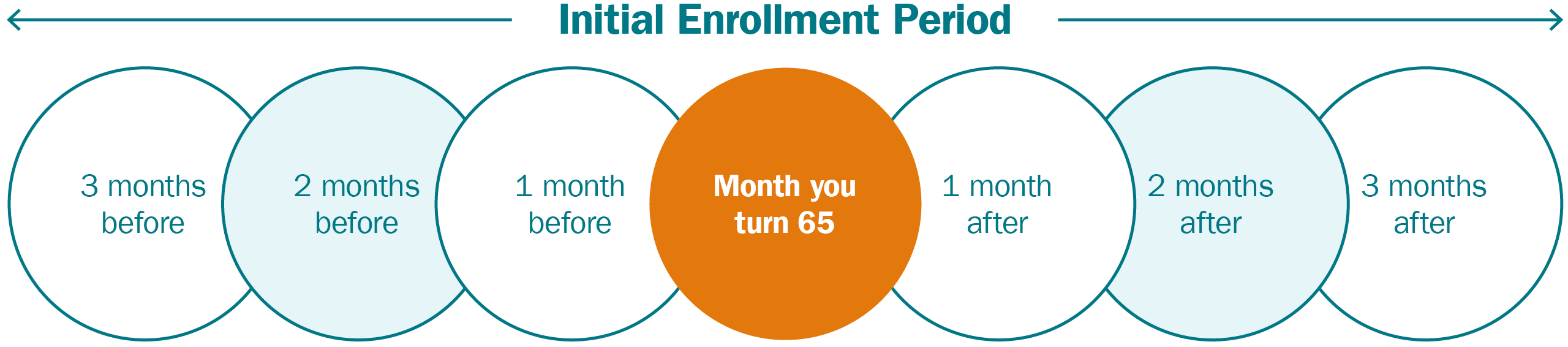

Initial Enrollment Period

For most people, the Initial Enrollment Period (IEP) is the first opportunity to enroll in Medicare, and it begins three months before the month you turn 65 and ends three months after the month you turn 65. If you turn 65 on Aug. 15, for example, you can apply from May 1 to Nov. 30.

If you are receiving Social Security retirement benefits when you turn 65, you will automatically be enrolled in Medicare Parts A and B, unless you opt out. Your initial enrollment period for prescription drug coverage (Part D) is also typically the same seven-month period as your Medicare IEP.

Special Enrollment period

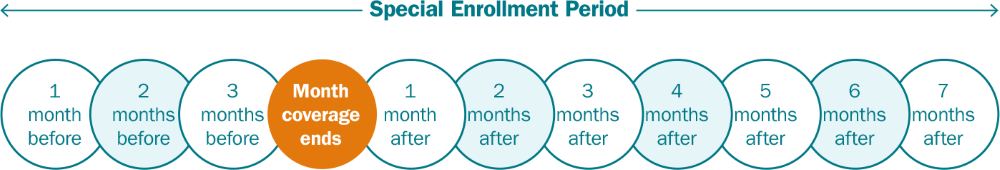

If you’re working at age 65 and have health insurance through your employer (or your spouse’s employer), you can delay enrolling in some parts of Medicare until you (or your spouse) stop working. In such cases, you’re eligible for a Special Enrollment Period and will not incur a late enrollment penalty.

Your Medicare Special Enrollment Period will run for eight months, starting when your employer-sponsored health coverage ends and ending seven months later. Note that retiree health insurance and COBRA insurance do not count as employer-sponsored insurance for the purposes of the Special Enrollment Period. Further, some small employers do not provide medical coverage for employees past the age of 65.

If you kept working after 65 and had prescription drug coverage through your employer-sponsored health plan, you will qualify for a Part D Special Enrollment Period, which typically gives you up to two months to join a prescription drug plan without incurring a late enrollment penalty once your previous coverage ends.

4. Avoid these enrollment mistakes

If you miss certain Medicare deadlines, you may face increased costs and fees. Here are a few common mistakes to avoid when enrolling:

Don’t miss your initial enrollment or special enrollment period

If you don’t sign up for Medicare during your initial enrollment period and you don’t qualify for a special enrollment period, the next chance you’ll have to enroll is during the General Enrollment Period, which runs from Jan. 1 to March 31.

If you do sign up for Medicare in the General Enrollment Period, you will:

- Likely have a gap in coverage.

- Have to pay a penalty that will raise your Part B premiums by 10% a month for every 12 months you are late in enrolling — for as long as you have Medicare.

- Be required to pay a late enrollment penalty on your Part D premiums.

- Could be denied Medigap coverage or be forced to pay higher premiums.

Don’t wait to sign up for a Medigap policy

If you’ve decided to get coverage through Original Medicare, it’s critical to sign up for a Medigap policy in the six months after you first get Part B (whether you signed up for Original Medicare during your Initial Enrollment Period or a Special Enrollment Period). During this Medigap Open Enrollment, insurers have to offer you the best price — and can’t deny you coverage due to preexisting health problems.

After this period, however, you may be significantly limited in your ability to buy a policy or pay substantially more to get one.

Medigap policies can be difficult to change after initial enrollment

It is not always as easy to add or change Medigap policies after the initial enrollment. Doing so could require a medical questionnaire or underwriting, and the insurer can decline coverage or charge more due to preexisting conditions.

Know when to stop contributing to your HSA

While you can continue to spend from your HSA once you sign up for Medicare, you cannot set up or contribute to one. In addition, if you delay enrolling in Medicare because you’re covered under an employer-sponsored health plan, you must stop contributing to your HSA at least six months before you enroll in any part of Medicare. If you don’t, you could incur a tax penalty.

Learn more: Minding the gap: What to do when facing the loss of health care coverage

5. Determine what Medicare coverage is right for you

Choosing your health care coverage in retirement often requires you to make trade-offs between your annual healthcare expenses and the coverage available to you. For many, the biggest decision becomes whether to choose original Medicare (along with a Medigap policy) or a Medicare Advantage plan. Here’s a look at some of the pros and cons of each plan:

|

|

Pros |

Cons |

|---|---|---|

|

Original Medicare |

|

|

|

Medicare Advantage |

|

|

6. Sign up for Medicare

Once you’re eligible, you can apply for Medicare in one of three ways:

- Apply online, through the Social Security Administration’s website.

- Call the Social Security Administration at 800-772-1213. (TTY 800-325-0778.)

- Visit your local Social Security office, though the Social Security Administration encourages people not to show up without an appointment.

Enroll with more confidence

An Ameriprise financial advisor can help you consider your Medicare options so that you can select a plan that helps meet both your financial goals and health care needs.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.