Medicare basics: What is Medicare and how does it work?

Find out how Medicare works, what it costs and when you should enroll.

Medicare is a valuable federal health insurance program for many, but its many intricacies around costs, coverage and enrollment can make it complex to navigate.

An Ameriprise financial advisor can help you better understand how Medicare works, the choices available to you and how to account for this benefit in your overall retirement financial strategy.

Here’s an overview of the program. For an even more in-depth look, review our downloadable guide to Medicare.

What is Medicare?

Medicare is a nationwide federal health insurance program for people aged 65 and older, or those with qualifying illnesses and disabilities. This four-part program is designed to support each individual’s retirement health care needs, hospital services, outpatient services, prescription drug costs or a combination of them.

Learn more: Planning for health care costs in retirement

Who qualifies for Medicare?

Those age 65 or older qualify for full Medicare benefits if:

- You are a U.S. citizen or have been a permanent resident for the past five years.

- You are receiving or are eligible for Social Security benefits or Railroad Retirement benefits.

- You or your spouse is a government employee or retiree who has not paid into Social Security but has paid Medicare payroll taxes while working.

Those under age 65 qualify for full Medicare benefits if:

- You have received Social Security disability benefits for at least two years.

- You receive a disability pension from the Railroad Retirement Board and meet certain conditions.

- You have end-stage renal disease kidney dialysis or are a kidney transplant patient.

- You have Lou Gehrig’s disease.

Part A:

Hospital insurance

Covers the care you receive while an inpatient at a hospital or skilled nursing facility.

Part B:

Medical insurance

Covers doctor visits, routine medical services such as flu shots, and emergency medical services.

Part C:

Medicare Advantage

Provided by private insurance companies and offers Medicare Part A and Part B coverage, usually with additional benefits, including vision and dental coverage.

Medicare Advantage plans often have more barriers to care and are more restrictive on provider access.

Part D:

Prescription Drug Plan (PDP)

Provides prescription drug coverage through plans administered by private insurers.

What is Medicaid?

Medicaid is a state-run program with income-based eligibility to provide individuals with low- or no-cost health care.

What is Medigap?

Because Original Medicare does not cover every health care expense, many people purchase Medicare supplement insurance, also known as Medigap.

Here’s what to know about these policies:

- The federal government regulates Medigap policies, but they are sold and administered by private insurance companies. The policies are identified by letters and standardized to help consumers compare prices. (Note that Medigap policies in Massachusetts, Minnesota and Wisconsin have slightly different standardization.)

- An ideal time to buy a Medigap policy is during your initial enrollment in Part B. During this period, Medigap providers can’t decline your application or charge a higher premium because of a pre-existing condition. After the Initial Enrollment Period, Medigap plans in most states may reject your application or charge higher premiums.

What's not covered by Medicare?

- Dental care

- Eye care

- Long-term care

- Custodial care

- Hearing services

- Cosmetic surgery

- Care abroad

- Chiropractors

Social Security benefits calculator

Social Security benefits are an important factor to consider in your future retirement income. Use this calculator to estimate what your retirement benefit amount could be.

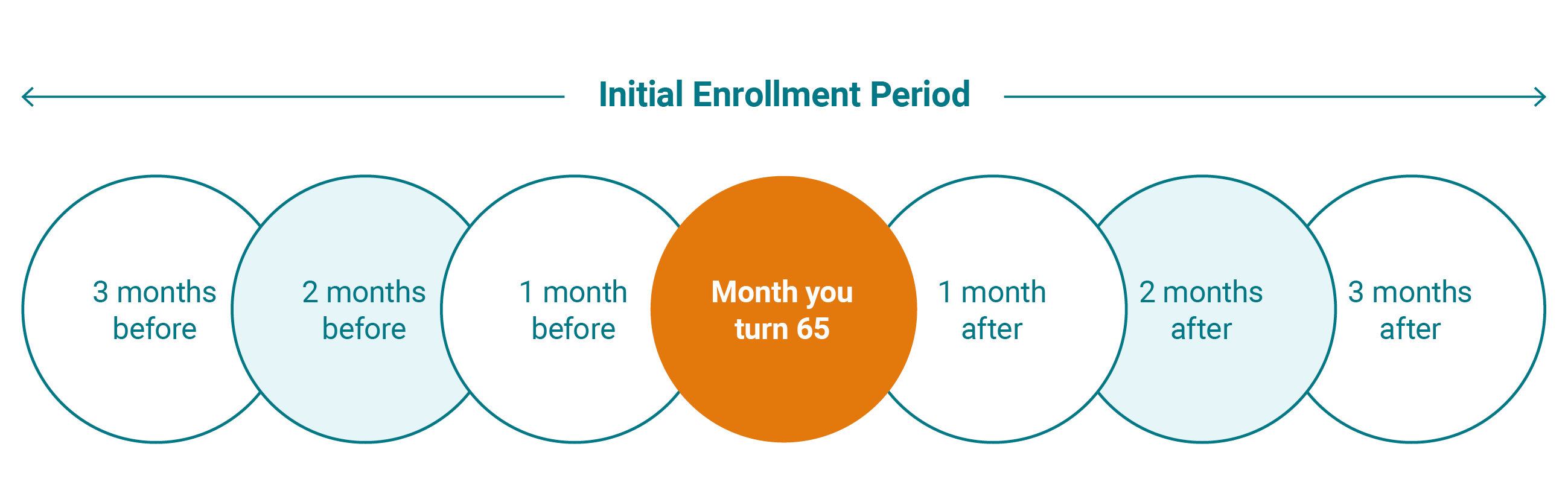

Initial Enrollment Period: This period is a seven-month window that begins three months before you turn 65. If you sign up for Original Medicare, the initial enrollment for Medigap, known as your Medigap Open Enrollment, starts when you first sign up for Part B coverage and lasts for six months.

Learn more: How to sign up for Medicare the first time: A step-by-step guide to enrollment

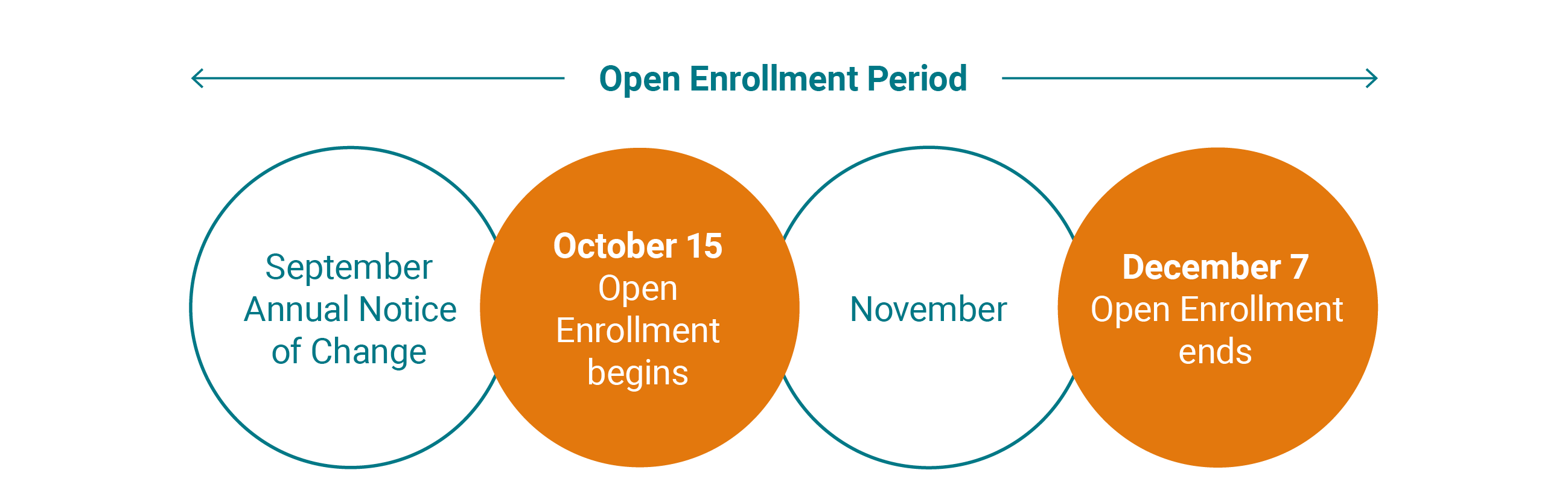

Medicare Open Enrollment (Oct. 15 – Dec. 7): This period is for people already enrolled in Medicare and is when you can make changes to your health or prescription drug coverage for the year ahead.

Learn more: 4 reasons to review your Medicare options every year

General Enrollment and Medicare Advantage Open Enrollment (Jan. 1 – March 31): This is the enrollment period for those who have never signed up for Medicare (Parts A, B or both), who didn’t sign up during their Initial Enrollment Period or who don’t qualify for a Special Enrollment Period.

Learn more: Making changes to your Medicare coverage

- No monthly premium if you worked and paid Medicare taxes for 10 years (40 quarters). If you worked and paid Medicare taxes for less than 40 quarters, then you will be subject to a premium that is determined by federal law each year.

- Premiums, deductibles and coinsurance rates are determined according to federal law each year.

- If your modified adjusted gross income as reported on your federal tax return from two years ago is above a certain threshold, you'll be charged an extra fee known as the Income Related Monthly Adjustment Amount (IRMAA).

- Monthly premiums will vary based on the type and plan and insurer you choose.

- Deductibles and coinsurance are dependent on the Medicare Advantage plan you choose.

- Monthly premiums will vary by your chosen plan and your income.

- If your modified adjusted gross income is above a certain threshold, you must pay an IRMAA surcharge on top of your premium.

How to apply for Medicare

- Visit your local Social Security office.

- Call the Social Security Office at 800-722-1213.

- Apply online at ssa.gov.

Download our Medicare guide

Choosing your retirement medical coverage is an important decision that has both health and financial implications. For more on Medicare premiums and surcharges, download our guide.

We’re here to help you navigate Medicare

An Ameriprise financial advisor can help you understand Medicare’s costs and complexities so you pick a plan that can work for you and your overall financial strategy.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.