Understanding your Social Security benefits

Find out what Social Security benefits you may qualify for and when you should start collecting.

When it comes to Social Security, there is a lot to consider. The federal program is probably most well known for its retirement income benefit, but you may also qualify for Social Security if you become disabled or lose a family member.

An Ameriprise financial advisor can help you navigate through your options and help you understand your benefits. See the diagrams below for information on how to make the appropriate choices for you and your family.

Understanding the federal program

What is Social Security?

Social Security is a U.S. federal program that provides enrolled individuals with a source of income when they become unable to work or earn sufficient wages on their own. There are three types of Social Security benefits:

-

Retirement (spousal benefits available in some cases)

-

Disability

-

Survivor

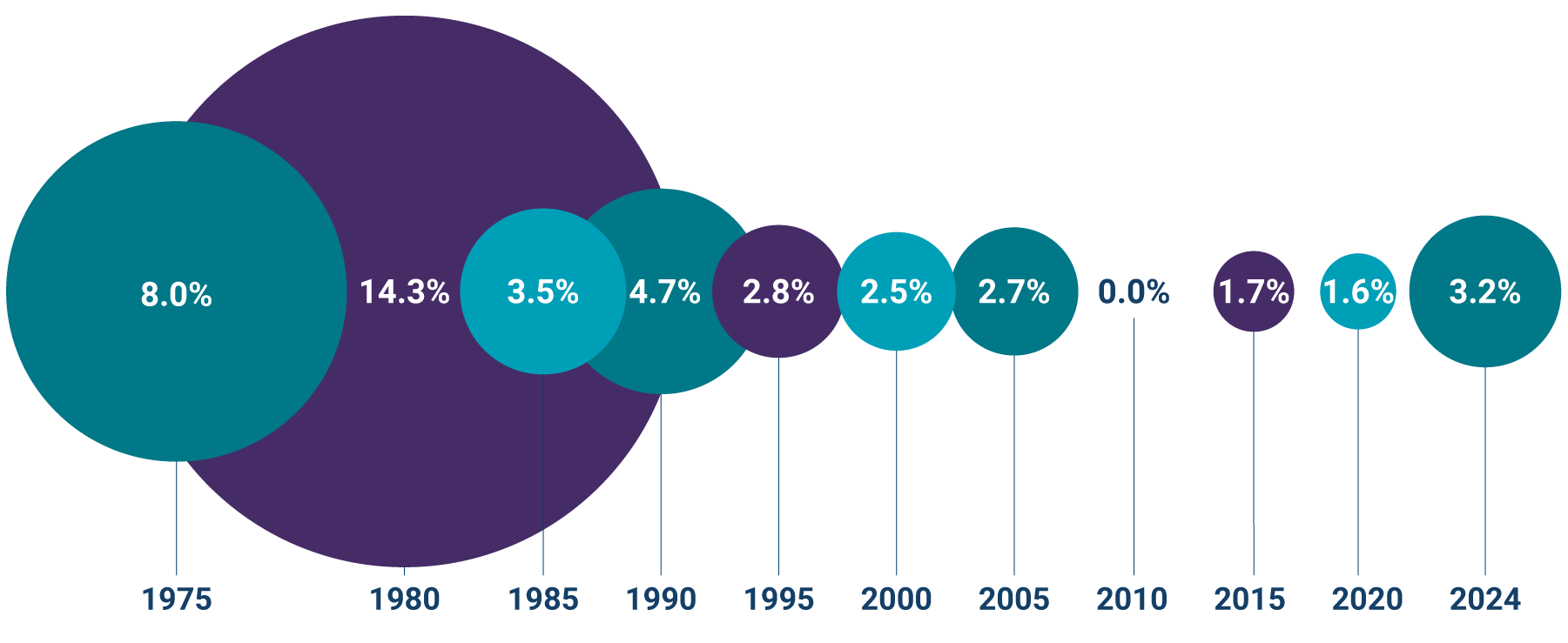

Does Social Security allow for inflation or cost-of-living increases?

The Social Security Administration can enact yearly benefit increases called cost-of-living adjustments (COLA) based on inflation. Since 1975, COLAs have ranged from 14.3% (1980) to 0.0% (2010, 2011, 2016).

Understanding retirement benefits1

Who can qualify for Social Security retirement benefits?

You are eligible to receive Social Security benefits in the United States once you’ve accumulated 40 work credits — as long as you also pay Social Security taxes (this may be an issue for certain government employees or those who are self-employed if applicable taxes are not remitted). Non-U.S. citizens who are living legally in the United States and have earned benefits can also qualify for Social Security.

What is my full retirement age?

Your full Social Security retirement age depends on the year you were born. If you were born on January 1of any year, refer to the previous year to determine your full retirement age.2

Year of birth |

Retirement age |

|---|---|

| 1943-1954 | 66 years old |

| 1955 | 66 +2 months years old |

| 1956 | 66 +4 months years old |

| 1957 | 66 +6 months years old |

| 1958 | 66 +8 months years old |

| 1959 | 66 +10 months years old |

| 1960 | 67 years old |

When should I start collecting Social Security retirement benefits?

The answer is different for every person and depends on many individual factors like your date of birth, marital status, health and financial position.

The longer you wait to start collecting Social Security, the higher your monthly benefit will be up to age 70. However, waiting may not be the right choice for everyone. The appropriate time for you will depend on your financial situation and your goals.

How do my Social Security benefits change if I retire early or late?

As life changes and priorities shift, you may wish to retire before or after your full retirement age. Taking Social Security early locks you into lower monthly payments and will decrease your lifetime benefit amount. Taking Social Security later increases your monthly payment and the amount you will receive over your lifetime.

Social Security benefit calculator

Social Security benefits can be an important factor to consider in your future retirement income. Use this calculator to estimate what your retirement benefit amount could be.

Can I still work and collect Social Security retirement benefits?

You can collect Social Security retirement benefits while working, starting at age 62. However, your age and earnings may impact the amount of benefits you receive during that time. Working won't permanently reduce the Social Security benefits you receive, nor will your withheld benefits disappear.

Once you reach full retirement age:

-

Your monthly benefit will increase, taking into account prior benefits detained due to earnings

-

Extra income no longer decreases your benefits

How working while collecting Social Security affects your benefit:

These types of income are exempt from the Social Security earning limit:

*If you are employed, only your wage amount applies to earnings limits. If you're self-employed, only your net earnings count.

Can I receive the Social Security benefits of my spouse or former spouse?

In some cases, retirement benefits are based on your own earnings record. However, Social Security spousal and survivor benefits are based on your spouse’s earnings, whether the spouse is deceased or divorced from you. Keep in mind that you can qualify for spousal or survivor benefits as well as your own retirement benefit, but Social Security won’t let you add these amounts together. Instead, you will receive whichever benefit is larger.

If your spouse receives Social Security benefits, you may be able to claim benefits based on their income, even if you have never earned Social Security benefits, you may be eligible for if you are:

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.