Wait. Did someone just call the cops to break up the AI party?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — February 9, 2026

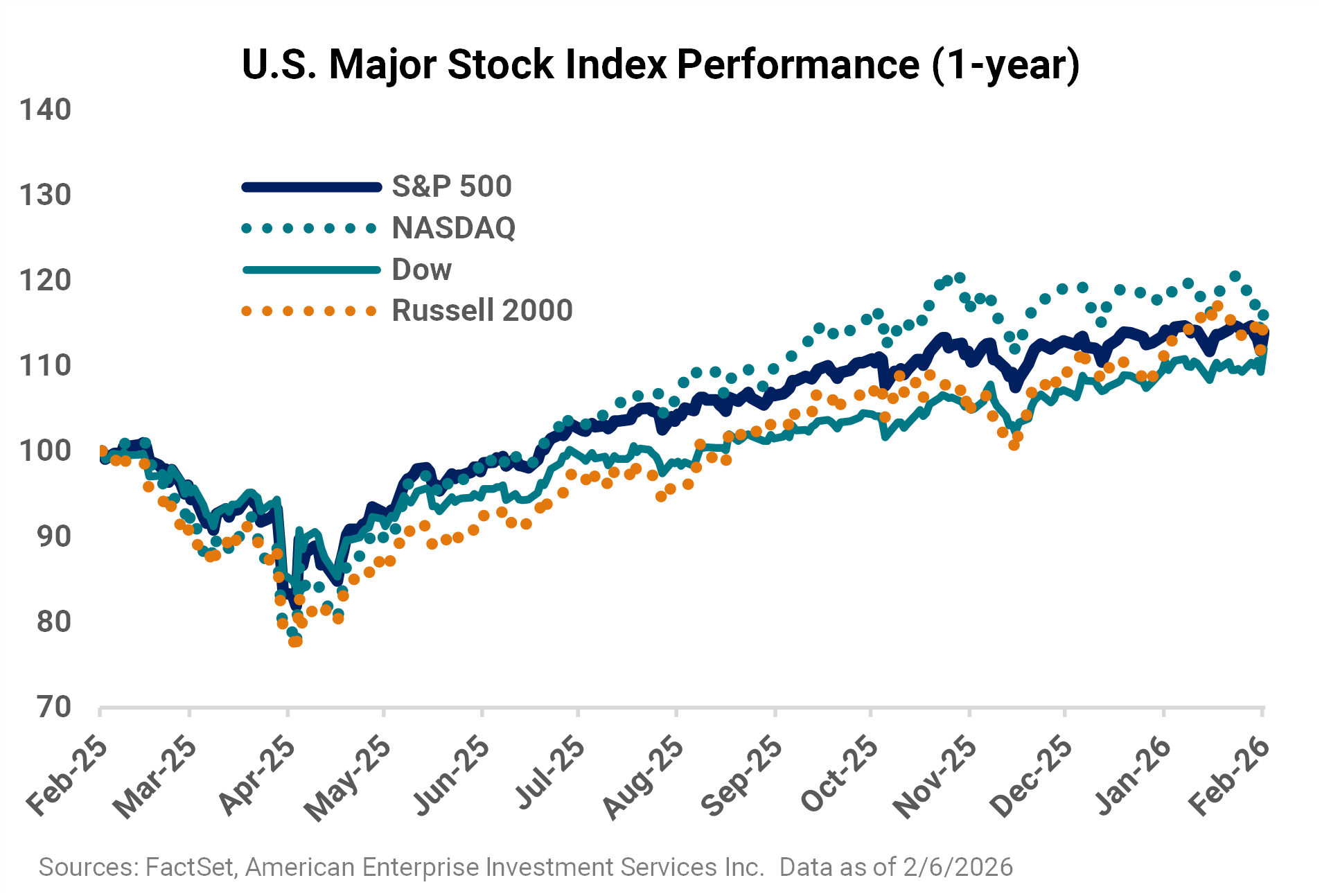

Last week, trading across U.S. stocks was volatile, reflecting rotation “away” from Tech, “to” Tech, and through periods of defensive/offensive positioning. AI fatigue, growing concerns about aggressive capex spending across key technology companies, and sharp declines in software and cryptocurrencies earlier in the week gave way to dip buying on Friday, with investors quickly moving back into areas of well-established strength (i.e., Technology) to take advantage of recent declines. This week, a barrage of additional fourth quarter earnings reports, the delayed January nonfarm payrolls report, and December retail sales will add needed context to the investment backdrop.

These figures are shown for illustrative purposes only and are not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Last week in review:

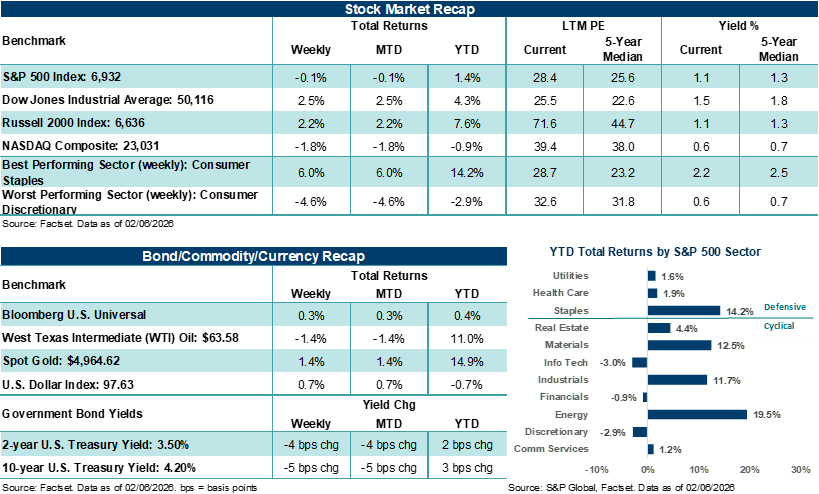

- The Dow Jones Industrial Average closed above 50,000 for the first time on Friday, gaining +2.5% on the week. The Russell 2000 Index gained +2.2% last week, outpacing the S&P 500 Index (-0.1%) and NASDAQ Composite (-1.8%) by a wide margin.

- Amazon (-12.1%) and Alphabet (-4.5%) reported solid earnings results for the previous quarter, though aggressive 2026 capex plans weighed on their stock prices and contributed to steep losses across Consumer Discretionary (-4.6%) and Communication Services (-4.4%).

- U.S. Treasury prices were firmer across the curve, the U.S. Dollar Index broke a two-week losing streak, Gold rose +1.4%, and West Texas Intermediate (WTI) crude settled lower, its first weekly decline since December.

- December job openings came in at their lowest level since September 2020, while January Challenger layoffs rose to their highest January total since 2009. Combined with a below-consensus January ADP private payrolls report, labor softness remains an unresolved challenge for the Fed and investors alike.

- January ISM manufacturing unexpectedly rose to its highest level since August 2022, while ISM Services expanded at levels consistent with expectations.

“Investors are rightfully looking for opportunities beyond the AI theme. And a more diverse set of sectors is helping broader averages like the S&P 500 tread water while near- and intermediate-term Tech dynamics play out.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Wait. Did someone just call the cops to break up the AI party?

No. But on some days lately, it may sure feel that way. In our 2026 Outlook report, published at the end of last year, we noted the following: Artificial intelligence remains one of the most powerful investment themes of the 2020s. We believe the opportunity set for companies and investors remains large, but sentiment is shifting. The next phase of AI may need to be defined more by tangible results. Investors should expect scrutiny to remain elevated around whether these investments are improving margins, accelerating growth, and/or creating durable competitive advantages. Just a few short weeks into 2026, stocks across the Technology complex appear to be reacting to that scrutiny with greater volatility, despite a still-strong fundamental outlook for Tech and AI this year. As a result, sky-high capital expenditure announcements of late and concerns that AI capabilities could soon disrupt industries more quickly than anticipated are beginning to weigh on investor sentiment.

Notably, investors are being forced to quickly re-underwrite artificial intelligence trends across Big Tech, tech-adjacent industries, and broader swaths of the economy over the near-to-intermediate term. For much of the last two years, the AI theme was broadly treated as an all-encompassing growth story, a sort of panacea for any company willing/able to tap into its new capabilities. This includes faster computers, smarter software, and higher productivity across the workforce, all leading (hopefully) to ultimately higher profits for those willing to commit the time and resources. In a nutshell, that logic helped drive a powerful stock rally across a select group of mostly large-cap technology companies over recent years, especially within hardware and software, seen as natural beneficiaries of AI adoption. However, what has changed more recently, as stock volatility has increased, is not that the AI party is being broken up, but rather confidence in which companies and industries will ultimately benefit from the new technology (i.e., who gets to stay at the party).

As last week’s market volatility highlighted, software stocks currently sit at the center of this AI reassessment. As our equity team recently noted, for years, investors have valued software companies highly because their business models are relatively insulated from most cyclical risks. For example, once a software product is built, it costs very little to deliver another copy. Revenue is usually recurring and often tied to per-employee licenses or long-term contracts. As companies grow, software company profits can grow too, and if companies don’t grow, cutting software costs is usually way down on their list of expense savings. However, investors are increasingly concerned that artificial intelligence could materially disrupt these long-entrenched assumptions and cause “structural” stress across the industry. Although AI-driven capabilities are expensive to run and require massive computing power, they can also help reduce the need for as many users. The benefit for companies? Standalone AI systems are increasingly demonstrating that they can do work that once required multiple employees and, in some cases, multiple software tools.

In our view, this helps explain why investors have sold software stocks so aggressively as of late, with the S&P 500 Software and Services Index down roughly 26% from its 10/28/25 peak, while the S&P 500 is up +0.6% over the same period. Importantly, investors' concern is not that companies like Salesforce, ServiceNow, Adobe, or legal and research platforms will suddenly stop being useful or profitable. Instead, the fear is that AI software/plugin tools from less established players may more quickly compress businesses' willingness to pay for new software, shift their software spending, reduce the number of software licenses needed, and/or disrupt the predictability of future profits that have made software companies historically attractive to investors.

Bottom line: When new AI tools can automate entire workflows, such as reviewing contracts, generating research, or producing marketing content (see recent AI advancements across Alphabet’s Gemini and Anthropic’s Claude), we believe the value of traditional software bundles may become harder to defend over time. In our view, that uncertainty has pushed investors to aggressively reduce software exposure, even in companies that are still reporting solid earnings. Time will tell whether software fundamentals will progress as negatively as investors appear to be pricing in at the moment, but we suspect some of the well-established, well-run software companies that enjoy strong integration across businesses will likely find a way to adapt and compete in an AI-driven environment. Importantly, we wouldn’t discount software companies' ability to adopt new AI capabilities over time, especially if they can pair that with strong contracted revenue streams and proprietary data advantages that remain difficult to duplicate.

At the same time, large-cap technology as a whole is also starting to see increased selling pressure, though not to the extent that software companies have experienced. As most investors understand, artificial intelligence requires enormous investment in data centers, semiconductors, networking equipment, and power capacity. Based on what investors are hearing in this season's quarterly earnings reports, AI costs are growing rapidly, but so too is the revenue flowing to the companies that supply this infrastructure. For example, semiconductor manufacturers and equipment makers will likely benefit directly from increased AI spending this year, as every new model/application often requires more physical capacity. Thus, profit visibility for hardware companies appears clearer in our view, as their customers remain committed to spending.

For example, Amazon, Microsoft, Alphabet, Meta Platforms, and Oracle are projected to collectively spend more than $700 billion on AI this year. For context, that spending rivals Japan’s spending budget, and surpasses that of Germany and Mexico. At such enormous AI spending levels, it has become much harder for investors to automatically assume that the spending these handful of companies are undertaking will yield the type of profits that justify it. Thus, investors have asked tougher questions during this earnings season, such as, how long will it take for these investments to pay off, and at what return? Based on how these stocks and others across Big Tech have performed over recent weeks, investors are prioritizing returns on investment over rosy assumptions about the future.

Bottom line: We believe markets are in a period of healthy rotation, and near-term skepticism about AI (which is probably justified given valuations in certain pockets) isn’t necessarily causing broader market disruptions at the moment. At present, Big Tech fundamentals appear sound. Investors are rightfully looking for opportunities beyond the AI theme. And a more diverse set of sectors is helping broader averages like the S&P 500 tread water while near- and intermediate-term Tech dynamics play out. In our book, as long as fundamental conditions hold and Tech surprises are kept to a minimum (NVIDIA reports results later this month), current market conditions continue to favor a balanced asset allocation approach.

The week ahead:

-

Seventy-eight S&P 500 companies will report Q4’25 profit results this week, including those from Coca-Cola, McDonald’s, Marriott International, and Cisco Systems.

-

Wednesday’s January nonfarm payrolls report is expected to show +80,000 new jobs, up from +50,000 in December. The unemployment rate is expected to hold steady at 4.4%. Annualized January CPI data on Friday is expected to tick lower from December levels on both a headline and core basis but remain above the Fed’s +2.0% target.