ChatGPT changed the world. Three years into the AI revolution, what comes next?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — December 1, 2025

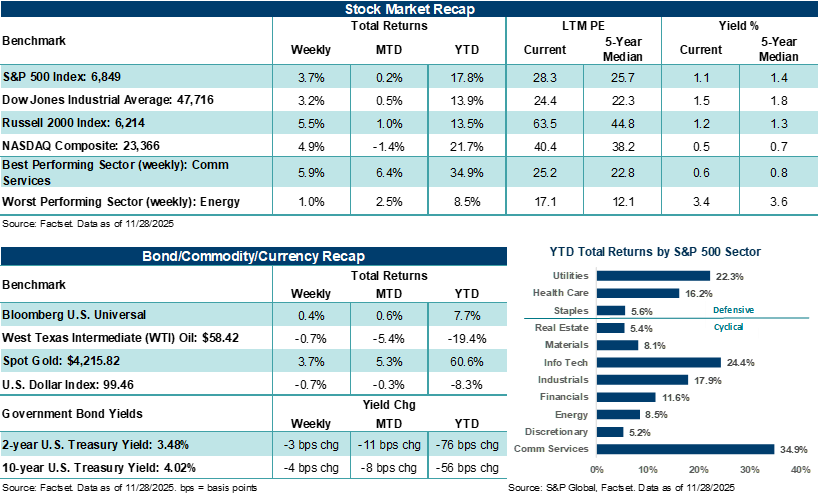

Stocks posted strong gains during the shortened Thanksgiving week, helping major U.S. stock averages finish mixed for the month of November, despite increased volatility throughout the month.

Last week in review:

-

The S&P 500 Index rose +3.7% last week, and the NASDAQ Composite gained +4.9%. The S&P 500 eked out a small gain in November and, after being down 4.5% month-to-date at one point, finished higher for the seventh straight month. The NASDAQ ended November down 1.5% as AI scrutiny weighed on sentiment.

-

The Dow Jones Industrials Average and Russell 2000 Index posted solid gains last week and finished November higher.

- Notable factors that moved stocks last month included shifting odds for a 25-basis point December Fed rate cut, which currently stands above 85%, and the sustainability and quality of aggressive AI spending commitments among a handful of Tech companies. As a result, the bulk of the Magnificent Seven companies finished the month of November lower, except for Alphabet (+13.9%) and Apple (+3.1%), with the former benefiting from the positive launch of Gemini 3.

- In November, U.S. Treasury prices were mostly firmer across the curve. Gold rose for the fifth consecutive month, West Texas Intermediate (WTI) crude posted its fourth consecutive decline, and the U.S. Dollar Index declined slightly.

- Following the longest U.S. government shutdown in history, U.S. economic data began to flow later in the month. However, important data on inflation and employment could remain cloudy through year-end due to collection issues resulting from the government shutdown.

- According to Adobe Analytics, Black Friday online sales hit a record $11.8 billion, up +9.1% from last year. Notably, AI-driven traffic to U.S. retail sites increased by an eye-popping +805% compared to 2024, as consumers used chatbots to hunt for holiday deals from their couches.

“The first three years of AI were marked by investor excitement and extraordinary spending to start building the infrastructure needed to harness the advanced form of computing. In our view, aggressive spending is likely to continue over the coming years and is necessary to scale AI in ways that unlock broader uses across business. That said, investors are likely to focus more intently on companies that can leverage AI to enhance profit margins, reduce costs, and expand opportunities.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

ChatGPT changed the world. Three years into the AI revolution, what comes next?

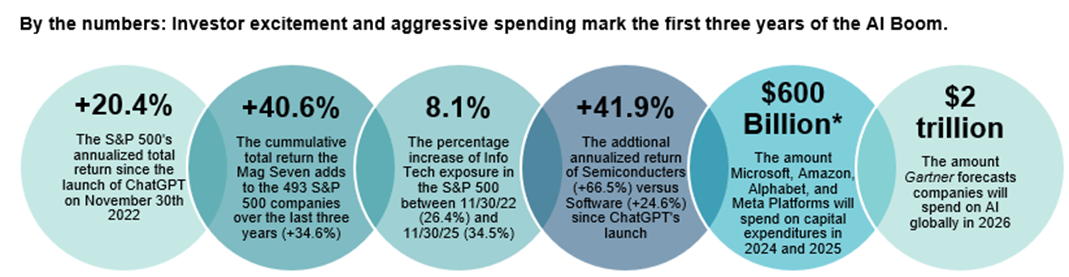

Three years ago, almost to the day, the world received its first polished glimpse of artificial intelligence with the introduction of OpenAI’s ChatGPT on November 30, 2022. Until the launch of ChatGPT, a free consumer-facing chatbot that allowed anyone to ask any question at any time and receive an immediate (mostly accurate) response, AI had generally taken form in machine learning models that companies and universities tested in laboratory settings. But since the launch of ChatGPT, computing has undergone a revolutionary transformation over the past three years, as major Tech companies race to put their stamp on how the world will operate in the 21st century. Notably, new large language models from other public and private companies emerged quickly following the launch of ChatGPT, introducing ever more powerful capabilities that showcased AI’s true promise and transformative potential, thereby immediately capturing investors' attention.

Hyperscalers, semiconductor manufacturers, networking companies, and hardware makers have been the early beneficiaries of the AI buildout over the last three years, as investors have quickly rewarded companies that are profiting immensely “today” from the buildout in data centers and growth in modeling. Yet, at some point, we would expect investors' interest to rise more holistically across the software space, specifically for companies that can either maintain leadership in an AI-driven era or disrupt established and entrenched software leaders. Undoubtedly, the last three years have been marked by the AI hardware boom, which we expect to continue throughout 2026. However, over the next three years, and as often happens when transformative technology emerges and then begins to mature, “software” (or platforms users rely on to interact with the new technology) becomes increasingly important in unlocking productivity and driving evolving technological benefits. In our view, the world will begin to move beyond chatbot interfaces over the next three years as computing capabilities increase, allowing consumers and businesses to more fully connect systems, tools, data, and software in ways that are very likely to unlock the next wave of AI growth.

Importantly, we expect that over the next three to five years, a clearer picture will emerge of which companies are thriving in an AI-driven era, and which are not. This applies not only to Technology, encompassing both hardware and software companies, but also across various industries, ranging from large- to-small. Access to AI-driven cloud computing, advanced on-device capabilities, connected and powerful software/tools/data interfaces, and a strong management foundation are likely to be the recipe for running a successful business in the second half of this decade. Companies that recognize these attributes earlier rather than later could hold a competitive advantage by the end of the decade. Historically, sectors such as Financials and Healthcare are among the earliest adopters of new technology outside of the Tech Industry itself. Companies in these areas are already investing heavily in AI and testing use cases across banking, financial services, drug development, and medical and surgical advancements. As AI use cases evolve into “business as usual,” companies that can make this shift at scale early will likely gain market share from those that cannot.

This example is shown for illustrative purposes only and is not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

These examples are shown for illustrative purposes only and are not guaranteed. Past performance is not a guarantee of future results.

Sources: FactSet, Bloomberg, Gartner, Stanford University, and company filings. *Capex includes fiscal year actuals and projections. Data through 11/30/25.

Bottom line: As investors plan for the year ahead, we believe they should ensure a healthy allocation to well-established, quality-focused “active” strategies across broad equity and sector-specific funds. As AI winners and losers emerge over the coming years, and businesses overall grapple with a rapidly changing competitive and technological environment, we believe individual investors should lean more prominently on professional money managers who have the skill, time, and ability to help identify how the next leg of AI could play out across the market over the coming years.

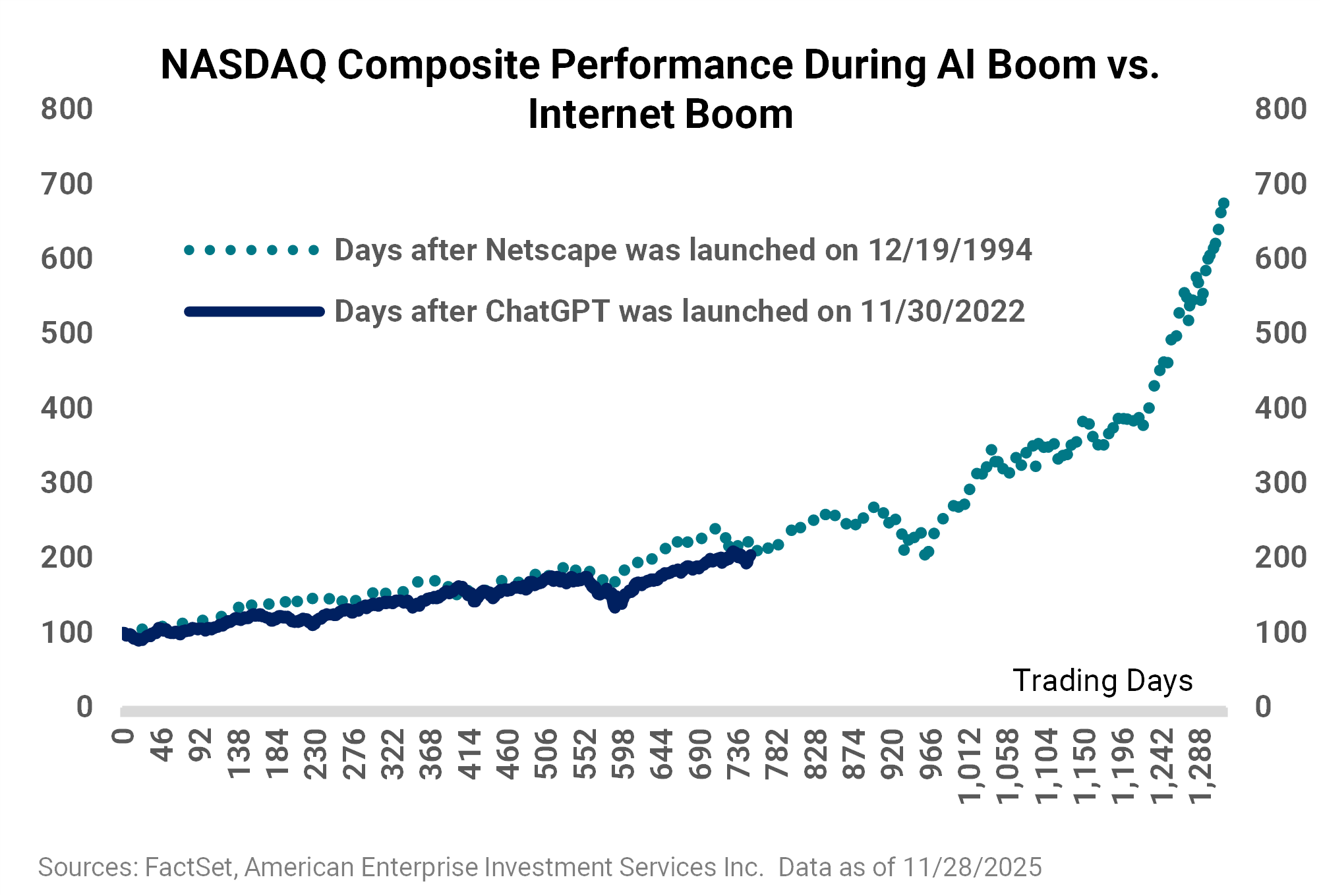

Finally, as the charts above show, U.S. stock performance has been highly concentrated among a select group of Big Tech companies over the first three years of the AI Boom, with trends closely tracking those of the early days of the Internet Boom in the 1990s. Additionally, capital expenditure (capex) on AI among a small group of U.S. companies has been substantial over the last two years, with estimates suggesting that AI spending globally will expand aggressively in 2026. At various points this year, investors have questioned whether AI is in a bubble and whether the current capex is worthwhile. According to Stanford University’s latest Artificial Intelligence Index report, two-thirds of Americans now believe that AI-powered products and services will significantly impact their daily life within the next three to five years. However, AI in its current form still lacks the ability to reliably reason across complex problems, which continues to limit its trustworthiness in systems and applications that require high-stakes, no-error outputs. Thus, we believe that increased investment in data centers, power generation, modeling, networking, and other related areas will be needed to bring AI to the scale that most Americans now expect by the end of the decade.

Bottom line: The first three years of AI were marked by investor excitement and extraordinary spending to start building the infrastructure needed to harness the advanced form of computing. In our view, aggressive spending is likely to continue over the coming years and is necessary to scale AI in ways that unlock broader uses across business. That said, investors are likely to focus more intently on companies that can leverage AI to enhance profit margins, reduce costs, and expand opportunities. And while it’s very possible that AI is in a bubble today, with some early AI winners at risk of disruption in the future, history is clear on the transformative power of change. Revolutionary technology endures, and new winners emerge over time, even when bubbles eventually pop. Investors must stay patient, disciplined, and willing to look through the cycle.

The week ahead:

-

Adobe forecasts that Cyber Monday will likely represent the peak online spending day of the holiday season, with consumers projected to spend a little over $14 billion. Americans will do a major portion of their online holiday shopping this year on mobile devices, with 2025 potentially becoming the first year that more than 50% of online purchases over the holiday season (November 1 – December 31) are done on phones or tablets.

-

The delayed September PCE report will be released on Friday, marking the last key inflation data the Fed will receive before next week’s meeting. A preliminary December look at University of Michigan consumer sentiment is out on Friday.