Earnings and headlines loom as the S&P 500 hesitates near 7,000

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — January 20, 2026

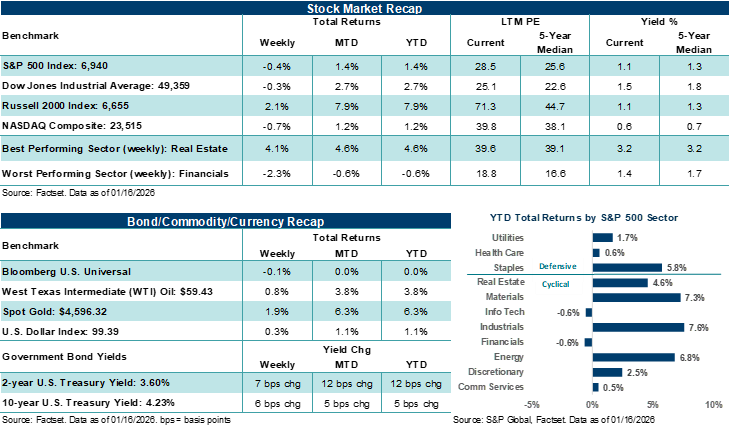

Major U.S. stock averages mostly fell last week. However, the Russell 2000 Index posted another strong week of performance, as the small-cap barometer has gotten off to a fast start in 2026. December core consumer inflation came in cooler than expected, while November producer price inflation came in hotter than expected on an annualized basis. This week, the fourth quarter earnings season heats up, with 35 S&P 500 companies scheduled to report results.

Last week in review:

-

The S&P 500 Index and NASDAQ Composite floated lower mostly on Big Tech weakness, particularly across Meta Platforms and Amazon. The equal-weight S&P 500 outperformed the cap-weight Index by over 100 basis points.

-

The Russell 2000 Index bucked the week’s softer trend, finishing higher, benefiting from rotation trading away from Big Tech and a procyclical tailwind.

- U.S. Treasury yields gravitated higher, Gold finished higher, the U.S. Dollar edged lower, and West Texas Intermediate (WTI) crude settled below $60 per barrel.

- The headline Consumer Price Index advanced +2.7% year-over-year last month, coming in as expected, while core CPI (ex-food and energy) ticked lower to +2.6% annualized from +2.7% previously.

- Producer Price Index and retail sales data for November reinforced stable U.S. economic conditions, while December existing home sales surpassed expectations.

- Bank earnings also helped reinforce generally stable consumer and business conditions in the U.S., while White House headlines during the week, such as a Department of Justice criminal probe into Fed Chair Powell’s handling of building renovations, kept headlines fluid.

“The new year has certainly opened with plenty for investors to keep track of, particularly as headlines have spun on an almost daily basis across markets, the economy, and geopolitics.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Earnings and headlines loom as the S&P 500 hesitates near 7,000.

The new year has certainly opened with plenty for investors to keep track of, particularly as headlines have spun on an almost daily basis across markets, the economy, and geopolitics. Basically, halfway through January, the S&P 500 Index continues to press against the psychologically significant 7,000 level, but without breaching it. It’s been 295 trading days since it crossed 6,000, a slower climb than the 190 days it took to go from 5,000 to 6,000, according to Dow Jones Market Data. But investors' hesitation around big round numbers in the S&P 500 isn’t out of the ordinary either and fits with historical precedent. Thus, given the current state of valuations across major averages and the barrage of recent headline volatility, the bar to push stocks higher from here, even with incremental positive news, is high when indexes already sit near record levels. Of course, this type of dynamic isn’t a surprise to most seasoned investors.

At the most basic level, we believe investors want to see confirmation through upcoming earnings reports that business conditions and outlooks warrant current valuations before pushing stock prices higher, particularly after last year’s gains. As we have noted previously, earnings will likely need to do much of the heavy lifting this year if stocks are going to move higher from here, and this week’s increased flow of fourth quarter earnings reports offers a good test of matching company fundamentals with current prices.

On those fundamentals, FactSet estimates show S&P 500 Q4’25 earnings per share (EPS) growing by over +8.0% year-over-year on revenue growth of +7.7%. That said, investors have likely already built into their expectations that companies, in aggregate, will top those estimates during the reporting season, given historical precedent. On a positive note, bank results last week pointed to a pretty steady consumer and business backdrop, but with a few caveats. Notably, credit trends remained solid, and management commentary and outlooks on consumers and small businesses were generally constructive, while investment‑banking and underwriting activity improved from last year’s lows. However, net interest income and deposit costs were mixed across the major banks, and expense control was an area of focus for investors, which is why stocks reacted “selectively” to results last week despite healthier deal pipelines and ongoing capital return. In our view, bank fundamentals are solid, which provides a positive start to the earnings season. Of course, investors will want to see this generally healthy backdrop spread across more companies, industries, and sectors as the earnings season now kicks into gear.

In our view, Technology companies will likely continue to carry an outsized influence over how investors interpret profit results over the coming weeks. Even excluding NVIDIA, Info Tech's fourth-quarter EPS growth is projected to come in at roughly +18% year-over-year, well ahead of the broader S&P 500. Interestingly, Taiwan Semiconductor’s report last week, showing +35% year-over-year EPS growth in Q4, upward capital spending plans, and strong AI revenue growth, suggests AI-related chip companies could see solid results for the previous quarter. In our view, the AI infrastructure buildout remains a multi-year investment theme spanning compute, advanced packaging, memory bandwidth, and power systems, and could be a durable earnings stream for the companies involved this year. Though not directly tied to the AI theme at the moment, Intel reports earnings results on Thursday, with most of the Magnificent Seven releasing their highly anticipated results the week of January 26. Pro-cyclical areas outside of Tech, including the Russell 2000 Index, continue to lead markets higher in the early days of 2026. LSEG Lipper reported that $28.1 billion was added to global equity funds for the week ending January 14, and EPFR tracked roughly $36.5 billion over the same period. From our vantage point, this suggests that, despite some uncertain headlines and slower momentum in Big Tech, investors remain comfortable allocating to equities at the start of the year.

Interestingly, President Trump on Friday said he wanted to keep National Economic Council Director Kevin Hassett in his current role, effectively taking him out of the hunt to be the next Federal Reserve Chair. Prediction markets immediately shifted toward former Fed Governor Kevin Warsh as the next Fed Chair, with current Fed Governor Chris Waller a distant second. U.S. Treasury yields rose following the announcement, and the U.S. dollar firmed amid the prospect of a more hawkish reaction function compared to a Hassett-led Fed. However, several Republican senators said they would not consider a Fed Chair nominee until the Powell investigation is resolved, which, in our view, may force President Trump to lower the temperature on his Fed rhetoric. By the end of last week, markets were starting to price in a later start to rate cuts this year, which could place a bigger premium on companies that can fund growth internally, hold margins, and rely less on borrowing or near-term policy relief.

And finally, as investors enter this week, geopolitical and trade and tariff headlines from the White House could continue to swirl as markets attempt to keep their focus on fundamentals and earnings reports. Over the weekend, President Trump said eight NATO members (i.e., Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland) will face new tariffs starting at 10% on February 1, rising to 25% on June 1 if a deal for the U.S. to acquire Greenland isn’t reached. Over the weekend, President Trump’s decision to impose escalating tariffs on eight NATO allies, framed as leverage to secure a U.S. purchase of Greenland, has quickly triggered diplomatic and trade confrontation across the Atlantic. Simply, if imposed, the new duties on top of an already elevated tariff structure could seriously threaten the U.S./EU trade agreement reached in late July. The new tariff threats have already drawn sharp and unified European condemnation, with EU leaders reportedly considering punitive economic measures against the U.S. Even here at home, many in Congress question the White House’s approach. Globally, the White House’s position on Greenland has strained NATO solidarity, forcing European governments to signal that Greenland is not negotiable while they continue to face pressure from the Russia-Ukraine war and U.S. tariffs. In our view, investors and markets have smartly looked past various geopolitical developments this year, keeping their focus on factors that drive profits, growth, and interest rates. That said, Greenland’s large, undeveloped deposits of rare earths, its strategic significance for U.S. air and missile defense, and its growing influence on new shipping and trade lanes across the Arctic may be among the reasons driving Trump’s acquisition strategy. And given the sovereignty concerns and escalating tensions between the two economically intertwined regions, investors would be unwise, in our view, to simply ignore this recent geopolitical development.

Bottom line: The S&P 500 Index is struggling to crack the 7,000 level, which we believe it can if fundamentals and earnings remain on track with our expectations. But as we highlighted in our 2026 Outlook and Themes report, investors should be prepared for “wildcard” developments on tariffs and trade this year, as well as a range of potential market reactions. At least early in the new year, the White House has laid down several wildcards that have forced investors to remain on guard.

The week ahead:

-

Earnings reports from Netflix, United Airlines, Johnson & Johnson, Procter & Gamble, and Intel line the week.

-

On the economic side, the shortened Martin Luther King Jr. holiday week includes some home data, November PCE data on Thursday, and a preliminary look at January S&P Global manufacturing and services data on Friday.