With a Fed rate cut likely this week, is it time for policymakers to recalibrate their message?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — December 8, 2025

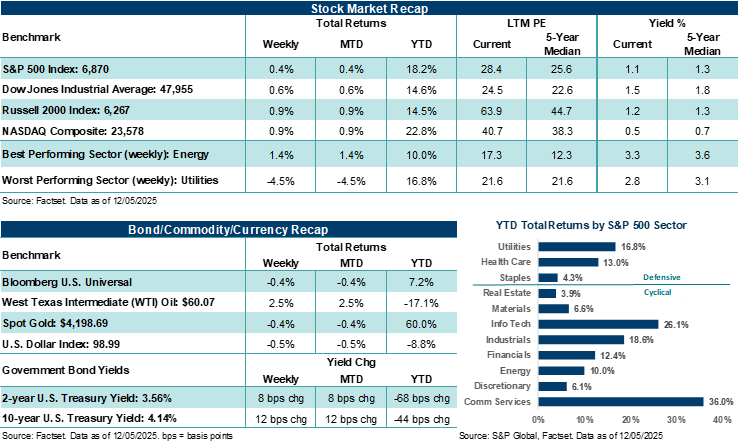

U.S. major averages eked out small gains in the first week of December, after the S&P 500 Index closed November higher for the seventh straight month. Throughout last week, investors digested incoming data that pointed to mixed economic conditions, while also starting to look ahead to this week’s closely watched Federal Reserve meeting, which could shape how stocks trade into year-end.

Last week in review:

-

The S&P 500 Index and NASDAQ Composite gained +0.3% and +0.9%, respectively.

-

The Dow Jones Industrial Average (+0.5%) and Russell 2000 Index (+0.8%) also posted gains.

- U.S. Treasury yields finished higher, the U.S. Dollar Index and Gold ended lower, and West Texas Intermediate (WTI) crude settled above $60 per barrel.

- November ISM manufacturing remained in contraction and showed a decline in employment, while ISM services expanded to a nine-month high, with the employment component rising to its best level since May (though still in contraction).

- U.S. holiday sales are tracking ahead of expectations, with U.S. shoppers spending $44.2 billion from Thanksgiving to Cyber Monday, representing an +8.8% year-over-year increase.

- The latest read on weekly initial jobless claims fell to their lowest level since September 2022, with continuing claims dropping sharply. However, Challenger job cuts rose by +24% year-over-year in November, with year-to-date cuts running at their highest level since 2020.

“Markets head into the last Federal Reserve meeting of the year this week with a slightly clearer understanding of inflation dynamics, against a still-softening employment backdrop. That said, data gaps and delayed economic releases due to the U.S. government shutdown will persist into next year, thus continuing to complicate investors' and policymakers' views of current conditions.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

With a Fed rate cut likely this week, is it time for policymakers to recalibrate their message?

Markets head into the last Federal Reserve meeting of the year this week with a slightly clearer understanding of inflation dynamics, against a still-softening employment backdrop. That said, data gaps and delayed economic releases due to the U.S. government shutdown will persist into next year, thus continuing to complicate investors' and policymakers' views of current conditions. However, last week’s delayed September PCE report (the Federal Reserve’s preferred measure of inflation) showed core prices rose by +0.2% month-over-month and were higher by +2.8% year-over-year, in line with expectations. Headline PCE rose +0.3% month-over-month in September and +2.8% annualized. Notably, goods prices climbed +0.5% in September as tariffs continued to feed through the economy, while services inflation rose just +0.2%. In addition, preliminary December University of Michigan consumer sentiment improved while inflation expectations eased. Consumers’ one-year-ahead inflation expectation now stands at +4.1%, and the five-year rate is at +3.2%, the lowest since January. Bottom line: This combination of cooler core inflation and softer expectations may provide the Federal Reserve with an opportunity to recalibrate its policy message this week, at least on the margins.

Importantly, the labor backdrop looks mixed heading into Wednesday’s Fed decision. The November ADP report showed a 32,000 decline in private payrolls, driven by small firms shedding roughly 120,000 positions, even as medium and large firms added jobs. Additionally, the Challenger report released last week indicated 71,000 announced layoffs in November, pushing the year-to-date total past one million. Corporate restructuring, AI adoption, and tariff uncertainty were identified as key factors contributing to the layoffs in 2025. Nevertheless, weekly initial jobless claims remain low, indicating that the announced cuts have not yet led to widespread layoffs. That is, hiring has slowed, and small businesses are hesitating, but broader labor stress has not broken through official claims data. We believe this mixed signal on employment trends likely supports a 25-basis point “insurance cut” this week to help balance risks associated with the Federal Reserve’s dual mandate to support price stability and full employment.

As such, the market has shifted rate cut expectations accordingly. The CME FedWatch Tool now implies a high probability of a 25-basis-point reduction on Wednesday, with trading centered on a year-end fed funds target range of 3.50% to 3.75%. The odds of a rate cut this week have shifted significantly over recent weeks, following public remarks from Fed officials. Some FOMC members have stated that policy remains modestly restrictive and there is room for a near-term adjustment to move closer to neutral, given the vulnerability of the labor market. In the same breath, some have reminded investors that a further cut in January still depends on incoming data. And several regional Fed presidents have argued for holding policy steady, given that inflation is still above target. Bottom line: We expect policymakers to continue having a healthy debate about the forward trajectory of rate policy heading into next year, with some dissenters likely to remain present in whatever Fed decision is delivered this week.

Nevertheless, the most likely outcome on Wednesday is a quarter-point cut paired with continued cautious forward guidance. The statement will likely acknowledge that inflation has moderated while possibly making a nod to price pressures across tariff-linked goods and/or rising non-labor costs. We expect language in the policy statement to remain restrictive but move closer to neutral, and that additional adjustments in policy will be determined meeting by meeting as delayed releases for October, November, and December arrive. In our view, Fed Chair Powell could continue to aim to reduce the odds of the market front-loading rate cuts next year by keeping the bar for a January cut high. However, Powell may also indicate that January’s meeting is open to a rate cut “if” labor conditions soften further or core inflation drifts lower.

The updated Summary of Economic Projections will likely be a main focal point for investors post-meeting and could help redirect or reinforce where the committee sees policy evolving in 2026. In our view, the September update serves as a useful anchor for potential changes in the Fed’s outlook this week. In September, the Fed saw real GDP at +1.6% in 2025 and +1.8% in 2026, unemployment easing from 4.5% to 4.4%, PCE inflation decelerating from +3.0% to +2.6%, and the fed funds rate drifting from 3.6% in 2025 to roughly 3.4% in 2026 and 3.1% in 2027. That is, Fed officials collectively forecast an economic backdrop of moderation in 2026. And particularly for the fed funds rate, if the median fed funds target holds near 3.4% for 2026, markets may interpret this as slightly hawkish and somewhat out of step with current market expectations.

Importantly, we expect Powell’s press conference to likely emphasize continued recalibration toward neutral policy rather than a pivot to aggressive easing, something he has artfully navigated over several press conferences now. We expect the Chair to cite softer hiring and uneven consumption, acknowledge goods inflation linked to tariffs, and stress the need for better visibility once shutdown‑delayed economic releases clear. Admittedly, questions about the neutral rate are likely to arise in the Q&A, particularly as investors seek more insight into where that rate stands and when the committee plans to reach it. And given a still murky employment picture, a stronger-than-expected nonfarm payrolls print on December 16, or a surprise firming in core inflation as newer releases arrive, the January rate decision could be a more complicated one and raise the bar for further easing. Conversely, we believe that continued weakness in small-firm hiring and ongoing moderation in core prices would strengthen the case for one or two more cuts next year. We expect Powell to stress these points in his press conference. How the market interprets his comments, the rate decision, policy statement, and economic projections are likely to shape how stocks finish the final weeks of 2025.

Bottom line: We believe the Fed will cut its policy rate by 25 basis points this week, pair it with a continued data-dependent approach, and keep January’s meeting live for an additional rate cut, but with a high bar for further cuts from there. In addition, rate projections for next year should continue to point to a gradual path of cuts, accompanied by positive economic growth and lower inflation. And if labor trends can steady and profit growth holds, the setup for markets in 2026 looks constructive, in our view.

The week ahead:

-

The S&P 500 Index has quietly pushed back up to its late October high and starts the week less than 1.0% away from an all-time high. How stocks react this week, following Wednesday’s Fed decision, could help shape whether the Index can reclaim or surpass its high-water mark over the coming days.

-

On the economic front this week, November New York Fed Inflation Expectations (Monday), the November NFIB Small Business Index (Tuesday), October JOLTS (Tuesday), and delayed housing data are on the docket.