Is corporate America up for its first big test of 2026?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — January 12, 2026

Pro-cyclical areas outside of Technology led U.S. stock markets higher during the first full week of trading in 2026. Key employment data, geopolitical headlines and developments across Washington made for a headline-driven start to the new year.

This week, the fourth quarter earnings season kicks off, allowing investors to assess how business conditions closed out 2025 and how management teams see the year ahead developing.

Last week in review:

-

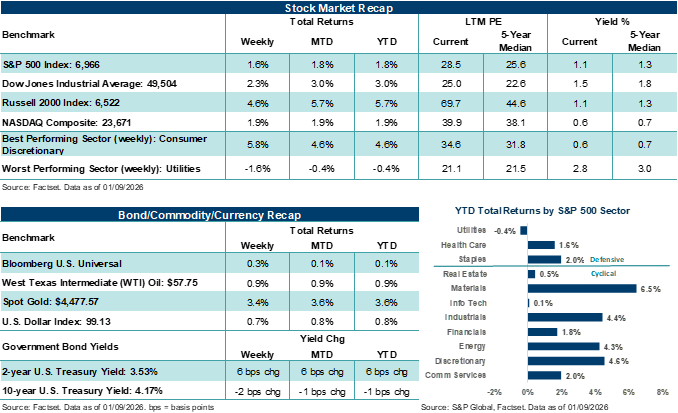

The Russell 2000 Index jumped over +4.5%, led by a pro-cyclical rotation driven by expectations for benefits from larger tax refunds, lower tariff pressures, and capex support. All major U.S. stock averages finished the week higher.

-

The U.S. captured Venezuela President Nicolas Maduro, which prompted a flood of headlines across Energy stocks, oil production questions, sanctions, and what U.S. military actions mean for the rest of the Western Hemisphere.

- President Trump threatened defense companies, proposed a $1.5 trillion 2027 defense budget, announced a ban on large institutional investors from buying single-family homes, and instructed some agencies to buy mortgage bonds to help push down mortgage rates.

- U.S. Treasuries finished mixed across the curve, West Texas Intermediate (WTI) crude rose, and the U.S. Dollar Index and Gold pressed higher.

- December ADP private payrolls, November JOLTS, and the December nonfarm payrolls report all pointed to a soft but stable employment backdrop in the U.S.

“Earnings will need to do more of the heavy lifting this year to keep major averages rising. Starting this week, investors will see if corporate America is up for the challenge.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Is corporate America up for its first big test of 2026?

Stocks finished their first full week of 2026 on a high note, with the S&P 500 Index, Dow Jones Industrial Average, and Russell 2000 Index all capturing new record highs. And despite a quiet finish in December, the S&P 500 and NASDAQ Composite are higher in three of the last four weeks.

On the economic front, December’s employment report confirmed a “low hire, low fire” labor environment. In our opinion, this could be a positive factor for further upward stock momentum, that is, if this week’s start to the fourth quarter earnings season begins on the right foot. Nonfarm payrolls rose by +50,000 last month, with private payrolls higher by +37,000, and prior months revised down by 76,000, leaving fourth quarter job growth nearly stalled. The unemployment rate ticked down to 4.4% from 4.5%, a decline attributed to lower employment participation and the lingering effects of the government shutdown. In investors' first clear look at the jobs report in months, hiring remained concentrated in healthcare and social assistance, as well as leisure and hospitality, while retail, construction, and manufacturing declined. Notably, manufacturing employment has declined for eight consecutive months, and federal government employment is 277,000 lower than it was in January, according to data from the U.S. Department of Labor. Under the surface, pressures from underemployment increased even as layoffs remained limited. The number of long-term unemployed rose by roughly 400,000 last year, and those working part-time for economic reasons increased by roughly one million since December 2024, while temporary help shed jobs in nearly every month of 2025. However, initial jobless claims last week remained low, with the four-week average the weakest since April 2024, and Challenger job cuts fell to a 17-month low last month. Bottom line: Limited net hiring in the U.S., paired with few layoffs and stable wage growth, should keep the Federal Reserve on the sidelines when it meets this month and help confirm that the job market is not in immediate need of further rate cuts at the moment.

From a stock perspective, at least at the start of the year, market breadth appears to be improving, with an increased number of sectors and industries participating in last week’s rally. For example, Small-Caps, Consumer Discretionary, Materials, and Industrials helped lead averages higher, and in our view, help provide a healthy sign that investors are leaning into pro-cyclical themes tied to fiscal spending and/or easing tariff pressures. Notably, a “low hire, low fire” labor backdrop, limited layoffs, and steady wages could help stabilize income among consumers without stoking inflation worries, which could help underpin early-year sentiment on the consumer heading into the fourth quarter earnings season. That said, artificial intelligence is expected to remain a strong narrative during the upcoming earnings season, with upbeat demand and sustained capital investment expected following CES updates last week. Even outside of AI, select semiconductor companies are pointing to better orders and backlogs, which could be positive for Technology earnings. And helping round out the more bullish aspects of current market conditions, services activity in the U.S. continues to remain in expansion, while input prices eased last month, and holiday spending data should be constructive for retail earnings reports later in the reporting season.

However, the more bearish developments that lined last week’s headlines suggest investors shouldn’t ignore potential early-year headwinds. For example, geopolitical and Washington headlines have increased risk, from developments in Venezuela to broader policy noise, including the pending International Emergency Economic Powers Act (IEEPA) decision which didn’t occur last week, affordability proposals in Washington, and unexpected policies and executive orders that could impact housing and defense companies. In addition, manufacturing remains in contraction, job openings have cooled, and market concentration across Big Tech is a broader risk as a handful of mega-cap stocks carry an outsized influence on major stock averages. As was the case last year, market sentiment, valuations, and positioning appear stretched on several measures, which could amplify negative investor reactions should actual results fall short of expectations.

Thus, there stands the market and economic setup for investors as we enter the all-important fourth quarter earnings season this week. FactSet estimates call for Q4’25 S&P 500 earnings per share (EPS) to grow by +8.3% year-over-year on revenue growth of +7.7%. Notably, the S&P 500 is on pace to record its 10th consecutive quarter of EPS growth, and its 21st consecutive quarter of revenue growth, an impressive stretch of sustained profit momentum we believe helps justify why stocks have climbed higher over recent years.

The big banks will kick off the fourth quarter earnings season over the coming days, with JPMorgan, Bank of America, Citigroup, Wells Fargo, Goldman Sachs, and Morgan Stanley all being closely watched and playing a leading role in shaping how investors will initially react to the start of the reporting season. In our view, markets are seeking a clear understanding of funding costs and deposit pricing, the trajectory of net interest income and margins, and whether loan growth can build amid steady household and business activity. Notably, credit quality across these institutions will also be a key focus, encompassing charge-offs, delinquencies, and guidance on consumer and commercial health, as well as expense discipline and capital return plans. Investors also want to hear whether capital markets and M&A activity are improving (something most investors expect to see in 2026) and if management sees conditions accelerating in the current quarter. Importantly, expectations are high after big‑banks outperformed last year, so the tone and guidance from these companies will likely matter as much as the reported numbers themselves.

Bottom line: We believe the first week of the fourth quarter earnings season could help set the tone for how stocks trade through the rest of the month. Strong updates on credit, margins, and capital deployment from key banks could help anchor investor confidence as the reporting season quickly broadens to the rest of corporate America over the coming weeks. However, if expenses run hot or guidance turns cautious, market reactions could be more volatile, and the narrative may shift toward a more selective or defensive stance given some of the more bearish developments outlined above. As we highlighted in our outlook reports at the end of last year, earnings will need to do more of the heavy lifting this year to keep major averages rising. Starting this week, investors will see if corporate America is up for the challenge.

The week ahead:

-

Fourteen S&P 500 companies will report fourth quarter earnings results this week, including two Dow 30 components.

-

On Tuesday, the December Consumer Price Index (CPI) headline and core measures are forecast to come in at +2.7% year-over-year. On Wednesday, the December Producer Price Index (PPI) will be reported. Both updates will provide a clearer assessment of recent U.S. inflation dynamics following the effects of the government shutdown.