Setting the table for a Warsh-led Fed

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — February 2, 2026

Although the S&P 500 Index briefly cracked the 7,000-level last week and eked out a small gain, most major averages finished the week lower. Mixed reactions to Magnificent Seven earnings, a Federal Reserve meeting, and President Trump's announcement of his Fed Chair nominee on Friday kept investors busy. This week, 127 S&P 500 companies will report fourth quarter results, including Alphabet and Amazon, while ISM and employment data will be closely watched.

Last week in review:

-

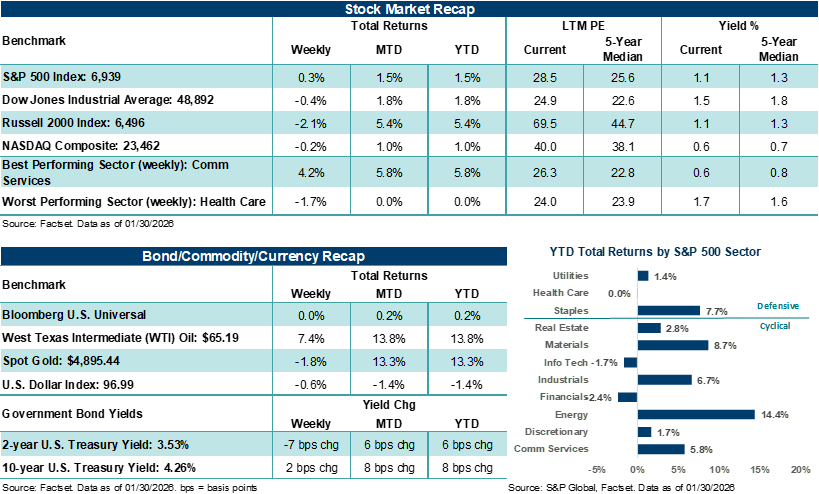

The S&P 500 Index gained +0.3%, while the NASDAQ Composite and Dow Jones Industrials Average each lost less than 1.0% on the week. The Russell 2000 Index gave back some of its outperformance in January, losing 2.1% last week. That said, all four major averages finished higher in January, with the Russell 2000 gaining 5.3%, outpacing the S&P 500 by 394 basis points.

-

Elevated earnings expectations heading into key Mag Seven reports last week produced mixed stock reactions. Outsized capex spending weighed on Microsoft (-7.7%), while Meta Platforms' results and outlook (+8.8%) were favorably received by investors. Apple (+4.6%) posted stronger-than-expected iPhone sales and provided a generally favorable outlook, while Tesla (-4.2%) delivered solid results and stressed its move toward autonomous driving and robotics.

- U.S. Treasury prices were mixed across the curve, while the U.S. Dollar Index declined for the second consecutive week and traced four-year lows.

- Gold settled lower. Notably, silver spent much of the week above $100 per ounce, but pulled back 22.5% on Friday, seeing its largest daily decline since the Hunt Brothers attempted to corner the silver market in 1980, per FactSet.

- As expected, the Federal Reserve left its fed funds target rate unchanged at 3.50% - 3.75% and we believe it is unlikely to alter its wait-and-see rate approach over the near term and until there is clearer evidence on the path ahead for labor and inflation. Notably, Federal Reserve Chair Jerome Powell will preside over just two more Fed meetings until his Chairmanship expires in May.

- On the economic front, the December Producer Price Index came in hotter-than-expected on the headline and core measures, and January consumer confidence hit its lowest reading since 2014, with those saying jobs are plentiful falling to its lowest level in five years.

“At first blush, we believe a Warsh-led Fed will continue to maintain the committee’s strong credibility of independence and support its dual mandate of price stability and full employment through monetary policy grounded in economic rigor and strong consensus-building.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Setting the table for a Warsh-led Fed.

On Friday, President Trump nominated former Federal Reserve Governor Kevin Warsh to serve as Chair of the Federal Open Market Committee. In our view, Warsh’s background blends a high level of policy experience with a long-standing skepticism toward the Fed’s rise of balance sheet “activism.” Warsh served as one of the youngest Fed Governors from 2006 to 2011 and sat on the committee during the global financial crisis, where he supported initial emergency measures but opposed expanding quantitative easing beyond QE1. In speeches and commentary since leaving the Fed, Mr. Warsh has argued that successive rounds of asset purchases across previous economic shocks have helped subsidize fiscal expansion and raised financial stability risks. Notably, Warsh was a vocal critic of the Fed during the pandemic, saying that prolonged large-scale asset purchases could sow the seeds of inflation down the road. In part, we believe Warsh was correct, as easy monetary policies did add to inflation pressures post-pandemic. In our view, his background, coupled with his ties across markets and Washington, positions him to be an incoming Fed Chair who will likely offer a pragmatic view of current processes and be cautious about balance-sheet positioning. Bottom line: We believe Warsh has the credentials and pedigree to lead the Fed, while bringing fresh perspectives on how monetary policy could evolve over time. Importantly, Warsh has been a well-regarded and independent voice on monetary policy across financial and economic circles for decades.

Interestingly, monetary policy under Warsh could draw a sharper line between interest rate policy and the asset side of the Fed’s toolkit. The Fed Chair nominee has previously signaled that the U.S. economy can grow faster without stoking inflation when productivity does the heavy lifting. Given the current state of the economy, this may imply that Warsh could support a lower neutral rate, with room to cut the fed funds rate further if inflation continues to decline. At the same time, we believe he is unlikely to endorse a return to balance-sheet expansion as a routine instrument of monetary support, potentially altering how investors view Fed actions moving forward, particularly during periods of economic stress. That said, we would expect ongoing Reserve Management Purchases to continue as a matter of routine operations under a Warsh-led Fed. Yet, investors should expect tighter scrutiny of any proposal to enlarge the Fed’s balance sheet as a means of providing stimulus. Also, Warsh has in the past floated the idea of a revised operating accord that reduces the Fed’s footprint in money markets and could set firmer boundaries between fiscal and monetary functions. As a result, we would expect a Warsh-led Fed to use conventional methods of easing policy primarily through the fed funds rate, while setting a higher bar for using the Fed’s balance sheet as a tool. Meaning, the combination of both approaches during times of stress, which investors have grown increasingly more accustomed to since the financial crisis, may not be implemented to the same degree as in the past. In our view, this could impose greater risks on financial markets during periods of stress exactly at the time investors have traditionally looked to the Fed for support.

Another important item for investors to watch is how the Fed communicates its policy moving forward. We believe Warsh’s communication style could be leaner and less scripted than that of previous Chairs. Notably, Mr. Warsh has questioned the value of frequent public projections and extended forward guidance. While we don’t believe the Chair nominee would seek to reduce the frequency of the Summary of Economic Projections right away, he may adopt a lighter approach to post-meeting press conferences. Possibly, over time, that could shift the market’s focus toward economic data and meeting outcomes as the primary means to gauge forward rate policy, thereby narrowing the window for pre-signaled policy paths. As a result, investors would need to be prepared for larger market moves around labor and inflation releases and Fed decision days, since there might be less Fed signaling, placing a larger premium on incoming data. While this may sound like a new approach, it is a cadence and Fed dynamic that was largely in place prior to the twenty-first century.

According to reports over the weekend, former colleagues describe Warsh as “outcome-oriented” and supportive of consensus-building if paired with clear objectives. If Mr. Warsh passes his confirmation hearing (which we believe he will), he will need to be sensitive to the Fed's criticisms of recent policy choices, show clear support for Fed independence, and take the lead early in articulating policy views and positions that others on the committee can support. Importantly, the Fed Chair sets the agenda and shapes debate, but the committee sets policy. Early read-throughs from the market will likely focus on how quickly Warsh can align the Board and Reserve Bank presidents on communications, potential changes to communications, and, of course, the path for rates.

Bottom line: At first blush, we believe a Warsh-led Fed will continue to maintain the committee’s strong credibility of independence and support its dual mandate of price stability and full employment through monetary policy grounded in economic rigor and strong consensus-building. However, under a new Fed Chair, investors shouldn’t be surprised if communication policies adjust, monetary policy mechanics change on the margin, and market reactions around Fed decision-making also adjust more frequently over time. In the coming days, weeks, and months, investors will seek to learn more about Mr. Warsh’s current views on the economy and policy and begin incorporating his views, to some degree, into market pricing. That said, if confirmed, Mr. Warsh will be one vote (admittedly a pretty important vote) on a larger committee of seasoned Fed officials. Investors should feel confident that the Fed's core structure remains the bedrock of the institution and that, as history has shown, Fed Chairs act more as temporary stewards of the larger collective. We believe Mr. Warsh is well-suited to continue this tradition and steer monetary policy in a direction that best supports the U.S. economy.

The week ahead:

-

Roughly 33% of S&P 500 companies have reported fourth quarter profit results, with the blended earnings per share (EPS) growth rate higher by nearly +12% year-over-year. However, fewer companies are beating analyst Q4 estimates, and stock reactions following results have been more negative than historical averages. Along with notable reports from Alphabet and Amazon this week, a wider selection of companies across S&P 500 industries are scheduled to report and could provide a more holistic view of corporate fundamentals and outlooks by the end of the week.

-

On Friday, the U.S. Senate passed five appropriations bills worth $1.2 trillion to fund the government through September and a sixth to provide two weeks of funding for the Department of Homeland Security while Democrats and Republicans agree on changes to agency policies. The House will need to vote on the agreement ASAP to end the current partial government shutdown, which began on Saturday.

- December JOLTS (Tuesday), January ADP private payrolls (Wednesday), and January nonfarm payrolls on Friday will provide investors with a clearer view of the labor backdrop and help confirm or refute whether current Fed policy is geared correctly versus its full employment mandate.