Setting the stage for 2026

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — December 15, 2025

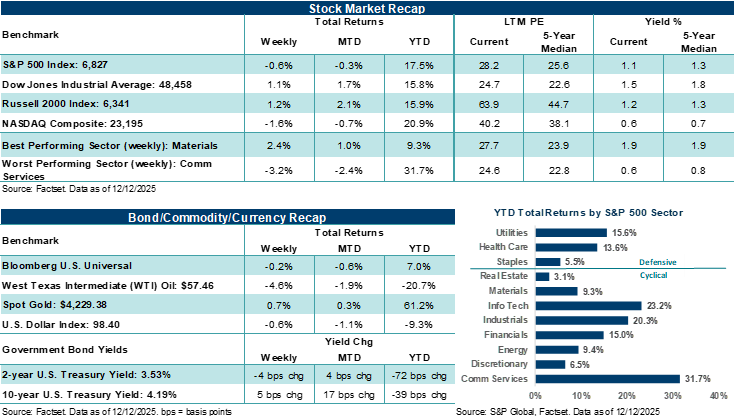

Major U.S. stock averages finished last week mixed. Broader cyclical areas of the market outperformed Big Tech following the Federal Reserve cutting its policy rate, and investors continuing to rotate away from AI-related areas amid disappointing results from Oracle last week and a high earnings bar for Broadcom. This week, fresh data on December manufacturing and services activity is on the calendar, as well as delayed government data on employment and inflation.

Last week in review:

-

The S&P 500 Index lost 0.6%, despite hitting a new closing high on Thursday. The NASDAQ Composite fell 1.6%, pressured by a sharp 12.7% decline in Oracle and a 7.8% loss in Broadcom.

-

Oracle posted profit results that showed weaker-than-expected free cash flow for the previous quarter, higher-than-expected capex guidance, and slower cloud revenue, while Broadcom posted strong profit results and guidance, high expectations acted to weigh on sentiment post-report. More broadly, AI skepticism and capital expenditure concerns continue to challenge Technology stocks as December winds down, following another strong year of returns in 2025.

- The Dow Jones Industrial Average (+1.1%) and Russell 2000 Index (+1.2%) hit new highs, benefiting from investors rotating into non-tech cyclical areas last week and following the Federal Reserve lowering its policy rate by 25 basis points for the third consecutive meeting.

- The December FOMC meeting ended with the fed funds target rate at 3.50% to 3.75%, its lowest level in three years. Fed officials provided a diverse assessment of future rate policy in 2026, as seen in the updated Summary of Economic Projections, and generally offered a positive forecast for economic and inflation conditions next year, although rate policy remains data dependent.

- U.S. Treasuries finished mixed across the curve, the U.S. Dollar Index ended lower, Gold finished higher, and West Texas Intermediate (WTI) crude fell 4.6%.

- Outside of the market and the Fed events last week, President Trump held additional interviews for the Fed Chair position, S&P 500 fourth quarter earnings estimates trended higher, and job openings for October came in ahead of estimates.

“2026 should be a constructive year for asset prices and economic conditions. That said, investors should also expect fits and starts during the year that will likely challenge their conviction and test their patience. For most investors, this means leaning on strong active management and strategies designed to uncover opportunities beyond the Magnificent Seven.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Setting the stage for 2026.

In our view, markets are poised to enter 2026 with a constructive backdrop, despite elevated stock valuations and growth expectations across Big Tech. Recent volatility within the AI space here at the end of 2025 has been a healthy reminder to investors that scrutiny of aggressive growth forecasts is intensifying, following three strong years of U.S. equity gains that have been highly concentrated in Big Tech.

Nevertheless, we see U.S. market and economic fundamentals entering next year on a stable footing, supported by solid infrastructure, technology, and manufacturing investments alongside healthy consumer trends that could broaden beyond high-income earners over the coming quarters. Fiscal policy, including the One Big Beautiful Bill Act, should add tailwinds next year through tax relief for some and incentives for domestic capital spending. Importantly, we see inflation pressures moderating over the course of next year, which could enable gradual Federal Reserve rate cuts that should help support borrowing and spending. That said, longer-term interest rates may remain firm next year, given persistent U.S. debt and deficit dynamics, as well as growing Treasury supply.

Globally, we expect economic growth to remain steady but rangebound, with Europe and China continuing to navigate trade frictions and policy uncertainty. At the same time, there may be room for potential upside surprises across areas of Asia, for example, as AI adoption accelerates outside U.S. borders and geopolitical tensions potentially ease. And while trade and tariff policies may remain ever-present wildcards for the global economy and corporations in 2026, we believe the White House will look to support U.S. growth through current fiscal policies and lower regulations during a mid-term election year.

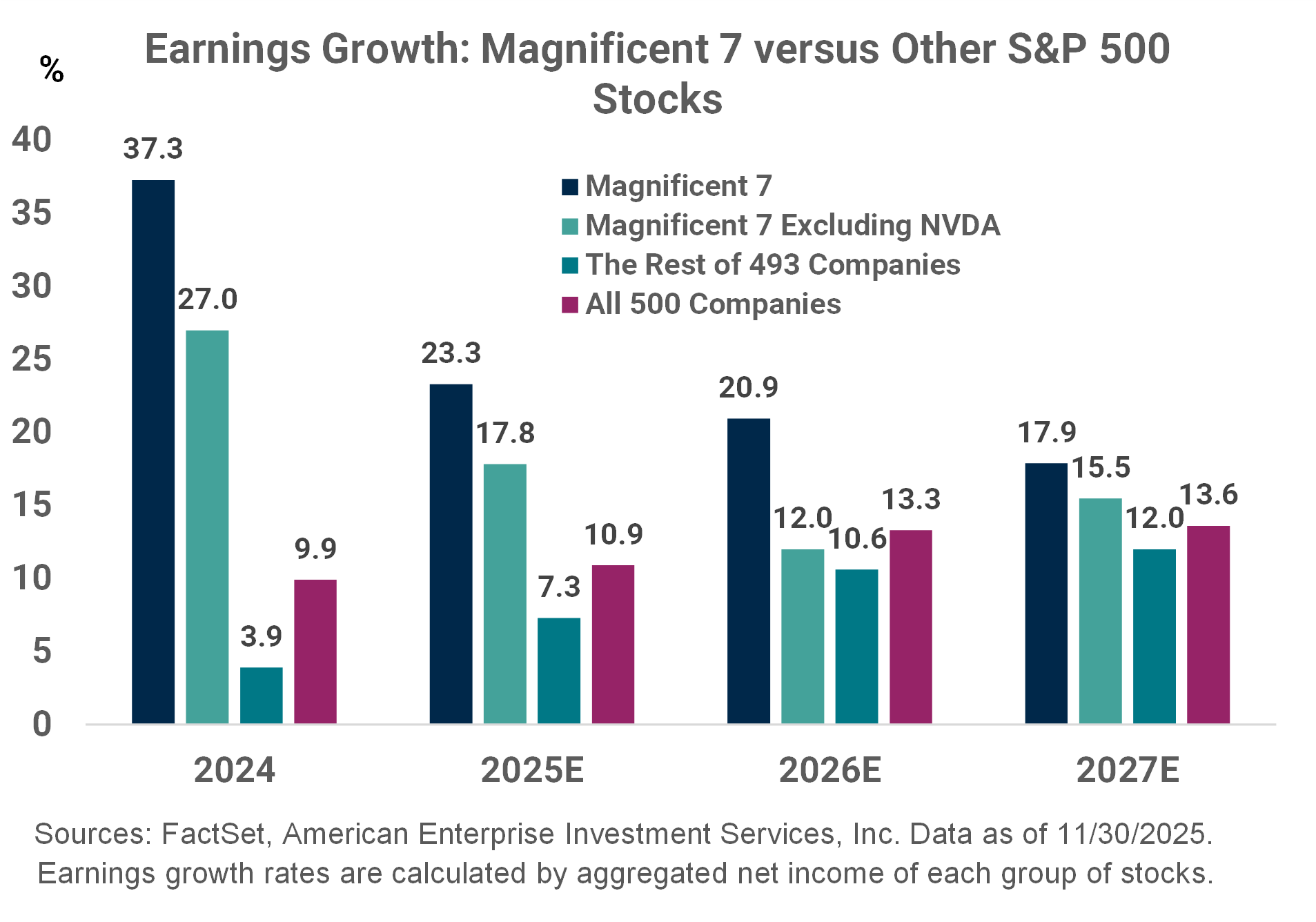

Against this backdrop, the next phase of the bull market will likely rely less on expanding valuations and more on evidence that recent investments, particularly in AI, are translating into improved corporate margins, cash flow, and productivity. It’s no surprise that Big Tech and AI drove major U.S. indexes to new highs in 2025, but what is less widely reported is that much of the market’s gains were also fueled by expanding profits across a broader set of industries this year. That trend will likely need to continue in 2026 for stocks to press higher. Notably, the forward price-to-earnings multiple for the S&P 500 is near its historical highs today. However, much of that premium is currently concentrated in mega-cap technology companies, which, we believe will likely continue to deliver strong profits and cash flow in 2026. Bottom line: While U.S. stocks are likely to experience bouts of volatility next year as markets digest evolving profit dynamics, we expect Big Tech’s secular drivers to remain a source of strength for major benchmarks, such as the S&P 500 and the NASDAQ Composite.

Notably, we expect S&P 500 earnings per share to grow by double-digits in 2026, with profit gains seen “across” most major sectors. Moderating inflation, combined with already strong margins and healthy consumer and business conditions, could leave multiple industries well-positioned for growth in the coming year. Nevertheless, investors should expect stock leadership to see more periods of rotation as markets recalibrate around shifting profit signals, and investors increasingly reward companies that convert AI spending into “measurable profits and benefits”. We anticipate AI transitioning from hype to proof over the course of next year, with companies that demonstrate improved operating margins, higher revenue per employee, and faster cycle times being rewarded in an environment where there is more scrutiny around capital expenditure. In our view, “stealth winners” of AI, or the companies embedding advanced tools into logistics, manufacturing, finance, and select industrial verticals, could outperform those companies chasing headline-grabbing consumer applications and AI hype.

Bottom line: 2026 should be a constructive year for asset prices and economic conditions. That said, investors should also expect fits and starts during the year that will likely challenge their conviction and test their patience. For most investors, this means leaning on strong active management and strategies designed to uncover opportunities beyond the Magnificent Seven. Notably, we believe maintaining exposure to quality-focused approaches can help mitigate concentration risk, while temporary drawdowns may offer chances to deploy excess cash into high-quality growth strategies or rebalance toward strategic targets. And finally, diversification strategies across international markets, alternatives, and real assets (which proved effective in 2025) should remain critical levers to mitigate U.S. valuation risk and potential pullbacks in Big Tech, should they occur next year. After three years of strong gains across major U.S. stock averages, investors would be wise to temper return expectations for next year, take a more selective approach to their investments, and look for company profits to do more of the heavy lifting in driving stock returns in 2026.

On Thursday, December 18, our 2026 Investment Outlook & Themes report will be available. The publication presents our perspective on the key themes that could shape the investment landscape next year, along with a more detailed outlook for markets and the economy. The report will also include our 2026 targets/forecasts for the economy and key indexes, as well as a detailed scenario analysis of macroeconomic conditions and portfolio strategies. Please ask your Ameriprise financial advisor for a copy.

Weekly Market Perspectives will return on January 5, 2026. Have a safe and happy holiday season.

The week ahead:

- On Tuesday, investors will get fresh preliminary December looks at manufacturing and services activity from S&P Global. In addition, delayed October and November updates on nonfarm payrolls will help fill in some missing pieces on the employment picture following the longest U.S. government shutdown in history. However, given that the employment data will be somewhat stale and the December Fed meeting is now in the rearview mirror, “as expected results” might produce a muted reaction in the market this week.

- In addition, November retail sales (Wednesday), November CPI (Thursday), and November core PCE (Friday) will also help add additional color on the consumer and inflation front heading into year-end.