Stocks search for direction amid an increasingly complex environment

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — February 17, 2026

Major U.S. stock averages continued to grind lower last week amid mixed economic updates and ongoing AI pressures. This week, a first look at Q4 GDP, home data, and earnings reports line the calendar.

Last week in review:

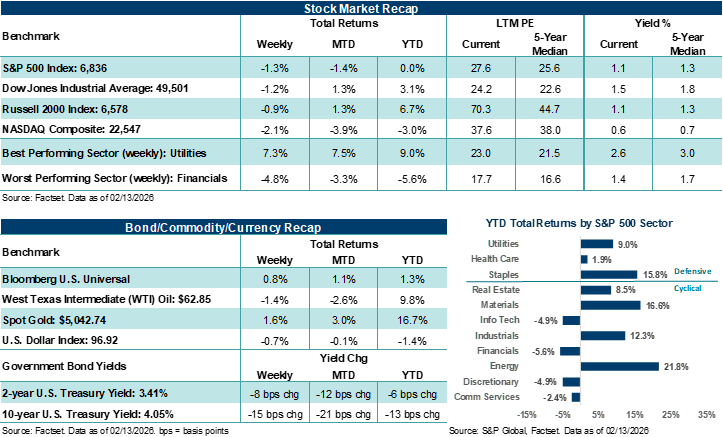

- Stock momentum continues to decelerate. The Dow Jones Industrial Average lost 1.2%, the S&P 500 Index fell 1.3% (its second consecutive weekly decline), the NASDAQ Composite dropped 2.1% (its fifth straight weekly drop), and the Russell 2000 Index lost 0.9% (down in three of the last four weeks).

- Big Tech stocks slumped, including Apple, Alphabet, and Cisco, which weighed on major averages. However, non-tech cyclical and defensive stocks outperformed, while the Equal-Weight S&P 500 Index outpaced the standard benchmark by 170 basis points and notched a record high mid-week.

- U.S. Treasury prices rallied, driving yields to multi-month lows, as the 2-year yield fell to its lowest level since late November and the 10-year yield dropped to its lowest level since early December. West Texas Intermediate (WTI) crude moved lower, Gold climbed back above $5,000 per ounce, and the U.S. Dollar Index declined.

- Despite more hawkish remarks from some Federal Reserve officials last week, investors stepped up bets on interest-rate cuts. By the end of the week, fed funds futures were pricing in roughly 59 basis points of rate reductions by year-end, the most dovish shift in rate expectations since mid-December.

- On the geopolitical front, U.S./Iran tensions remained elevated with President Trump sending a second aircraft carrier deployment to the Middle East. In a largely symbolic move, the House voted to repeal the White House’s tariffs on Canadian imports, while press reports noted the White House may trim steel and aluminum tariffs to address inflation.

- Importantly, corporate earnings continued to surprise to the upside. With roughly 74% of Q4’25 S&P 500 company profit results complete, the blended earnings per share (EPS) growth rate stands at +13.2% year-over-year, well above the roughly +8.0% growth rate expected at the end of the quarter. According to FactSet, S&P 500 revenue growth is up an impressive +9.0% on an annualized basis in Q4, marking the highest level since Q3’22, with Info Tech, Communication Services, and Healthcare on pace to report double-digit revenue growth for the previous quarter.

“Last week’s economic data gave market bulls more evidence that inflation is cooling and the labor market remains on solid footing. At face value, we believe this should give investors the confidence to remain guardedly optimistic about the path forward for growth, profits, and stock prices, even if that is accompanied by increased volatility this year.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Stocks search for direction amid an increasingly complex environment

Markets spent last week walking a fine line between focusing on the developments that could be positive for stock momentum and the factors that could become more disruptive to that momentum over the near-to-intermediate term. This included updated U.S. economic data that offered a more favorable view of recent conditions, as well as a hard-to-ignore building narrative that the trends around artificial intelligence are taking a more complex turn. For the bulls, last week’s data updates reinforced the idea that the U.S. economy remains firmly on solid footing. And for the bears, last week’s AI headlines delivered fresh reasons to question the durability of near-term stock strength, particularly if entrenched AI tailwinds start more meaningfully shifting direction and become entrenched headwinds for broader markets.

On the economic front, the January nonfarm payrolls report surprised to the upside, with the U.S. economy adding +130,000 new jobs, over twice the FactSet estimate, while the unemployment rate dipped to 4.3%. In addition, average hourly earnings rose +0.4% month-over-month, while the average workweek ticked up to 34.3 hours. In our view, the labor data indicates the U.S. economy remains strong enough to support income growth and consumer spending, possibly without reigniting inflation if current trends hold (a clear positive for corporate profit growth). That said, job gains last month were narrowly focused across a few industries, and the pace of hiring remains well below the post-pandemic boom, suggesting the U.S. economy is still decelerating beneath the surface. In fact, the Bureau of Labor Statistics revised 2025 job growth down by one million, showing the U.S. economy added just 181,000 new jobs last year. Importantly, that’s the lowest level of job growth since 2003 outside of recessionary periods.

Despite the mixed signals on the labor front, we believe last week’s inflation data is a bullish development that investors shouldn’t easily discount. The January headline Consumer Price Index rose just +0.2% month-over-month, bringing the year-over-year rate down to +2.4%, the slowest pace since May 2025. Notably, core inflation held steady at an annual rate of +2.5%, its lowest level since early 2021. In our view, that’s a welcome development for those expecting the Fed to ease rate policy later this year. As such, markets are currently pricing in a high probability of a rate cut by midyear, likely after Fed Chair Powell finishes his Chairmanship term in May. That said, the bears can still argue that the last mile of returning inflation to the Fed’s +2.0% target has been tediously slow, especially in core services inflation, which, to be fair, did show some notable progress last month, particularly within shelter costs.

And finally, on the economic front, last week's retail sales offered a more sober assessment of consumer spending as 2025 came to a close. December’s headline number was flat, and the control group, a key input for GDP, declined 0.1%. In our view, the shift is notable and counters stronger spending trends seen earlier in 2025. Bulls may interpret this as a sign that tighter policy is working to cool demand in a “controlled” manner. Bears, on the other hand, can highlight rising consumer delinquencies and growing financial stress among low- to middle-income households as signs that consumers may be more stretched than headline employment data suggests. Bottom line: Last week’s economic updates point to resilient conditions but also suggest investors should be cognizant that growth is approaching more normalized levels, which means room for policy mistakes from here will only get tighter.

Now, let’s get to what we believe is the more immediate dynamic driving the U.S. stock market right now, which is the quickly evolving AI narrative. As we noted in previous commentaries, what had been a clear driver of stock momentum (i.e., AI everything) is now being viewed by investors with greater nuance and scrutiny across industries, and in some cases, outright concern and fear. Headlines warning that many white-collar tasks could be automated within 12 to 18 months, as new AI tools are announced and rolled out across insurance, tax planning, wealth management, and logistics, have caused sharp selloffs in several service-oriented sectors, as investors reassess the vulnerability of business models once thought to be insulated from near-term disruption in technology.

Notably, as we highlighted previously, even within Big Tech, the tone has grown more cautious over the last several weeks, making it more difficult for broader U.S. stock averages to see sustained momentum higher. For context, Information Technology and Communication Services account for over 43% of the S&P 500 by market capitalization. Importantly, within Tech, companies continue to tout AI as a long-term growth engine, but the near-term costs of building that engine are rising quickly. Thus, the traditional view of an asset-light industry turning into an asset-heavy one (even if it's temporary) is changing how investors approach Tech at the moment. As a result, the need to build out AI capabilities raises serious questions about the forward trajectory of Technology profit margins, capital allocation decisions, and the sustainability of free cash flow. Although the bulls can continue to point to the opportunity in AI to unlock future productivity gains, investors are clearly starting to differentiate more sharply between companies positioned to benefit from the technology, and those at risk of being displaced and disintermediated. However, we believe the knee-jerk negative reactions seen in areas like software and financial services over recent days and weeks are likely overdone, and opportunities in well-established, well-run companies are starting to emerge for those willing to see through the volatility. In our view, this is an opportune time to ensure you have included high-quality actively managed equity strategies within your portfolio to help your portfolio navigate this increasingly complex market environment.

Bottom line: Last week’s economic data gave market bulls more evidence that inflation is cooling and the labor market remains on solid footing. At face value, we believe this should give investors the confidence to remain guardedly optimistic about the path forward for growth, profits, and stock prices, even if that is accompanied by increased volatility this year. At the same time, that data also reinforces the need for investors to question how smooth the road ahead will be, given bifurcated consumer trends and still elevated inflation. And importantly, the AI narrative appears to be evolving from an all-encompassing force that drives major stock averages higher to one in which “selectivity” among winners and losers possibly becomes an increasingly critical factor in shaping how an investor's portfolio performs this year. Thus, we believe the next phase of the AI cycle could be shaped by a combination of how investors react to Big Tech trends as well as how a broader set of companies and industries navigate an environment where technological disruption and innovation possibly spreads faster than many expected.

The week ahead:

- During the week, 57 S&P 500 companies are scheduled to report Q4 results, including those from DoorDash, Booking Holdings, and Walmart, which should provide interesting updates on the American consumer.

- On Friday, investors will receive their first look at Q4 GDP, with Bloomberg estimates suggesting the U.S. economy grew by an impressive +3.0% in the final quarter of 2025 following the +4.4% pace of growth in Q3.

- Fed meeting minutes, December PCE inflation, and preliminary looks at February PMI activity also line the week.