The smaller the better

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — January 26, 2026

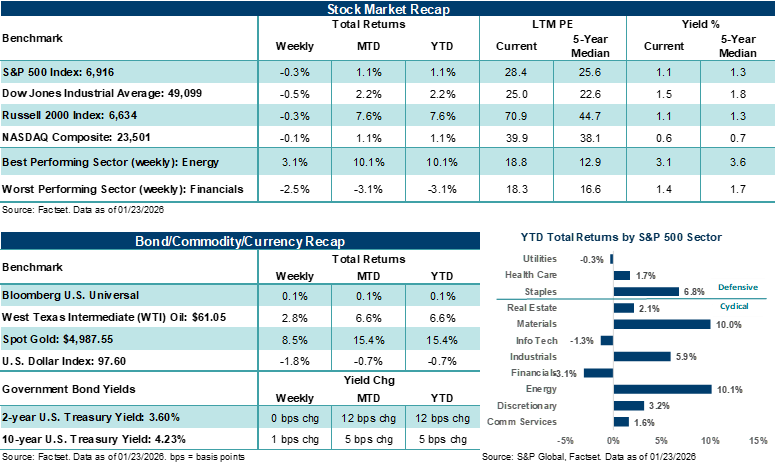

Major U.S. stock averages finished lower last week, with the S&P 500 Index and the NASDAQ Composite ending in the red for the second-straight week. Geopolitics and Greenland dominated the headlines, with earnings themes playing an unusual backseat role as the fourth quarter reporting season kicked into gear. However, this week, a Fed meeting and earnings reports and outlooks from several key Magnificent Seven companies should help turn investors' attention back to important fundamental developments.

Last week in review:

-

The S&P 500 lost 0.4%, while the NASDAQ Composite ended fractionally lower. However, Big Tech finished the week mostly higher, with Meta Platforms gaining +6.2%. However, Intel lost 17% on Friday after it noted during its fourth quarter earnings call that it faced inventory shortfalls and challenges with its 18A chip production in the current quarter.

-

The Russell 2000 Index also finished with a loss, following two straight weekly gains, and the Dow Jones Industrial Average ended down 0.5%.

- Treasury yields finished little changed on the week, and the U.S. Dollar Index ended down roughly 2.0% (its largest weekly decline since May).

- Gold jumped +8.5% (its best week since March 2020), and as the precious metal now flirts with the $5,000 per ounce level. West Texas Intermediate (WTI) crude settled higher by nearly +3.0% and posted its fifth straight weekly gain.

- One of the primary influences on the varied equity, currency, and commodity crosscurrents last week was U.S./Europe developments around President Trump’s proclamations regarding Greenland. Heading into President Trump’s speech at the Davos World Economic Forum in Switzerland, the President said he would impose several NATO members with an additional 10% tariff on February 1 if they stood in the way of the U.S. acquiring Greenland. In response, Europe said it would freeze procedures to pass the current U.S/EU trade agreement and possibly enact measures that would seriously damage trade and commerce between the two countries. However, following the President’s sharply pointed Davos speech, he said he had reached a framework agreement with NATO on Greenland, but did not provide details, and said the U.S would not impose the new 10% tariffs on Europe. And to help cool tensions, Europe said it would resume its parliamentary procedures to pass the U.S./EU trade agreement struck in July. Bottom line: This is likely not the end of the Greenland saga, and investors should be prepared for continued headline-grabbing developments on the subject and associated asset volatility. That said, we see worst-case scenarios, such as the U.S. using force to obtain its objectives in Greenland, or a complete break in U.S./EU trade relations, as very low. Importantly, trade between the U.S. and Europe is vital to both economies, and we believe each side will eventually find a path forward on Greenland that meets their interests without severing economic ties or Western alliances. We believe investors are best served by keeping this point top of mind during what is very likely more uncertainty ahead on the matter.

- On the economic front, November core PCE inflation (+2.8%) came in a bit cooler than expected on an annualized basis but remains well above the Fed’s +2.0% target and heading into this week’s Fed meeting. Finally, a preliminary look at January S&P Global PMI services and manufacturing showed U.S. activity remains in expansion at the start of the year.

“Investors appear a little more willing at the start of the year to rebalance at least some of their positioning away from the AI trade, for valid reasons, and toward asset categories, sectors, industries, and companies that are more exposed to the ‘real’ economy.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

The smaller the better.

The Federal Reserve will hold its first policy meeting of the year starting Tuesday, and based on market odds, the committee is very likely to keep its target rate steady at 3.50% - 3.75% at the conclusion of the meeting on Wednesday. In our view, current readings on employment and inflation justify a hold by policymakers this week. However, markets will be watching carefully how the policy statement reads and how Fed Chair Powell frames current labor and inflation conditions and the path for forward rate policy in his press conference. Interestingly, President Trump continues to hint that he has likely chosen the next Fed Chair. Investors shouldn’t be surprised if the President looks to play a wildcard this week and steal Powell’s thunder by announcing the next Fed Chair, maybe even as soon as before or during the Fed’s two-day meeting.

Interestingly, small-cap stocks have taken a substantial lead over their large-cap peers at the start of 2026. The Russell 2000 Index is outpacing the S&P 500 Index over multiple sessions (outperforming by +6.5% year-to-date), helped by easing financial conditions, attractive relative valuations, and improving earnings revisions across rate-sensitive groups like regional banks. In our view, small-caps are also benefiting from growing investor interest in domestically focused companies, which could see balance-sheet improvement if interest rates grind lower this year and U.S. economic conditions remain supportive. Bespoke Investment Group recently noted that small-cap stocks have been quietly keeping pace with large-cap stocks for some time now, with the Russell 2000 actually “outperforming” the S&P 500 since early August. This shift in leadership, which was under the surface through much of the fourth quarter last year, is bubbling up to the surface in early 2026, and in our view, appears consistent with solid fundamental conditions, expectations for supportive fiscal and monetary policies, as well as improved earnings leverage for smaller companies relative to large caps.

That said, small-cap stocks historically see longer periods of outperformance versus large caps when the economy is coming out of a recession or exiting a period of slow growth, which by most measures definitely does not describe the current environment. And investors shouldn’t mistake improving small-cap earnings expectations for the quality of those earnings broadly. Notably, only 60% of Russell 2000 companies are profitable, leaving investors with a large swath of companies that lose money or report no earnings. And we suspect that if market sentiment shifted more negatively and for a prolonged period, momentum in small-cap stocks could stall or even reverse as investors allocate toward companies with visible and quality earnings streams up the market-cap structure. Thus, we’ll have to see if early-year momentum in small-caps is “durable” and not just early-year rotation activity (e.g., sell the winners/buy last year’s laggards), or a place to hide out in front of key Magnificent Seven earnings reports this week.

Nevertheless, cyclical areas outside of Technology, including small caps, are helping confirm broader industry participation in this year’s stock gains, despite the increased volatility. For example, Industrials are benefiting from better order visibility and domestic demand, while Materials and Energy are providing cash flow and valuation support for investors looking to diversify portfolio positions. Although it’s too early in the year to say that investors are ready to expand their horizon beyond Big Tech in a lasting way, early stock performance this year suggests major averages are seeing a reduction in their dependence on a single style or factor, namely the AI theme.

Bottom line: Investors appear a little more willing at the start of the year to rebalance at least some of their positioning away from the AI trade, for valid reasons, and toward asset categories, sectors, industries, and companies that are more exposed to the “real” economy. But with several Mag Seven companies set to report this week and given their size, influence, and concentration across key indexes/diversified large-cap strategies, investors also appear to be adjusting portfolios away from being overly exposed to Tech should some Mag Seven results disappoint inflated expectations this week. Yet, unless reports from Mag Seven companies materially reset the earnings outlook (which we believe will not be the case), the early-year preference for small caps and non-tech cyclicals could remain intact as investors seek a wider base of earnings contributors and index performance participants.

And speaking of Mag Seven earnings, we’ll finish on this. In aggregate, Magnificent Seven companies are down 0.4% year-to-date, significantly trailing the +3.6% return in the S&P 500 Equal Weight Index, +5.7% return in the mid-cap S&P 400 Index, and +7.6% gain in the Russell 2000. So far in 2026, the smaller the major index, and the less dependent on technology, the better the performance. With Tesla, Meta Platforms, Microsoft, and Apple all scheduled to report highly anticipated results this week, we’ll see whether “smaller the better” remains the theme heading into February.

The week ahead:

-

Although 103 S&P 500 companies are scheduled to report results this week, it will likely be Meta, Microsoft, and Apple that grab investors' attention. According to FactSet, the Magnificent Seven are expected to see Q4’25 earnings per share growth of +20.3% year-over-year, while the other 493 companies see aggregate EPS growth of just +4.1%. Any unexpected disappointment from these key Big Tech companies could see major U.S. stock averages start to buckle.

-

On the economic side, this week, home data and December producer inflation line the calendar.