Tips to reduce your taxes in retirement: Retirement tax planning FAQs

These tips can help you reduce the taxes you owe as you near retirement and in your retirement years.

In this article, we’ll answer the following questions:

- What types of retirement income are taxable vs. non-taxable?

- What are some tax saving strategies to consider if I’m still working but nearing retirement?

- What is an RMD, and how does the RMD tax penalty work?

- What are some tax-saving moves to make before I am required to take distributions?

- After I stop working and my income is potentially lower, how can I take advantage of 0% or low tax rates?

- How can I reduce my taxable income while supporting charitable efforts?

| Taxable | Non-taxable |

|---|---|

| Social Security – up to 85% of your Social Security benefits may be taxable depending on the amount of income you have from other sources | Social Security – if your total modified adjusted gross income is below certain limits |

|

Withdrawals of earnings and pre-tax contributions from IRAs, 401(k)s,* and other retirement plans

*Special rules apply to appreciated employer securities in qualified retirement plans

|

Withdrawals of after-tax contributions from 401(k)s, IRAs and other retirement savings plans (whether withdrawals are considered to be from after-tax or pre-tax contributions and earnings is based on the law and will depend on ordering rules applicable to the account) |

| Pension payments | Qualifying withdrawals from Roth 401(k)s, Roth IRAs, and Roth 403(b)s |

What are some tax saving strategies to consider if I’m still working but nearing retirement?

- Consider taking advantage of any pre-tax deductions available to you. Review your financial position and consider contributions to your 401(k) up to the maximum allowed, including any catch-up contributions for those over age 50. Also remember to take advantage of company benefits such as pre-tax payroll deductions for flexible spending accounts, transportation, supplemental insurance, etc.

-

Review your assets to identify potential long-term capital gains (gains on assets held longer than one year), which are currently taxed at lower rates than short-term capital gains or ordinary income.

-

Consider selling securities in non-qualified accounts that have a capital loss, which may be deductible to the extent of any realized capital gains plus ordinary income of up to $3,000 per year. Please note that for taxpayers whose income, including any realized gains, is below specific thresholds, the tax rate on long-term capital gains is zero percent. In this scenario, recognizing losses simply to offset long-term capital gains may not be advisable since no long-term capital gains tax may be due. Consult with your tax advisor.

- Approach charitable giving in the most advantageous way. For example, you might be better off giving appreciated stock that has been held more than one year to a charity, rather than a cash donation. You may get a tax deduction for the full fair market value of the asset, and an eligible charity could sell it without incurring capital gains tax on the appreciation.

- Think ahead to estate planning to potentially help reduce the impact of estate taxes, if applicable. Annual gifting is one way to reduce the value of your taxable estate. For 2024 the annual gift tax exclusion allows each donor to give up to $18,000 to an unlimited number of recipients without paying federal gift tax or using part of their lifetime exclusion. Over time, this is a strategy you might consider to remove assets from your taxable estate.

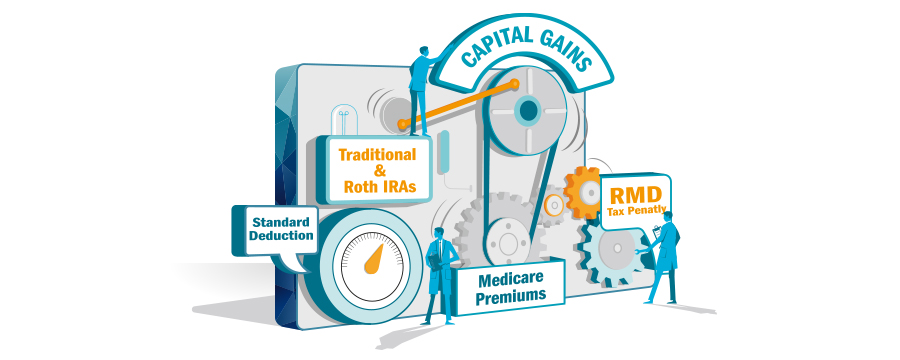

What is an RMD, and how does the RMD tax penalty work?

Across 401(k), IRA, 403(b) and 457(b) accounts, the IRS does not allow investors to maintain balances indefinitely. As such, federal law mandates that a minimum amount must be withdrawn each year, beginning at a certain age. This amount is a required minimum distribution, or RMD.

The RMD age is currently 73. Please note, you don’t have to take your first RMD until April 1 of the following year that you reach the RMD age. RMDs for subsequent years must be taken by Dec. 31.

If you do not take a distribution or if you withdraw less than the required amount, you may have to pay a penalty of up to 25% of the amount not taken. The penalty is reduced to 10% if the shortfall is corrected within a two-year window.

What are some tax-saving moves to make before I am required to take distributions?

Because many retirees are in a lower federal income tax bracket before they are subject to the required minimum distributions (RMDs) rule, they have an opportunity to manage the impact of taxes on their income.

Here are few moves to consider:

-

Converting taxable assets to a Roth IRA. If you expect to be in a higher tax bracket when your RMDs begin, consider converting pre-tax IRA investments to a Roth IRA before then. Think about your ability to pay the taxes on the conversion as well as your timeline before you would need to access the Roth IRA. Converting to a Roth IRA generates a tax bill, but it could be less expensive now because of your temporarily lower income tax bracket — and the temporarily lower federal income tax brackets that are set to expire after 2025.

-

Selling investments that have appreciated. The tax rate on long-term capital gains — assets held beyond one year — is based on your taxable income. If you have stocks, mutual funds, bonds or other taxable investments, it may make sense to sell appreciated long-term investments while your taxable income is lower. Some, or all, of net long-term capital gains may be taxable at the 0 percent capital gains tax rate if your total taxable income (including the realized gains) falls below the threshold for your filing status. Talk to your tax professional to see if this applies to you.

-

Redeeming older savings bonds. While you’re in a lower tax bracket, you may want to cash in US savings bonds issued when interest rates were higher. If you have bonds issued more recently, talk to your financial advisor about your options, given rising interest rates.

-

Exercising employee stock options. If you own employee stock options, exercising them while you’re in a lower tax bracket may benefit you — especially if the current stock valuation is high.

-

Revisiting your withdrawal strategy. Because withdrawals from tax-deferred accounts are neither penalized nor required between the time you reach 59 1/2 and your RMD age, you have more flexibility and control with your withdrawal strategy for retirement savings. Your Ameriprise financial advisor will help you create a plan for how much money to withdraw each year to meet your goals while managing your tax liability over the years.

After I stop working and my income is potentially lower, how can I take advantage of 0% or low tax rates?

During the time between when you stop working and when you begin taking required minimum distributions (RMDs), you could consider these opportunities with your Ameriprise financial advisor:

-

Standard deduction. If you’re able to cover expenses with savings or other cash accounts, consider taking advantage of the standard deduction ($14,600 single; $29,200 married filing jointly in 2024). Depending on your other income, you could use the standard deduction to withdraw up to the $14,600/$29,200 from a taxable account such as a 401(k) or IRA every year without paying federal income tax on that money. Income above the standard deduction amount starts being taxed at the 10% rate. If you have started taking Social Security benefits those amounts should be considered in the calculation because, depending on the amount of Social Security benefits, some of those benefits may be taxable as well.

-

0% long-term capital gains tax rate. While your income is lower before RMDs begin, you may be eligible to realize gains at the 0% long-term capital gains rate. Taxable income limits applicable to the 0% long-term capital gains are $47,025 for those filing as single and $94,050 for those who are married filing jointly in 2024. The calculation includes the net realized gain in determining the amount of taxable income used to determine what qualifies for the reduced rate.

How can I reduce my taxable income while supporting charitable efforts?

If you’re interested in providing charitable support, donating to a non-profit organization with a qualified charitable distribution (QCD) can help you achieve that goal. A QCD is a nontaxable distribution from an individual retirement account (IRA) directly to an eligible charity. You must be at least 70.5 years old to take advantage of the QCD strategy.

For taxpayers who have reached their RMD age, the QCD can be used as part, or all, of your RMD, removing the otherwise taxable RMD from your income, if done correctly. QCDs do not prevent a taxpayer from itemizing deductions, for the tax rules around QCDs talk to your tax professional.

You could also consider donating appreciated stocks or assets. If you donate appreciated stock that you’ve held for more than a year, then you’ll generally be able to claim a potential charitable tax deduction for the full fair market value of the stock. This approach saves paying the capital-gains tax that would result if you instead sold the stock and donated the cash.

Tax Center

Taxes can impact your financial investments and savings outcomes, even outside of tax filing. Visit our Tax Center for helpful articles, FAQs and other resources.

Tax Center

The benefits of working with a financial advisor and tax professional

Your Ameriprise financial advisor will help you balance your financial priorities with tax implications by helping you create a plan that meets both your personal and financial goals. Because your financial advisor understands your finances, they may also be able to recommend a tax professional for you. Working together, your Ameriprise financial advisor and your tax professional will help structure your investments and retirement distributions for tax efficiency.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

Ameriprise Financial cannot guarantee future financial results.

There are risks associated with fixed income investments, including credit risk, market risk, interest rate risk and prepayment and extension risk. In general, bond prices fall when interest rates rise and vice versa. This effect is more pronounced for longer-term securities.

Withdrawals from traditional IRAs, 401(k) accounts, and other pre-tax investments prior to age 59½ are generally subject to a 10% IRS penalty on taxable earnings, though exceptions may apply.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SPIC.

Return to My Accounts

Return to My Accounts