Follow these 7 steps to help maximize all the different retirement savings accounts and tax incentives available to you.

Saving for retirement can be intimidating, but fortunately there are many different types of retirement savings accounts that can help streamline your efforts, while also potentially providing you with tax benefits.

An Ameriprise financial advisor can work with you to build a strategy that maximizes your retirement contributions to tax-advantaged vehicles, while keeping you on track for other financial goals.

Here are seven steps to help you make the most of your retirement contributions:

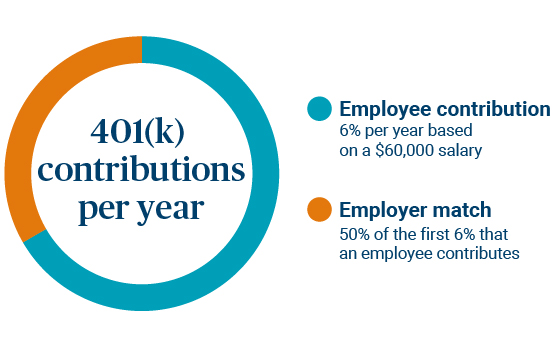

1. Take advantage of your employer match

If you have an employer-sponsored retirement plan such as a 401(k), contribute at least enough to qualify for the maximum matching contribution from your company, if one is offered. Think of the match as free money — missing out means passing up on additional contributions that can add up to a significant amount of money over time.

2. Increase your 401(k) contributions to the limit

If you are already contributing enough to get the employer match in your 401(k), consider increasing your contribution to the maximum yearly limit. For 2026, the contribution limit is $24,500, with an additional $8,000 catch-up contribution limit for those age 50 and over. (For those ages 60-63, the catch-up increases to $11,250, if your plan permits it).1 If you can't reach the maximum threshold quite yet, consider contributing whatever you’re able, then — as your career progresses and your income increases — plan on raising your contribution so you can eventually reach the max.

3. Max out an IRA

Once you’ve made use of your employer’s match and are contributing as much as you can, consider opening an IRA, which is a tax-advantaged retirement account that is not tied to your place of work. There are two types of IRAs — a traditional IRA and Roth IRA — both of which come with their own distinct tax benefits. If you can, consider contributing the maximum amount allowable by law, which is $7,500, or $8,600 if you're age 50+ in 2026. Making the maximum contributions to an IRA can pay off significantly over the long run.

Roth IRA vs. traditional IRA calculator

Use this tool to determine which type of IRA is appropriate for you.

4. Use an HSA for retirement medical expenses

For many people, one of the biggest costs in retirement is health care. Fortunately, health savings accounts (HSAs) — which are available to those with high-deductible health plans — offer unique benefits when used as a retirement investment vehicle.

If you use the funds for qualified medical expenses, contributions are tax-deductible, earnings are tax-deferred and withdrawals are tax-free. What’s more, once you reach age 65, the money in your HSA can be withdrawn for any reason without penalty, though you will have to pay taxes on any withdrawals made for non-medical purposes. The maximum contribution limit for HSAs in 2026 is $4,400 for individuals and $8,750 for families, with an additional $1,000 catch-up amount for those age 55+.

5. Consider a mega backdoor Roth IRA

A Roth IRA or Roth 401(k) allows you to contribute after-tax dollars and receive tax-free withdrawals on earnings and contributions in retirement. This source of income can help you manage your income tax bracket in retirement. However, if you don’t have access to a Roth 401(k) and you’re not eligible to contribute directly to a Roth IRA due to upper income limits, another option is a Roth conversion strategy known as a mega backdoor Roth IRA.

To take advantage of this strategy, you need to have a 401(k) that permits after-tax contributions (not all plans do). If allowed, your after-tax contributions count towards the overall limit for combined employer and employee contributions. In 2026, that limit is $72,000 (for those under 50), $80,000 (for those 50+) and $83,250 (for those ages 60-63).2 This includes all elective deferrals, employee contributions and employer matches or profit sharing to your 401(k) plus any after-tax contributions to a Roth 401(k). Using this strategy, your after-tax contributions may be eligible to be converted into a Roth IRA.

Learn more: Roth IRA strategies for high-income earners

6. Don’t forget catch-up contributions

If you’re age 50+, the government allows you to make catch-up contributions to IRAs and most workplace retirement plans. These contributions are in addition to the regular contribution limits and can provide an added boost to your retirement savings. Here’s a look at maximum individual contribution and catch-up contribution limits for 2026:

| Retirement account | Annual individual contribution limit | Catch-up contribution | Total individual contribution |

|---|---|---|---|

| Traditional and Roth IRAs | $7,500 | $1,100 | $8,600 |

| SIMPLE IRA and SIMPLE 401(k) | $17,000 ($18,100 for qualifying employers3) |

$4,000 for individuals age 50+ ($3,850 for qualifying employers3)

$5,250 for individuals ages 60-634 |

$21,000 for individuals ages 50+ ($21,950 for qualifying employers3)

$22,250 for individuals ages 60-634 ($23,350 for qualifying employers3) |

| 401(k), 403(b), 457(b), Roth 401(k) and Roth 403(b) | $24,500 |

$8,000 for employees age 50+

$11,250 for employees ages 60-634 |

$32,500 for employees ages 50+

$35,750 for employees ages 60-634 |

7. Use taxable accounts to augment your savings

Once you’ve exhausted all the tax-advantaged accounts and strategies available to you, consider turning to taxable brokerage accounts to save more for your retirement. While taxable brokerage accounts do not provide any special tax benefits, they do afford you flexibility and liquidity.

Taxable accounts can be especially useful if you plan to retire early because they generally do not need to follow the same set of rules and withdrawal restrictions that tax-advantaged accounts do. Further, there are no contribution limits on taxable accounts — you can save and invest as much as you’d like to your retirement goals.

Make the most of your retirement accounts

An Ameriprise financial advisor can help you make the most of your retirement contributions by devising a savings strategy that accounts for all the different tax-advantaged vehicles available to you.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.