Understand the basics and rules surrounding 401(k) plans so you can make the retirement savings decisions that are right for you.

For many Americans, the 401(k) is the cornerstone of their retirement savings strategy. But to take advantage of all its benefits, it’s helpful to understand your options and how this type of account works.

An Ameriprise financial advisor can help you make sense of your 401(k), review your plan’s investment options and make sure your contribution amounts align with your financial goals, risk tolerance and time horizon.

To get you started, explore the guide below to learn what a 401(k) is and how it works.

What is a 401(k)?

Created by the federal government in 1978, a 401(k) is a tax-advantaged retirement savings account that employers can offer employees. Overall, 401(k) plans allow employees to invest and save a portion of their income for retirement in a tax-efficient way.

How does a 401(k) work?

To have access to a 401(k), you must be employed by an organization that offers it to its workforce. With a 401(k), an employee sets a percentage of their income to be automatically taken out of each paycheck and invested in their account. Employees can choose how to allocate their funds among the investment choices offered by the plan, which usually include a variety of mutual funds and target date funds. Once an individual contributes to a 401(k), they generally cannot access these funds until age 59½ without paying a penalty to the government.

How to maximize your 401(k) investment strategy

Get more value out of your employer-sponsored plan with these tips.

What types of 401(k) plans are there?

There are several different types of employer-sponsored 401(k) plans:

-

Traditional 401(k): With a traditional 401(k), you fund your contributions with pretax dollars. Because your contributions are withdrawn from your paycheck before you’ve paid any taxes, your taxable income will be lower, potentially lowering your overall tax bill. For example, if you earn an annual salary of $100,000 and you contribute $10,000 to your 401(k), your taxable income for the year will be reduced to $90,000. However, when you withdraw funds from your account in retirement, contributions and investment earnings will be taxed as ordinary income.

-

Roth 401(k): A Roth 401(k) is often offered as part of your existing 401(k). With this option, you fund your contributions with after-tax dollars instead of pretax. Once you retire at age 59½ or later and begin taking distributions from your account, you won’t have to pay taxes on these contributions or earnings (not including any pretax employer match, which will be taxed when you collect it).1

-

403(b) and 457(b): Although not governed by the same rules as a 401(k), 403(b) and 457(b) plans have the same contribution limits, comparable investment opportunities and tax benefits as a 401(k). The key difference is that these plans are only available to the employees of nonprofits, tax-exempt organizations and local government. 401(k) plans are generally restricted to for-profit employers.

Whether you’re investing in a traditional or Roth 401(k) or both depends on what your employer offers and your retirement strategy.

What is employer matching?

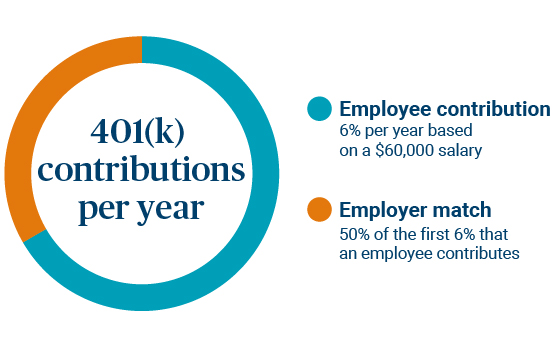

With an employer match, a company matches what an individual employee contributes to their 401(k) up to a certain amount. Most employer matches are based on a percentage of what an employee contributes.

For instance, a company may contribute 50% of the first 6% that an employee contributes. So, if your annual salary is $60,000 and you choose to contribute 6% to your 401(k) each year, you will contribute $3,600 and your company will contribute 50% of that, or $1,800. You can choose to contribute more of your salary, but your company match will be capped at $1,800.

What is 401(k) vesting?

Many companies have a vesting period that determines when employer contributions belong 100% to the employee. The money you personally contribute to your 401(k) belongs to you; however, your company’s match may not be yours immediately. Many companies require a person to remain employed for two to five years before the employer match is 100% entitled to the employee.

For example, if you leave a company after two years but the vesting period is three, your employer’s contribution to your 401(k) may go back to them — or you may receive only a percentage of it, depending on your company’s vesting schedule.

What are the 401(k) contribution limits?

The maximum contribution limit for employees to defer income to their 401(k) on a pretax basis is as follows. Those age 50+ are eligible to defer more of their income to their 401(k) in what’s known as a catch-up contribution.2

| 2026 employee pretax contribution limits | |

|---|---|

| Employees under age 50 | $24,500 |

| Employees age 50+ | $32,500 ($8,000 catch-up contribution) |

| Employees ages 60-63 | $35,750 ($11,250 catch-up contribution) |

There is also a maximum annual cap on the total combined amount that an employer and employee can contribute to a 401(k). This amount includes employer contributions and additional after-tax contributions that an employee may make.

| 2026 employee/employer contribution limits | |

|---|---|

| Employees under age 50 | $72,000 |

| Employees age 50+ | $80,000 ($8,000 catch-up contribution) |

| Employees ages 60-63 | $83,250 ($11,250 catch-up contribution) |

Learn more: How maxing out your retirement accounts every year can pay off

How is a 401(k) different from an IRA?

The primary difference between a 401(k) and an individual retirement account (IRA) is that an investor can open and contribute to an individual retirement account (IRA) on their own, whereas a 401(k) is only available to an investor through an employer. Additionally, IRAs don’t offer benefits like an employer match and they have a lower overall contribution limit. However, IRAs can provide investors with more flexibility and investment choices than a 401(k) can.

But it’s not an either-or decision: You’re generally allowed to contribute to both a 401(k) and an IRA.

Learn more: IRA basics: What is an IRA?

What are the 401(k) withdrawal rules?

Generally, you can withdraw funds from your 401(k) in four scenarios: When you retire, if you are experiencing hardship, if you qualify for an in-service distribution, or by taking out a loan:

1. Retirement withdrawal rules

The current age at which you’re able to withdraw without penalty from your 401(k) is 55 (if you leave your employer in the year you turn 55 or later). If you leave your employer before you turn 55, withdrawals will be subject to the 10% premature distribution penalty until age 59½.1

The IRS won’t let you keep your money in your 401(k) forever, however. Once you reach a certain age, you are required to begin taking required minimum distributions (RMDs) from your 401(k). The RMD age is currently 73, but you may be able to delay RMDs if you are still working and not a 5% or greater owner of the business.

Learn more: Required minimum distributions (RMDs)

2. Hardship distribution rules

While it is generally not advisable to withdraw from your 401(k) while you are still working and under age 59½, there are certain situations when you can request a hardship withdrawal, including:

-

Post-secondary tuition for you or your family

-

Medical or funeral expenses for you or your family

-

Certain costs related to buying or repairing damage to your primary residence

-

Preventing your immediate eviction from or foreclosure of your primary residence

Hardship distributions of pretax contributions and earnings are generally subject to tax and may be subject to a 10% early withdrawal penalty, as well.1 Hardship distributions are not eligible to be rolled to an IRA.

Learn more: Withdrawing your retirement funds early

3. Non-hardship in-service distributions rules

If you are still working and not eligible for a hardship distribution, you still may be eligible to withdraw money from the plan if you are age 59½ or older. This depends on the rules of your plan, however. Some money (transfers from other plans, employer contributions or after-tax deferrals) may be available prior to age 59½, although penalties may apply to pretax distributions. Unlike hardship distributions, these funds are eligible to be rolled over to an IRA.

4. 401(k) loan rules

Many plans allow you to borrow up to 50% or $50,000 of your funds — whichever is less — but you have to repay the loan with interest, usually within five years. You won’t be required to pay any taxes or penalties, and any interest you pay goes back into your account. However, if you leave your current job, you may be required to pay back your loan in full in a short amount of time.

If you default on your loan, you’ll be required to pay taxes and a 10% penalty fee (if you left your employer prior to the year you turned 55).

Learn more: Should you borrow against your 401(k) before you retire?

What happens to your 401(k) when I change jobs?

When you change jobs, you are no longer allowed to contribute to your former employer’s retirement plan. If you are not yet ready to retire, you have a few options when deciding what to do with your 401(k) funds:

-

Keep the money in your former employer’s plan.

-

Move your balance into your current employer’s plan.

-

Switch, or “roll over” to an IRA.

-

Cash out your plan (although this is not advised).

Each option has their pros and cons, so carefully weigh the risks and benefits to decide what’s right for you.

Learn more: What to do with your old 401(k) when switching jobs?

Make your 401(k) work for you

An Ameriprise financial advisor can help you create a 401(k) savings strategy designed to help you reach your retirement goals.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.