Effectively manage the impact of capital gains taxes so you can potentially keep more of your investment returns.

When you sell an investment or other capital asset that has appreciated in value, the profit you make from the sale is generally subject to capital gain tax rules. For many, this distinction in tax treatment can be good news: When managed strategically, your capital gains tax rate can be lower than your ordinary income tax rate.

Understanding how capital gains taxes work is key to mitigating the tax liability on your investments, now and in the future. Along with your tax professional, an Ameriprise financial advisor can help you understand how capital gains taxes may impact you, as well as strategies to potentially take advantage of lower capital gains tax rates.

What are “capital gains”?

Put simply, a “capital gain”1 is any profit you make from selling a capital asset, including equities and real estate, but also may include things like cryptocurrency, artwork and jewelry. The IRS considers that profit taxable, though often at a lower rate than ordinary income, if you owned the asset for longer than a year.

How capital gains taxes work

Generally, only assets sold for profit are subject to capital gains taxes. Even if you own a stock that has appreciated significantly, for example, you typically won’t incur any capital gains taxes until you sell the asset for a profit. Similarly, if you sell an asset that has depreciated in value, you won’t owe any capital gains tax since there aren’t any capital gains. (In the event you experience a capital loss, you may instead be able to deduct the loss from the sale of other assets, as part of a strategy called tax-loss harvesting.)

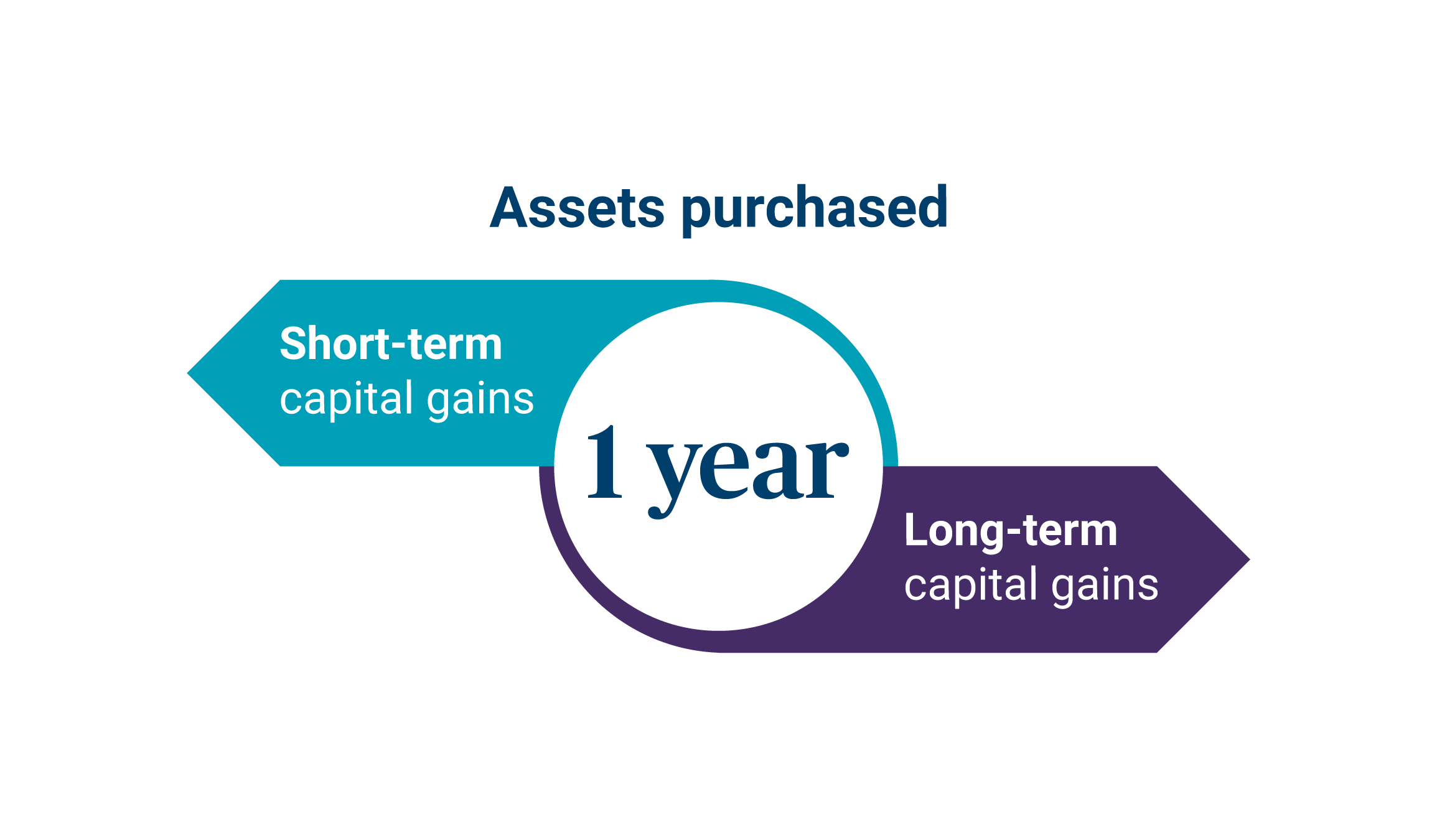

Your capital gains tax rate is based on two key factors: how long you owned the asset and your adjusted gross income.

- If you own your asset for a year or less, the gains are considered short term, and any profit you make off the sale is generally taxed at the same rate as ordinary income, which can be substantially higher than long-term capital gains rates.

- If you own your asset for longer than a year, then the long-term capital gains tax applies to any profit you make from the sale. The taxes you pay on long-term capital gains will depend on your income and filing status, but it’s generally lower than the ordinary income rate.

2026 long-term capital gains tax rates*

|

Filing status |

0% |

15% |

20% |

|---|---|---|---|

|

Single |

Up to $49,450 in income |

$49,451 to $545,500 in income |

Over $545,500 in income |

|

Head of household |

Up to $66,200 |

$66,201 to $579,600 |

Over $579,600 |

|

Married filing separately |

Up to $49,450 |

$49,451 to $306,850 |

Over $306,850 |

|

Married filing jointly and surviving spouse |

Up to $98,900 |

$98,901 to $613,700 |

Over $613,700 |

*In addition to paying tax on capital gains at the federal level, state treatment varies. Work with your tax professional to determine how capital gains and losses are treated where you file state income tax returns.

For example, let’s say you decide to sell 1,000 shares of a stock you bought 10 years ago. Though you bought it for $5,000, it’s now worth $15,000. Under the law, because the sale occurred more than a year after you purchased the asset, the $10,000 profit you “realized” is considered a long-term capital gain. In this scenario, you’re married filing jointly and your adjusted gross household income is $250,000, which means you are only subject to 15% capital tax rate on that $10,000 profit, which is $1,500. Had that asset been sold as a short-term capital gain, that $10,000 would be taxed as ordinary income and subject to a 24% tax rate, which is $2,400.

How to calculate capital gains taxes

There’s a simple formula:

- Determine your cost basis. Your cost basis for the asset is typically the purchase price plus any commissions or fees you pay.

- Determine your realized amount. This is the price you sold the asset for minus any commissions or fees you paid.

- Calculate your capital gain or loss. Subtract your basis (what you paid) for the asset from the realized amount (what you sold it for) to determine the difference: that is your capital gain or loss.

- Find out your capital gains tax rate. If your asset was held for longer than a year, you’ll be taxed at the long-term capital gain rate (see chart above). If your asset was held for a year or less, you’ll be taxed at the ordinary income rate.

- Determine the amount of tax owed. Multiply the capital gain by the appropriate tax rate to determine how much you may owe in capital gains taxes.

Capital gains tax and home sales

Current law allows for a sizable exclusion from the capital gains tax on profits from the sale of your primary residence. For single filers, the first $250,000 of profit is exempt from the tax, while married couples filing jointly won’t have to pay any capital gains on up to $500,000 in profits from a home sale. However, to qualify for the exemption:

- The home must be your primary residence.

- You must have lived it in for at least two years in the five years before the sale.

- You can’t have used the exclusion during the two years preceding the sale or exchange.

Learn more: Tax deductions and credits to know

Capital gains tax and tax-advantaged accounts

The capital gains tax generally does not apply to investment gains accrued in certain tax-advantaged accounts, which are accounts that are regulated by the IRS, but offer special tax benefits.

For example, withdrawals from retirement accounts such as 401(k) plans2 and traditional IRAs2 are taxed as ordinary income, which is higher than the capital gains rate. Withdrawals from HSAs, Roth IRAs2, Roth 401(k) plans2 and 529 plans3 are tax-free, provided that the appropriate conditions are met.

How to reduce your capital gains taxes

There are a variety of strategies you can implement that can help you lower capital gains taxes:

- Invest for the long term: Holding an asset for over a year allows you to qualify for the long-term capital gains tax rate, which is often significantly lower than the short-term capital gains rate.

- Invest in tax-advantaged accounts: You don’t have to pay capital gains taxes when you sell and trade investments within tax-advantaged accounts. For example, qualified distributions from Roth 401(k)2, Roth IRAs2, HSAs and 5293 plans are tax-free, meaning you will not pay any taxes on your investment earnings from those accounts, if conditions are met.

- Take advantage of tax-loss harvesting: While you don’t want your investments to lose money, a stock that has lost value can sometimes provide a tax benefit. Under a strategy known as tax-loss harvesting, you can use the loss in one investment to offset investment gains in another and reduce your taxable net profit.

- Strategically sell appreciated assets when you’re in a lower tax bracket: This strategy, known as tax-gain harvesting, could be especially helpful if you find yourself in the 0% long-term capital gains tax bracket.

- Donate appreciated assets to a nonprofit: Donating an investment asset that has appreciated in value to a qualifying nonprofit — rather than making a cash donation — can offer tax benefits. You will receive a tax deduction for the fair market value of the investment on the date of the gift, but you won’t have to pay capital gains tax or the net investment income tax (NIIT)1 on the appreciated value.

- Donate to a donor-advised fund: With this strategy, you can make a large donation in one year but spread out the distributions over several years. This may allow you to take advantage of itemizing deductions in one year and taking the standard deduction in others.

- Invest in low-income communities: Still another way to defer and potentially minimize capital gains taxes is to put money into what’s known as a qualified opportunity fund (QOF), vehicles designed to invest in distressed communities. To qualify, you must invest your capital gains into an eligible opportunity fund within 180 days of a stock sale and then hold the investment for at least five years to reap the tax benefits.

- Pass on highly appreciated assets through your estate: Assets inherited by beneficiaries that are not in a qualified account can receive a “step-up” in basis, which provides a permanent reduction in capital gains on those assets.

Learn more: Ways to potentially lower your taxes

Keep more of your money

As part of your overall financial strategy, an Ameriprise financial advisor can work with you and your tax professional to evaluate your gains and losses, identify risks and opportunities and consider ways to manage your tax liabilities.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.