Tax-loss harvesting, explained

Potentially turn investment losses into tax-savings opportunities with this tax strategy.

Markets are cyclical — they will inevitably move both upward and downward. As such, all long-term investors may experience losses periodically in their investment portfolio.

While investment losses are never the desired outcome, the good news is that they can be turned into a tax-savings opportunity through a strategy called tax-loss harvesting, which can help lower your tax bill and boost overall investment returns.

An Ameriprise financial advisor can work with you and your tax professional to help you develop an appropriate tax strategy for you.

Here's what to know about tax-loss harvesting:

What is tax-loss harvesting?

Tax-loss harvesting is a strategy that can increase after-tax returns by offsetting realized capital gains with realized capital losses. When executed properly, tax-loss harvesting allows you to manage and reduce your tax burden by selling investments at a loss to offset the taxes owed on capital gains from other investments. In summary, it’s one way to use the tax code to reduce the sting of an investment loss.

How tax-loss harvesting works

-

You identify an underperforming investment that no longer supports your financial goals.

-

You decide to sell that underperforming investment.

- That loss can reduce your taxable capital gains, and any excess may offset up to $3,000 of your ordinary income.

- Any additional excess losses will be carried over to be used in future years.

- The money from the sale can be reinvested.

- At tax time, you may have a lower tax burden.

Tax-loss harvesting can be part of a year-round investment and tax strategy. However, taxes alone should not be the main driver of your investment strategy.

Benefits of tax-loss harvesting

Tax-loss harvesting can help you:

- Reduce your overall tax liability by offsetting gains and/or reducing ordinary income.

- Spread out your losses. You may use capital losses to offset capital gains in the year they are incurred, and when those are exhausted, to reduce up to $3,000 of other income, leaving any remaining capital losses to be carried forward to use in future tax years.

- Diversify portfolios by selling poorly performing assets and redistributing funds to achieve a more balanced allocation.

- Take advantage of down markets, which typically offer more opportunities for investors to use tax-loss harvesting proceeds to purchase other stocks at competitive prices.

What type of investor should use this strategy – and when?

Many investors can benefit from tax-loss harvesting, but those in higher tax brackets will likely realize more benefits from this strategy.

Generally, tax-loss harvesting should be done when opportunities present themselves – which could be at any time during the year. However, some investors may find it helpful to wait until the end of the year because they’ll have a better understanding of their portfolio’s performance (including any capital gain dividends from mutual fund holdings which are typically paid out at the end of the year) and total potential tax implications.

All investors should keep this important timing consideration in mind: to reap the benefits of tax-loss harvesting in a particular year, you need to complete sales transactions by the end of that calendar year.

Special considerations for investors

As with any investment strategy, there are key considerations to keep in mind:

- Trading costs: expenses associated with selling an investment and purchasing a new one could offset potential tax benefits.

- Wash sale rule: this IRS rule was created to discourage selling a security at a loss solely to take advantage of a tax deduction. This means you can’t sell a security at a loss to claim tax benefits, only to buy the same or a “substantially identical” security within 30 days before or after the sale. Note that the wash sale rules apply even if the security is purchased in an IRA.

- Retirement accounts don’t qualify: tax-loss harvesting can be applied to stocks, bonds, shares in funds and other taxable investments. It doesn’t apply to sales in tax-deferred accounts, including Roth or traditional IRAs.

- Tax lot identification: if you made multiple purchases of the same security on different dates, know that you must identify the tax lot you wish to sell at the time of sale.

- Investors reporting a lower taxable income may not benefit: taxpayers with lower taxable income amounts could be offsetting long-term capital gains already taxed at a 0% rate with losses. This would not result in tax savings.1

An example of the potential benefits of tax-loss harvesting

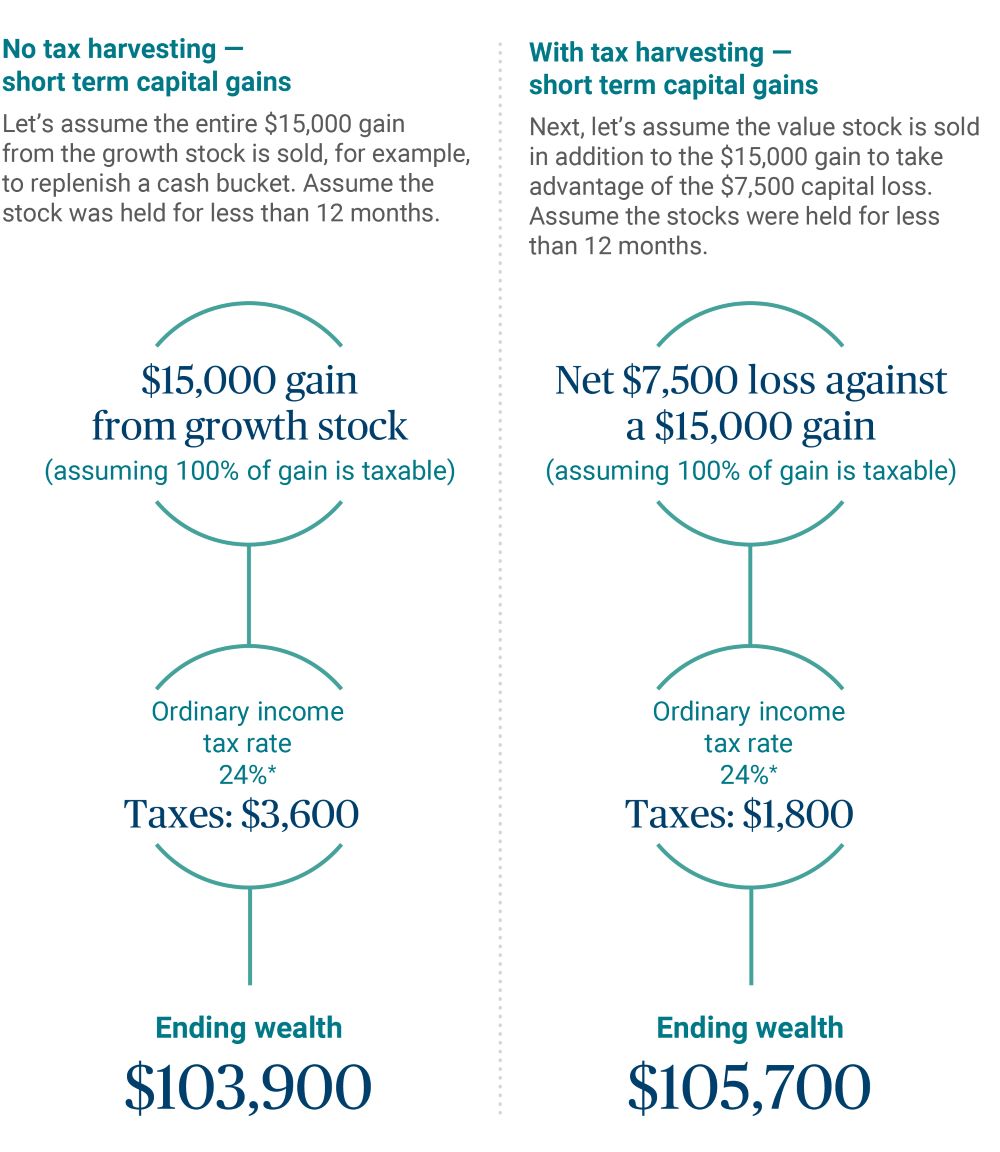

Assume you have a strategic allocation in a non-qualified account that is split between a growth and value stock where the growth stock returned 30%, while the value stock declined by 15%.

Let's look at the potential impact different tax strategies could have on wealth: 100% gain and netting gains/losses for short-term capital gains. In the example, the ending wealth is $107,500 before taxes. Assume the stocks were held for 12 months or less.

The amounts presented in the tables above do not account for transaction costs that would reduce net amounts.

*Short-term capital gains are taxed at ordinary income tax rates. In the 2025 tax year, the 24% tax rate applies to Single filers with taxable income of $103,350 – $197,300 and for Married Joint filers with taxable income of $206,700 – $394,600.

* This illustration is hypothetical and is not meant to represent any specific investment or imply any guaranteed rate of return.

This example shows that the higher the tax rate, the more critical tax-aware investing becomes, and that ending wealth can be enhanced through tax-loss harvesting. While not always possible, tax-aware investing should be a priority to help seek more favorable tax treatment and potentially enhance returns over time.

Is tax-loss harvesting right for you?

A consistently executed tax management strategy can help your assets receive more favorable tax treatment and potentially enhance your returns over time. An Ameriprise financial advisor can work with your tax professional to help determine if tax-loss harvesting is an appropriate tax strategy for your investments.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.