7 top retirement tips — retirement advice for every age

Retirement planning isn't only for the retired. These seven essential retirement tips by age can help you prepare right now, no matter what age or stage of retirement you're in — so you can feel more confident about living the retirement you want.

In this article:

Under age 50

1. Imagine this: You, not working

You can't plan for your retirement unless you know where you're going. So start thinking about your retirement lifestyle and what you want to do after you're done working. Unless you won't be done working: Maybe you want to start a business? Or do you want to travel, volunteer or become a professional grandparent? Maybe you'll build a cabin on a lake?

You can never start envisioning your retirement too soon or obtain advice for retirement too early. Even if you think your goals might shift in the years ahead, dreaming about them today gets the conversation started and helps you plan.

2. Start preparing for retirement early, save a lot

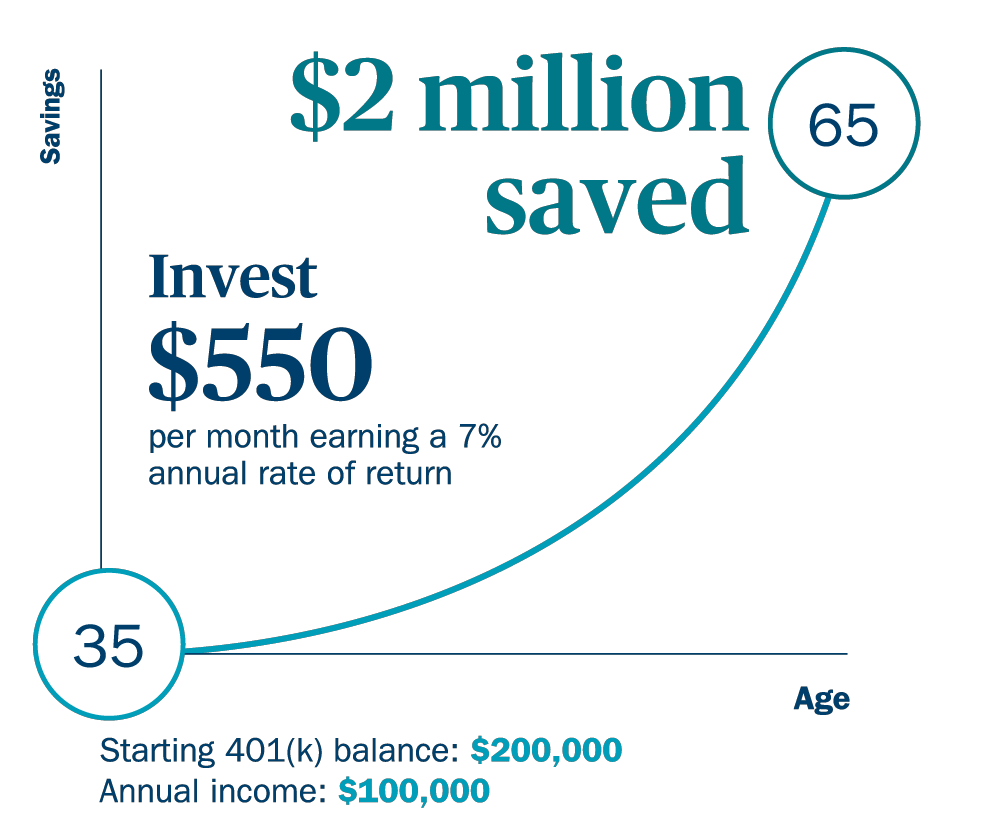

Once you know what you want to be doing, it's time to figure out how much you need to do it. Run some numbers using the Retirement Planner on ameriprise.com. Let's say you're 35 years old, earn $100,000 a year and have $200,000 in your 401(k). You might determine you need $2 million saved up by the time you're 65. To get there, you'd need to invest $550 per month and earn a 7% annual rate of return.

For illustrative purposes only. This example is not meant to represent any specific investment and does not consider fees or other expenses.

3. Save money at every opportunity

With rising retirement costs and people living longer, there's a chance you'll need a lot more money than you think in retirement. So save as much as you can during your earning years. Workplace-sponsored 401(k) plans let employees under age 50 save up to $22,500 each year, with an additional catch-up contribution of $7,500 per year for those age 50 and above. Plus, your employer may throw in a match.

Aim to save at least 15% of your gross pay. Not there yet? Increase your retirement savings contribution with every pay raise before you get too used to that higher paycheck.

4. Go beyond the workplace with IRAs

There are other tax-savvy ways to save for retirement, too. Consider opening a Roth IRA, which allows for after-tax savings and tax-free withdrawals when certain conditions are met. This can help you hedge against the possibility of future tax increases so you don't need to fret as much about taxes during retirement.

Another option to consider: A traditional IRA, which can help you further broaden your retirement savings plan and give you more control over your investment selections. IRAs can give you access to investment options you don’t have at work, such as municipal bonds, real estate investments, commodities and emerging market funds.

Learn more about Roth and Traditional IRAs.

5. Save strategically and allocate assets wisely

Don't let market swings throw your portfolio out of whack. Determining how to best allocate your investments between various kinds of assets — including stocks, bonds and cash — can be a powerful way to keep your retirement investments growing. Spreading your investments across various sectors and asset types can help soften the effects of big market fluctuations so you can worry less.

Dollar-cost averaging — putting fixed amounts into investments on a regular basis, regardless of market conditions — can also help. And rebalancing your portfolio can make it possible to lower your exposure to investments that have recently outperformed the market while increasing exposure to those that may be ready to grow. These strategies can be tricky, so make sure you ask your financial advisor for help.

6. Steer clear of emotional investing

As investors, our emotions tend to follow market cycles. When markets perform well, we tend to become euphoric and pour money into stocks. When markets turn down, our emotions change and can cause us to pull out of the stock market just as it reaches its low and miss out on potential gains as it rises again. The lesson: emotions can cause us to do just the opposite of what we should do.

7. Consider insurance to help reduce your worries

Even if you build a smart saving and investing strategy, unexpected events can occur. You could experience an illness that prevents you from working and earning an income. Or your home could be damaged in a storm. You need to protect yourself against the risks in today's world. Your financial advisor can help evaluate your personal situation and line up the right levels of protection, whether it's disability income insurance, long-term care coverage or auto, home and life policies. With sufficient protection, you can focus on the fun parts of planning for the future without having to worry as much about all the "what ifs" along the way.

Age 50 - 64

1. Add details to your dreams and goals

Start planning for the dreams you've had for years. You may have decided you'll spend your retirement years traveling, volunteering or becoming a professional grandparent. Get in touch with your financial advisor and get specific on what that will look like. Now that you're a little bit closer to retirement, you can start thinking tactically to ensure your dreams and goals become your retirement reality.

2. Catch up if you need to

Saving as much as you can should be a top priority as you near retirement. Make sure you're maxing out contributions to your retirement accounts as much as you can, including making any available "catch-up" contributions to your 401(k) and IRA. If you’re between 50 and 64 years old, you may be able to tuck away extra 401(k) catch-up money to help you meet your retirement goals.

3. Consider consolidating retirement accounts

By now, you might have three, five, or even 10 retirement accounts floating around. But it can be hard to invest right and manage so many accounts. It might make sense to consolidate before retirement so you can more easily and effectively tap your money when you need it. Work with your financial advisor to determine the appropriate plan of action for your various accounts, and start preparing a game plan for how you'll tap them in retirement.

4. Mind your health

Think health care costs are high today? Wait until retirement. In 2020, with both having median prescription drug expenses, a 65-year-old man was determined to need $130,000 in savings and a 65-year-old woman needed $146,000 in order to have a 90 percent chance of having enough money to cover health care expenses in retirement, according to the Employee Benefit Research Institute.1 And that figure will likely keep rising. Additionally, Medicare only covers a portion of the costs, and it may cover even less in the future. Work with your financial advisor to figure out how you'll cover health-related costs in retirement, and consider funding a health savings account. Some employers offer them as part of their health plans, but you can also set one up yourself if you buy individual health insurance. Contributions to a health savings account (HSA) by you or your employer aren't typically considered taxable income and withdrawals aren't taxed as long as they pay for eligible medical costs.

5. Start planning for retirement income

Talk to your financial advisor about the income you'll need during 30-plus years of retirement, and ask whether you should start planning for it now. Some strategies to consider include getting an annuity that provides a steady income stream throughout your lifetime or adjusting your investments.

6. Don't ignore long-term care

About 70% of Americans who reach age 65 will need long-term care at some point, according to the Department of Health and Human Services.2 While you're in your 50s and early 60s, consider purchasing coverage that could pay for the cost of a lengthy stay in a nursing facility or in-home care. It's typically better to lock in premiums while you're younger.

7. Re-evaluate how you invest

How you invested when you were 40 may not be how you should invest at 50 or 60. Priorities change, and you need to start focusing on preserving your wealth as much as growing it. Talk to your Ameriprise financial advisor about how you can build a complete strategy to help you feel more confident about living the life you want in retirement.

Age 65+

1. Review your retirement goals

Continue to meet with your Ameriprise financial advisor to review your retirement goals and assess your position. Your advisor can help you make adjustments, if needed, to align with your retirement needs.

2. Establish a spending plan

A general rule for withdrawing money from retirement savings is to only take out up to 4% each year. Of course, unexpected expenses can throw a wrench into the best-laid plans. Your Ameriprise financial advisor can help you establish a spending plan and withdrawal rate tailored to your needs.

3. Be tax savvy

How you withdraw from your various taxable and tax-deferred accounts in retirement — and which you tap first, second and so on — determines the taxes you owe and helps to make sure your money lives as long as you do. It's generally wise to tap taxable savings before tax-advantaged retirement accounts — especially with tax rates potentially on the rise. But everyone is different and there can be tax benefits to tapping several different types of retirement savings accounts at the same time.

4. Make your retirement savings last

A common mistake retirees make is shifting a big portion of their assets to cash and fixed-income investments. While you should consider investing more conservatively as you age — since you have less time to recover from market downturns — you don't want your investment portfolio to become so risk-averse that it's gobbled up by inflation. Remember, retirement can last more than 30 years, so it's important to ensure your retirement savings last. Work with your financial advisor to help you plan for your nest egg to keep growing and last as long as you need it.

5. Boost your retirement income

Talk with your financial advisor about ways to bolster your income stream during retirement — such as setting up an annuity or adding more dividend-paying stocks to your portfolio.

6. Prepare for the long run

Planning for your later years is crucial. People often only plan for their early retirement years, when they can travel the world or partake in their favorite activities. But those activities may not be realistic when you're 80, 90 or 100. Your financial advisor can help you think through how you hope to spend your later retirement years and work through some possible scenarios. Then you can take steps to be more prepared, such as securing long-term care coverage to help pay for any services you may need or setting up an annuity to protect your retirement income.

7. Keep checking in with your goals and finances

Don't leave your retirement on autopilot. Priorities often change over the course of retirement for many reasons. Reviewing your goals periodically can help you feel more confident that you can continue to live the retirement you want.

How Ameriprise can help with financial planning in retirement

Your Ameriprise financial advisor can provide you with retirement advice by age and recommend strategies to help you stay on track — so you can enjoy the retirement you’ve always envisioned.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

Return to My Accounts

Return to My Accounts