Have the storm clouds passed?

ANTHONY SAGLIMBENE, CHIEF MARKET STRATEGIST – AMERIPRISE FINANCIAL

Nov. 20, 2023

August to October was undoubtedly a gloomy period for investors, who had to contend with three straight months of stock declines. But as we turn into November, the storm clouds appear to have lifted and the forecast has shifted to a sunnier outlook for investors.

So, what’s behind this shift in market conditions and is it just a temporary gap in the storm? Here’s what may be on the radar for stocks as we move into the year-end:

The August-to-October drawdown, explained

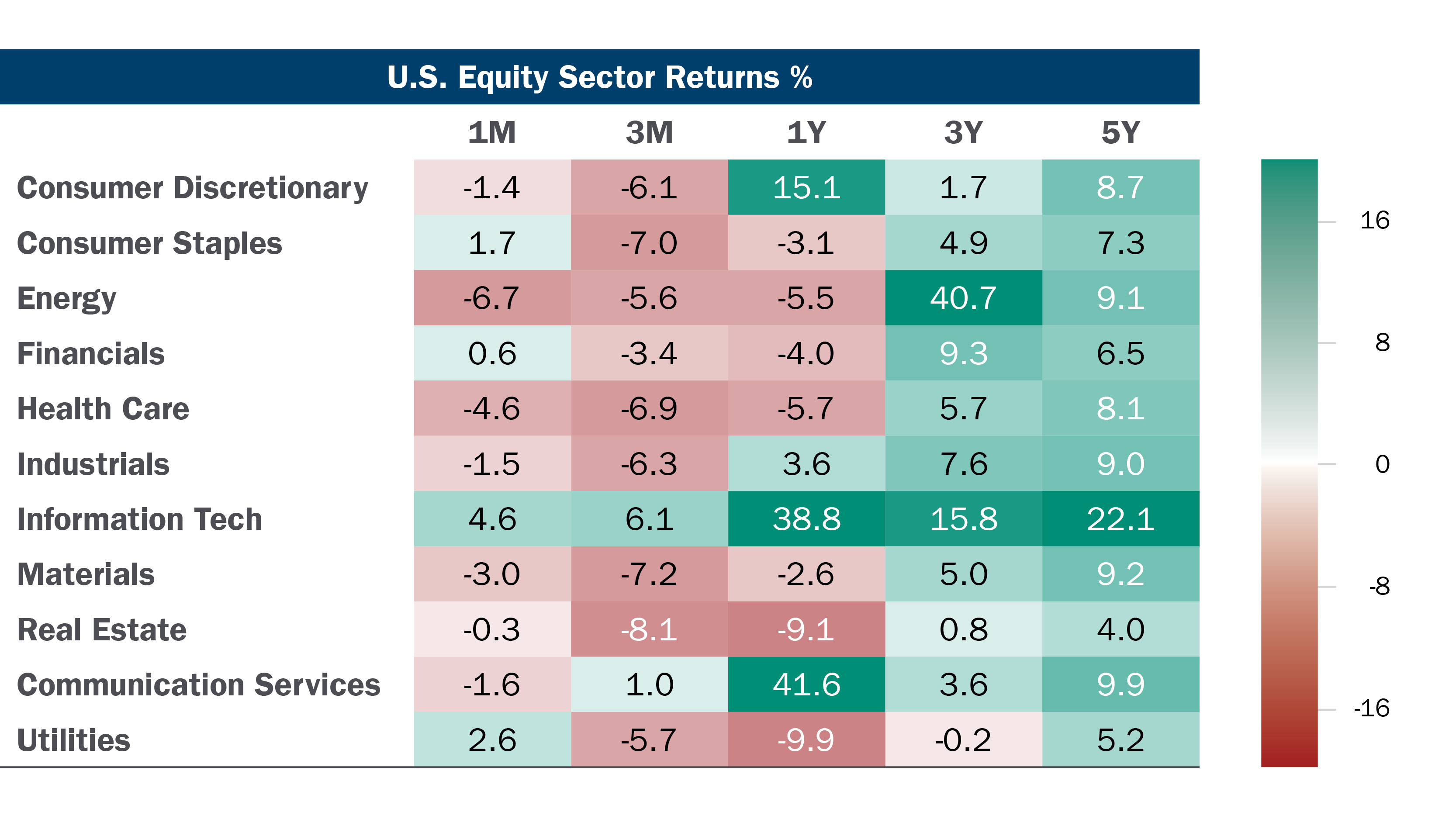

By the end of October, it was clear that investors had somewhat soured on stocks. The generally positive momentum across the stock market in the first half of 2023 — driven principally by mega-cap tech firms like Nvidia, Microsoft and Apple — had finally worn thin, with broader averages hitting five-month lows by the end of October.

This negative outlook was due to a confluence of dynamics: Inflation was moderating slowly, interest rates had climbed aggressively, recession risks loomed and earnings growth (while improving this year) faced added headwinds in the quarters ahead. Simply, the stew of risks outweighed the opportunities forming across the stock market, given investors could earn competitive yields on cash/cash-like investments. And considering the U.S. economy grew by a stunning +4.9% in Q3, driven by strong consumer spending, it had become more apparent to market participants that the Federal Reserve was unlikely to cut rates anytime soon.

Are the storm clouds beginning to part?

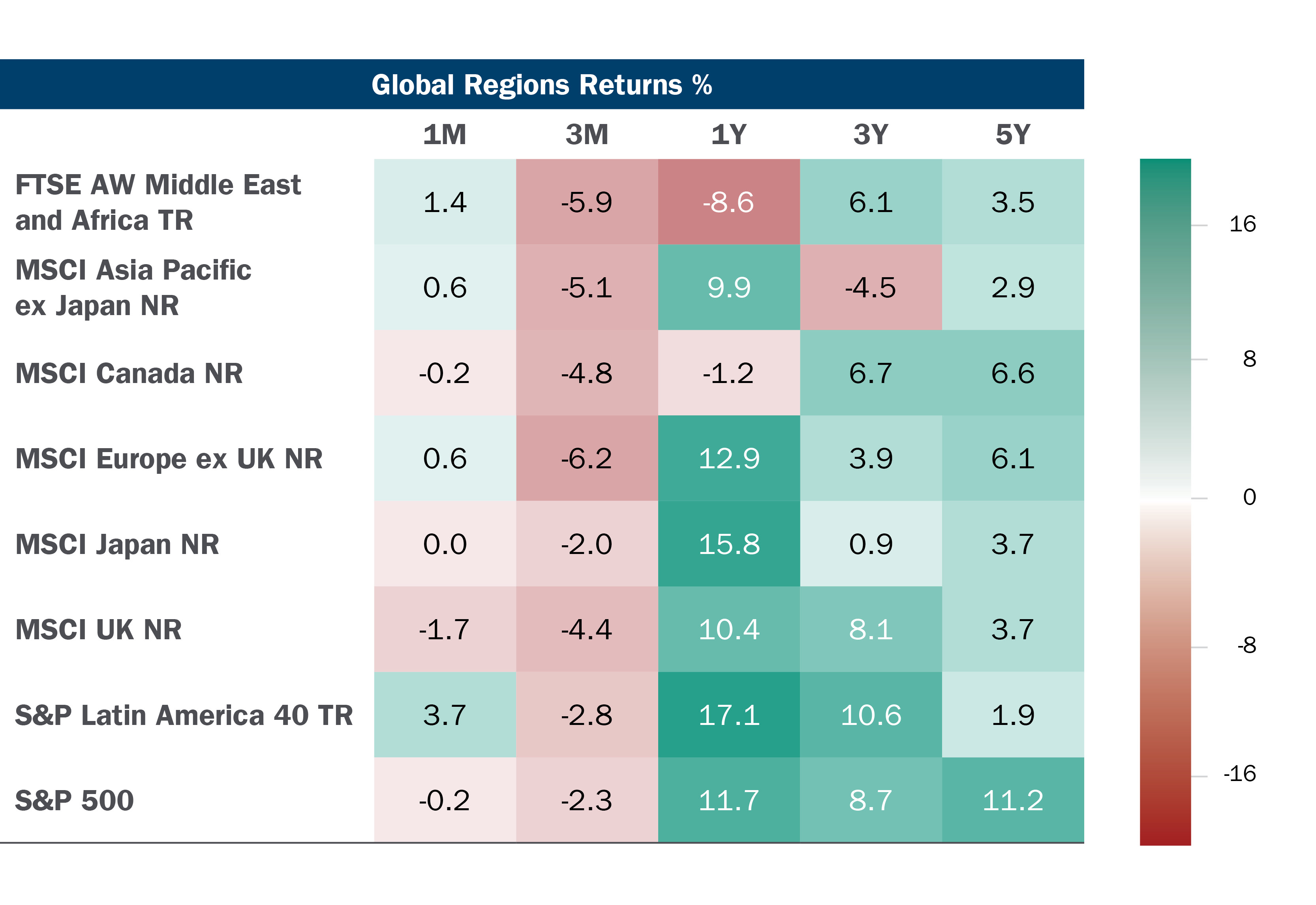

The turn into November marks a more favorable window for stocks through year-end, historically. The November-through-December period typically marks the best two-month period for the S&P 500 Index over the calendar year, posting an average gain of roughly +3.0% over that stretch, according to FactSet.

Unfortunately, investors had placed a strong focus on the storm clouds gathering around the big backup in government bond yields over recent months, oversold stock conditions, concerns about elevated inflation pressures leading to a recession, and ongoing geopolitical tensions. While some of these storm clouds remain, too much investor negativity mixed with extremely oversold stock conditions can provide a great recipe for kickstarting the market higher — even if it proves to be a temporary development.

Notably, stocks started November with a bang, reversing some of the more extreme negativity built into stock prices, and despite solid year-to-date gains for the major averages. Extremely oversold stock conditions at the end of October allowed investors to change the narrative after the Federal Reserve held rates steady this month, and stable economic conditions helped keep a soft-landing scenario for the economy (i.e., no recession) on the table. Importantly, the October Consumer Price Index came in weaker than expected and below September levels. In fact, core CPI last month moved to levels last seen in September 2021. Bottom line: If inflation pressures continue to ease (which we believe they should), the upward pressure on interest rates could also subside, allowing stocks more breathing room to the upside.

As such, the S&P 500 Index and NASDAQ Composite have quickly reclaimed some of their key trading averages, with stock participation looking more inclusive than earlier in the year. As the year winds down, we see markets continuing to adjust to several mixed signals across the economy, earnings trends, policy, and geopolitical risks. But at the heart of the matter, inflation and the direction of interest rates could be the most impactful influences on directing stock traffic over the coming weeks and months.

In our view, government bond yields will likely need to see lasting stabilization for stocks to experience further upside after a strong start to November. Investors should look for how government bond yields settle after a large drop at the start of the month to gauge if equities can continue to build on recent momentum.

Bottom line

Whether it's forming storm clouds on the horizon or periods of sunshine in the stock forecast, we believe a sound path forward for investors is to maintain an all-weather approach heading into year-end. A well-diversified, slightly defensive, quality-biased portfolio approach continues to be a prudent way to navigate through the various uncertainties weighing on markets. In our view, that approach applies rain or shine.

Weather the year-end uncertainty with an Ameriprise financial advisor

The end of the year is a good time to connect with your Ameriprise financial advisor and take steps to help strengthen your diversified approach and help position your portfolio to weather the uncertainty, should it continue. They can help you assess your current risk tolerance and asset allocation strategy, make rebalancing recommendations and determine if strategies like tax-loss harvesting make sense for your unique situation.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Ameriprise Financial associates or affiliates. Actual investments or investment decisions made by Ameriprise Financial and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances.

Some of the opinions, conclusions and forward-looking statements are based on an analysis of information compiled from third-party sources. This information has been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial. It is given for informational purposes only and is not a solicitation to buy or sell the securities mentioned. There is no guarantee that investment objectives will be achieved or that any particular investment will be profitable.

The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as advice designed to meet the specific needs of an individual investor.

There are risks associated with fixed-income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer term securities.

A rise in interest rates may result in a price decline of fixed-income instruments held by the fund, negatively impacting its performance and NAV. Falling rates may result in the fund investing in lower yielding debt instruments, lowering the fund’s income and yield. These risks may be heightened for longer maturity and duration securities.

The fund’s investments may not keep pace with inflation, which may result in losses.

Stock investments involve risk, including loss of principal. High-quality stocks may be appropriate for some investment strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with investing in stocks, as they can lose value.

Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

Asset Allocation and Diversification do not assure a profit or protect against loss.

Third party companies mentioned are not affiliated with Ameriprise Financial, Inc.

Past performance is not a guarantee of future results.

An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Definitions of individual indices and sectors mentioned in this article are available on our website at ameriprise.com/legal/disclosures in the Additional Ameriprise research disclosures section.

The Standard & Poor’s 500 Index (S&P 500® Index), an unmanaged index of common stocks, is frequently used as a general measure of market performance. The index reflects reinvestment of all distributions and changes in market prices but excludes brokerage commissions or other fees.

The NASDAQ Composite Index is a market-capitalization weighted index of all common stocks listed on National Association of Securities Dealers Automated Quotation system (NASDAQ). The NASDAQ Composite dates back to 1971, which is when the NASDAQ exchange was first formalized. Given that this is a market-capitalization weighted index and the fact that the largest market capitalization stocks trading on the exchange are technology related issues; the index is commonly referenced as a measure of technology stock performance, and thus may not be a good indicator of the market as a whole.

The Consumer Price Index (CPI) is an inflation indicator that measures the change in the total cost of a fixed basket of products and services, including housing, electricity, food, and transportation. The CPI is published monthly by the Commerce Department and is also commonly referred to as the cost-of-living index.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.

© 2023 Ameriprise Financial, Inc. All rights reserved.

Return to My Accounts

Return to My Accounts