Stocks rally as global central banks lean into positions supportive of economic growth

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — March 25, 2024

Last week offered a few surprises. The Bank of Japan hiked interest rates for the first time in seventeen years, the Federal Reserve continued to pencil in three rate cuts for this year despite lifting its inflation forecast, and the S&P 500 Index made its twentieth all-time high of the year last week. In addition, the Bank of England left rate policy unchanged, and the Swiss National Bank (SNB) unexpectedly cut its key interest rate by 25 basis points. The move by the SNB marks the first such reduction out of one of the world’s ten most-traded currencies since the pandemic. Bottom line: Stocks here and abroad rallied higher last week, principally on major global central banks leaning into positions that remain supportive of economic growth this year while acknowledging existing inflation pressures should ebb back to normal with time.

“Stocks here and abroad rallied higher last week, principally on major global central banks leaning into positions that remain supportive of economic growth this year while acknowledging existing inflation pressures should ebb back to normal with time.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Stocks rally higher

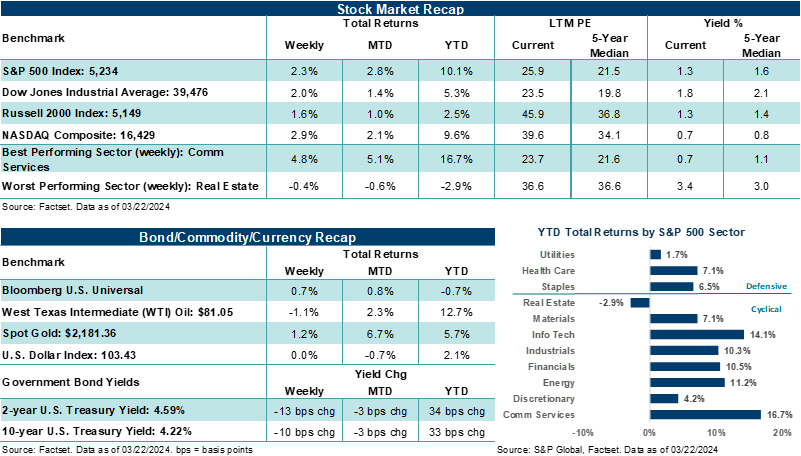

The S&P 500 Index and NASDAQ Composite snapped two-week losing streaks, with each gaining over +2.0% last week. The Dow Jones Industrials Average and Russell 2000 Index also moved higher on the week but trailed each of the larger-cap growth-orientated indexes. The S&P 500 put in its best week of the year, the NASDAQ saw its best weekly performance since January, and the Dow notched its best week since December. Notably, all the major U.S. stock averages have posted fresh new 52-week highs in March and are on pace for another month of gains as the first quarter quickly comes to a close.

In fact, all the major U.S. stock averages are higher in the first quarter heading into the final week of Q1. Of the eleven S&P 500 sectors, only Real Estate is lower on the year. Not surprisingly, Communication Services and Information Technology have led gains in Q1, as outsized profit growth and strong secular tailwinds from AI continue to enamor investors. But interestingly, Energy, Financials, and Industrials are all up double digits in the first quarter, with recent performance providing early signs that investors are beginning to look for opportunities outside Big Tech and in anticipation of lower interest rates later this year. A stable economy, still strong labor trends, reduced recession fears, and expectations for improved profit growth have provided a sizeable tailwind to stock prices in the first quarter. Combined with expectations for easing inflation and less restrictive monetary policies as we move through the year, stocks in the U.S. are on pace to post another strong quarter of gains.

Overseas, Europe’s STOXX 600 Index and Japan’s Nikkei 225 Index also made fresh 52-week highs last week. As Bespoke Investment Group noted, it’s quite rare for the S&P 500, STOXX 600, and Nikkei 225 to be hitting new 52-week highs simultaneously. Given it took thirty years for the Nikkei to finally surpass an all-time high, it shouldn’t be too surprising all three global stock benchmarks making new 52-week highs at the same time is a rare feat (only thirteen times since 1987, to be exact). As Bespoke highlights, while median returns for each index are generally in line with historical averages over the next year after simultaneously hitting new 52-week highs, returns in the U.S. were significantly higher than in Europe and Japan over the next twelve months. That said, improving fundamental conditions in Europe, combined with relatively attractive valuations and a cyclical focus across broad European benchmarks, could be an area investors turn toward to broaden their equity opportunities over the coming quarters. And stronger corporate governance, continued shareholder-friendly actions, normalizing policy conditions, and improved inflation trends may help support Japanese equities.

Outside of stocks, U.S. Treasury prices were firmer across the curve last week, Gold was fractionally lower, and West Texas Intermediate (WTI) crude was down 1.1%. On the quarter, stock investors have largely looked past the large bump higher in U.S. government bond yields this year while discounting the nearly +13% rise in WTI in 2024. Higher yields, if left unchecked, increase borrowing costs for businesses and consumers and could weigh on financial conditions over time. In addition, stronger oil prices somewhat push back on expectations for lower inflation as the year moves on, at least from a headline perspective.

Soft-landing scenario remains firmly intact

As we alluded to above, central bankers were the main event last week. As expected, the Federal Reserve left its fed funds rate unchanged at 5.25% to 5.50% for the fifth consecutive meeting. The current rate sits at its highest levels in more than 23 years but has helped push down core PCE to +2.8% at the end of January from +4.2% in July 2023. And despite the Federal Reserve’s updated forecast for higher growth, higher inflation, and lower unemployment in 2024 relative to its December projections, policymakers, in aggregate, continue to pencil in three 25-basis point rate cuts this year. In our view, that’s the major takeaway from last week’s Fed meeting, and it leaves the soft-landing scenario for this year firmly intact. From our standpoint, this means the Fed now looks less likely to leave rates at highly restrictive levels this year as long as it is confident inflation remains on a downward trend.

Notably, we have likely already entered a period where the Federal Reserve is now less likely to surprise the market from here on out. Unlike in 2022 and early 2023, where the Fed had to aggressively restrict policy to address high inflation, often catching the market off-guard with its moves, policy changes over the coming months and possibly quarters could be well-scripted and choreographed by officials. This should allow investors to finally re-center their focus on the fundamentals, including the overall level of economic growth as well as trends across corporate profits. Frankly, this is a far better use of investors' time, and it returns the attention to areas that have greater longer-term impacts on stock performance. This theme of a normalized macroeconomic environment, and one where investment decisions can be made on a stable foundation, is a concept we highlighted in our 2024 Outlook reports. The theme continues to hold water in our view.

Developed world central banks likely to move from a headwind to tailwind

As for the other major developed world central banks on tap last week, the Bank of Japan (BOJ) lifted its target short-term rate to around 0% to 0.1%, from negative 0.1%, for the first time since 2007. Wage increases and stable inflation around the BOJ’s 2.0% target were cited as reasons for the hike. Notably, BOJ Governor Ueda reinforced a gradual approach to normalizing the BOJ’s target rate, highlighting extreme accommodative monetary policies had served their roles. Although the era of an ultra-easy framework in Japan is likely over, BOJ policy is expected to remain accommodative for the foreseeable future. And in the U.K., the Bank of England (BOE) left rate policy unchanged, as expected, but noted that restrictive policies are now weighing on activity and loosening employment conditions. A stabilizing U.K. economy, following a mild recession in the second half of 2023, should allow time for the BOE to confirm economic conditions warrant lower rates sometime later this year. For additional color, market odds currently point to a summer rate cut by the European Central Bank.

Bottom line: Markets expect most developed world central banks to move from a headwind for asset prices to a tailwind in 2024. Hence, stocks have moved higher in the first quarter in anticipation of the first rate cuts.

Finally on the week, flash March manufacturing PMI hit its highest level since June 2002, while services PMI came in a tad weaker than expected. Builder confidence improved for the fourth straight month, with the measure moving back into expansion. Also, on the housing front, housing starts and building permits beat expectations, with existing home sales seeing its biggest jump in a year.

The week ahead

This week brings additional looks at housing conditions in the U.S., with a final look at February building permits and updates on February new home sales and the January S&P/Case-Shiller Home Price Index. March Consumer Confidence on Tuesday and a final look at Q4’23 U.S. GDP on Thursday will also grab some investor attention. FactSet estimates call for U.S. GDP in the final quarter of last year to tick up to +3.3% from +3.2% in the previous estimate. Interestingly, the Atlanta Fed’s GDPNOW forecast currently points to +2.1% growth in the first quarter of this year, which would be a shift lower from the fourth quarter but a couple of ticks above the longer-term cruising speed of the U.S. economy. Finally, while markets in the U.S. will be closed for Good Friday, the U.S. Bureau of Economic Analysis will release the closely watched February Personal Consumption Expenditure (PCE) Price Index. The last look at February inflation trends is expected to show the Fed’s preferred measure holding firm at +2.8% year-over-year on the core side (ex., food and energy) and slightly falling month-over-month versus January levels.

These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Sources: FactSet and Bloomberg. FactSet and Bloomberg are independent investment research companies that compile and provide financial data and analytics to firms and investment professionals such as Ameriprise Financial and its analysts. They are not affiliated with Ameriprise Financial, Inc.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Ameriprise Financial associates or affiliates. Actual investments or investment decisions made by Ameriprise Financial and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances.

Some of the opinions, conclusions and forward-looking statements are based on an analysis of information compiled from third-party sources. This information has been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial. It is given for informational purposes only and is not a solicitation to buy or sell the securities mentioned. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as advice designed to meet the specific needs of an individual investor.

Stock investments involve risk, including loss of principal. High-quality stocks may be appropriate for some investment strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with investing in stocks, as they can lose value.

The fund’s investments may not keep pace with inflation, which may result in losses.

A rise in interest rates may result in a price decline of fixed-income instruments held by the fund, negatively impacting its performance and NAV. Falling rates may result in the fund investing in lower yielding debt instruments, lowering the fund’s income and yield. These risks may be heightened for longer maturity and duration securities.

The products of technology companies may be subject to severe competition and rapid obsolescence, and their stocks may be subject to greater price fluctuations.

Past performance is not a guarantee of future results.

An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Definitions of individual indices and sectors mentioned in this article are available on our website at ameriprise.com/legal/disclosures in the Additional Ameriprise research disclosures section.

The Dow Jones Industrial Average (DJIA) is an index containing stocks of 30 Large-Cap corporations in the United States. The index is owned and maintained by Dow Jones & Company.

The Standard & Poor’s 500 Index (S&P 500® Index), an unmanaged index of common stocks, is frequently used as a general measure of market performance. The index reflects reinvestment of all distributions and changes in market prices but excludes brokerage commissions or other fees.

The NASDAQ composite index measures all NASDAQ domestic and international based common type stocks listed on the Nasdaq Stock Market.

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Russell 2000 includes the smallest 2000 securities in the Russell 3000.

The Purchasing Managers Index (PMI) is a measure of the prevailing direction of economic trends in manufacturing that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting.

The GDPNow forecasting model provides a "nowcast" of the official GDP estimate prior to its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis. GDPNow is not an official forecast of the Atlanta Fed. It is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model.

Personal consumption expenditures (PCE) are a measure of the outlays or how much consumers are spending. The PCE reading is released monthly by the Bureau of Economic Analysis.

Third party companies mentioned are not affiliated with Ameriprise Financial, Inc.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.

Return to My Accounts

Return to My Accounts