Can a strong start for stocks set the tone for the rest of the year?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — April 8, 2024

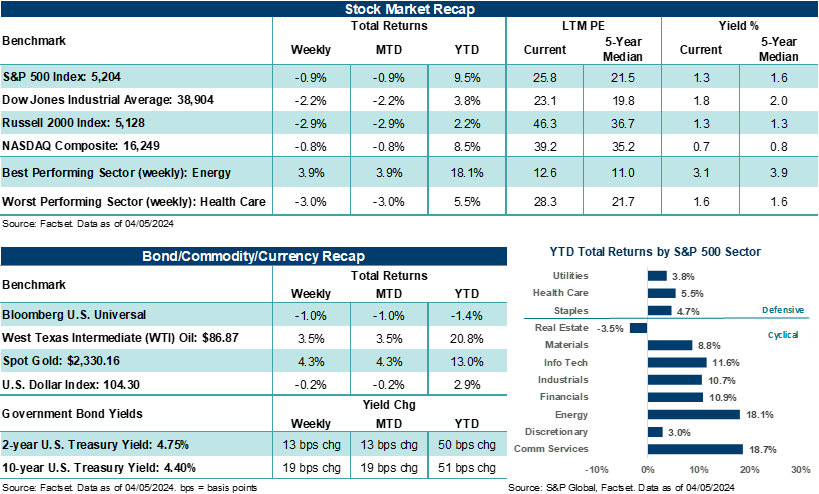

The S&P 500 Index and NASDAQ Composite finished last week lower, while the Dow Jones Industrials Average recorded its worst week of 2024. Government bond yields climbed higher on the week after mixed economic data/Fed speeches showed the Federal Reserve may not be as ready to cut interest rates as both policymakers and the market believed just a few weeks ago. Energy and Communication Services were the only S&P 500 sectors to finish the week positively, while Health Care, Real Estate, and Consumer Staples took the brunt of the selling pressure.

U.S. Treasury prices were notably weaker across the curve last week as yields moved higher. Year-to-date, the 2-year and 10-year Treasury yields are up over 50 basis points, with the 10-year yield recording its highest level of the year last week. The U.S. Dollar Index pulled back slightly, and Gold pushed higher for its best week since October, moving above $2,300 per ounce. West Texas Intermediate (WTI) crude settled higher, hitting its best levels in six months.

“Looking out over coming quarters, history suggests a strong start to the year for stocks can bode well for investors through the rest of the year. In the other 16 years that the S&P 500 rose +8.0% or more in the first quarter only in 1987 did the Index close the year lower.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Coming into the first week of the second quarter, stocks were coming off an incredible first quarter of performance. The S&P 500 Index finished the first three months of the year higher by +10.6% for its fifth positive quarter out of the last six. The double-digit gain is just the fourth time since 2000 that the Index has gained more than +8.0% in the first quarter and only the 17th time since 1950, according to Dow Jones Market Data. A strong U.S. economic backdrop, moderating inflation pressures, improving profit conditions, and expectations the Federal Reserve will lower its fed funds rate in the second half of this year were the principal reasons behind stocks tacking on additional gains in Q1 and after the S&P 500 rose +24% in 2023.

Stocks Move Higher on Q1 Profit Growth Expectations

Also, stocks continued to soar higher in the first quarter on building enthusiasm around Artificial Intelligence (AI). Expectations that accelerating profit growth across the AI ecosystem could keep lifting Big Tech higher in 2024 and also smaller-sized companies associated with the theme gave major averages a lift. However, dispersion in performance across the Magnificent Seven in Q1 indicates investors are becoming more discerning about which companies they are willing to push higher, given already extended valuations across a handful of mega-cap stocks.

Interestingly, Health Care and Consumer Staples logged their best quarters since the fourth quarter of 2022, while Financials recorded its fifth straight month of gains — its best run since 2018. In March alone, the Russell 2000 Index rose +3.4%, outperforming the S&P 500’s +3.1% gain and the NASDAQ’s +1.8% return. In our view, a still strong U.S. economy, healthy consumer/business spending trends, and the potential for lower interest rates by year-end fueled investors' appetite for relative-value opportunities outside of Tech/Growth as Q1 came to a close. We believe reduced recession odds for this year, given central bankers’ perceived willingness to cut rates in 2024, also helped the rally broaden in Q1.

However, some of those good vibes from Q1 took a hit last week. In a barrage of Fed speeches, policymakers continued to express caution, reiterating that it is too soon to declare victory on curbing inflation and that further evidence of its decline will be needed before the Federal Reserve is comfortable reducing its target rate. Bottom line: Barring an unforeseen shock or unexpected deterioration in labor conditions over the next few months (more on that in a moment), the Federal Reserve is more likely to leave rate policy unchanged, which pushes back on assumptions that the Fed is near a point where they are comfortable lowering their policy rate. Market odds now point to a roughly 50/50 chance the Fed will cut its target rate at the June meeting, down from approximately 70/30 odds in favor of a cut one month ago.

Employment Report Shows Labor Trends Are Strong and Resilient

Also helping to inform that change in Fed expectations were several economic reports last week that showed the economy is doing just fine at current rate levels. For example, manufacturing ISM moved back into expansion last month for the first time since September 2022. In addition, final S&P Global U.S. manufacturing PMI remained in expansion in March, with factory output growth hitting a 22-month high. ADP private payrolls jumped to +184,000 last month and higher than the upwardly revised +155,000 private payrolls in February. That said, the March services ISM report came in a little weaker-than-expected last week and down from February levels, though it remained firmly in expansion. S&P Global U.S. services PMI also ticked down to a three-month low in March, though also remained firmly in expansion. Given that the services side of the economy represents roughly 70% of U.S. GDP and is showing signs of slowing, we believe investors took a breath by the end of the week and following data showing rebounding conditions across manufacturing and still strong labor trends.

Speaking of labor trends, U.S. nonfarm payrolls grew by an unexpectedly robust +303,000 last month, and well ahead of the +205,000 jobs expected. The prior two months of job gains were revised higher by +22,000. Job growth last month was strong across healthcare, government, and leisure and hospitality. The unemployment rate dropped to 3.8% in March, down from 3.9% in February, as more workers entered the workforce. Notably, average hourly earnings (a measure of wage inflation) came in largely as expected on a month-over-month basis but fell to +4.1% year-over-year — the lowest level since June 2021.

Bottom line: Labor trends in the U.S. are strong and showing incredible resiliency, in our view. Current economic strength and recent inflation trends showing signs of stickiness likely complicate the Fed’s path moving forward, at least over the next few months. As a result, investors should expect some bumps in the road at some point, particularly against rate cut expectations for this year. In our view, the Fed is very unlikely to cut their target rate before their June meeting and may disappoint investors on the number of rate cuts for this year “if” inflation trends firm and labor conditions remain strong over the coming months.

The Week Ahead

Looking out over coming quarters, history suggests a strong start to the year for stocks can bode well for investors through the rest of the year. In the other 16 years that the S&P 500 rose +8.0% or more in the first quarter only in 1987 did the Index close the year lower. Per Dow Jones Market Data, the other 15 years saw the S&P 500 close the year higher for an average gain of +9.7% over the subsequent three quarters.

Notably, year-over-year profit growth expectations accelerate as the year moves forward. FactSet estimates currently call for S&P 500 earnings per share (EPS) to grow by +2.8% in Q1, +8.8% in Q2, +7.7% in Q3, and by an eye-popping +17.5% in Q4. Given we see economic growth slowing over the course of the year and consumer trends normalizing, outsized profit growth (at least versus expectations later in the year) could be somewhat difficult for companies in aggregate to achieve. Notably, the major U.S. stock averages have not had to deal with an extended period of consolidation or a typical downdraft of 5%, 10%, or even 15%, which can occur during any given year. Investors should expect stocks to face some headwinds at some point for reasons that are likely less obvious today. One example could include interest rates continuing to ramp higher due to stronger-than-expected growth, inflation pressures, and/or growing concerns about the level of deficit spending.

Yet, given underlying consumer/business strength and recession risks for this year coming down, we believe near-term stock weakness could be met with eventual buying activity. So, at the start of the second quarter, investors should stick relatively close to strategic targets, diversify across sectors (including cyclical value areas), and favor the U.S. as well as developed markets, such as Europe and Japan.

This week, it’s all about inflation. Investors will get a look at the March Consumer Price Index on Wednesday and the Producer Price Index on Thursday. Core inflation is expected to moderate month-over-month on both a consumer and producer price basis but remains elevated on a year-over-year headline basis. Higher energy prices are likely to play a factor in driving headline inflation figures for March. In the background this week, an update on the NFIB Small Business Index, the March FOMC meeting minutes, and a preliminary look at April Michigan Sentiment will capture investor interest. Finally, the start of the Q1 earnings season kicks off this week, with Delta Airlines, JPMorgan Chase, BlackRock, and Wells Fargo all providing first looks into corporate profit trends during the first quarter.

These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Sources: FactSet and Bloomberg. FactSet and Bloomberg are independent investment research companies that compile and provide financial data and analytics to firms and investment professionals such as Ameriprise Financial and its analysts. They are not affiliated with Ameriprise Financial, Inc.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Ameriprise Financial associates or affiliates. Actual investments or investment decisions made by Ameriprise Financial and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances.

Some of the opinions, conclusions and forward-looking statements are based on an analysis of information compiled from third-party sources. This information has been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial. It is given for informational purposes only and is not a solicitation to buy or sell the securities mentioned. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as advice designed to meet the specific needs of an individual investor.

Commodity investments may be affected by the overall market and industry- and commodity-specific factors and may be more volatile and less liquid than other investments.

Stock investments involve risk, including loss of principal. High-quality stocks may be appropriate for some investment strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with investing in stocks, as they can lose value.

The fund’s investments may not keep pace with inflation, which may result in losses.

A rise in interest rates may result in a price decline of fixed-income instruments held by the fund, negatively impacting its performance and NAV. Falling rates may result in the fund investing in lower yielding debt instruments, lowering the fund’s income and yield. These risks may be heightened for longer maturity and duration securities.

The products of technology companies may be subject to severe competition and rapid obsolescence, and their stocks may be subject to greater price fluctuations.

Past performance is not a guarantee of future results.

An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Definitions of individual indices and sectors mentioned in this article are available on our website at ameriprise.com/legal/disclosures in the Additional Ameriprise research disclosures section.

The Dow Jones Industrial Average (DJIA) is an index containing stocks of 30 Large-Cap corporations in the United States. The index is owned and maintained by Dow Jones & Company.

The Standard & Poor’s 500 Index (S&P 500® Index), an unmanaged index of common stocks, is frequently used as a general measure of market performance. The index reflects reinvestment of all distributions and changes in market prices but excludes brokerage commissions or other fees.

The NASDAQ composite index measures all NASDAQ domestic and international based common type stocks listed on the Nasdaq Stock Market.

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Russell 2000 includes the smallest 2000 securities in the Russell 3000.

The US Dollar Index (USDX) indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. This is computed by using rates supplied by approximately 500 banks.

The ADP National Employment Report is a monthly report of economic data that tracks nonfarm private employment in the U.S.

The Consumer Price Index (CPI) is an inflation indicator that measures the change in the total cost of a fixed basket of products and services, including housing, electricity, food, and transportation. The CPI is published monthly by the Commerce Department and is also commonly referred to as the cost-of-living index.

The Institute for Supply Management (ISM) manufacturing index is a national manufacturing index based on a survey of purchasing executives at roughly 300 industrial companies. It is an index of the prevailing direction of economic trends in the manufacturing and service sectors.

University of Michigan Consumer Sentiment Survey is a rotating panel survey based on a nationally representative sample of households in the coterminous U.S. The minimum monthly change required for significance at the 95% level in the Sentiment Index is 4.8 points; for Current and Expectations Index the minimum is 6.0 points.

Producer Price Index (PPI) measures change in the prices paid to U.S. producers of goods and services. It is a measure of inflation at the wholesale level. The index is published monthly by the U.S. Bureau of Labor Statistics (BLS).

Third party companies mentioned are not affiliated with Ameriprise Financial, Inc.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.

Return to My Accounts

Return to My Accounts