Why return to fixed income, now?

Brian Erickson, Fixed Income Strategist – Ameriprise Financial

Feb. 19, 2024

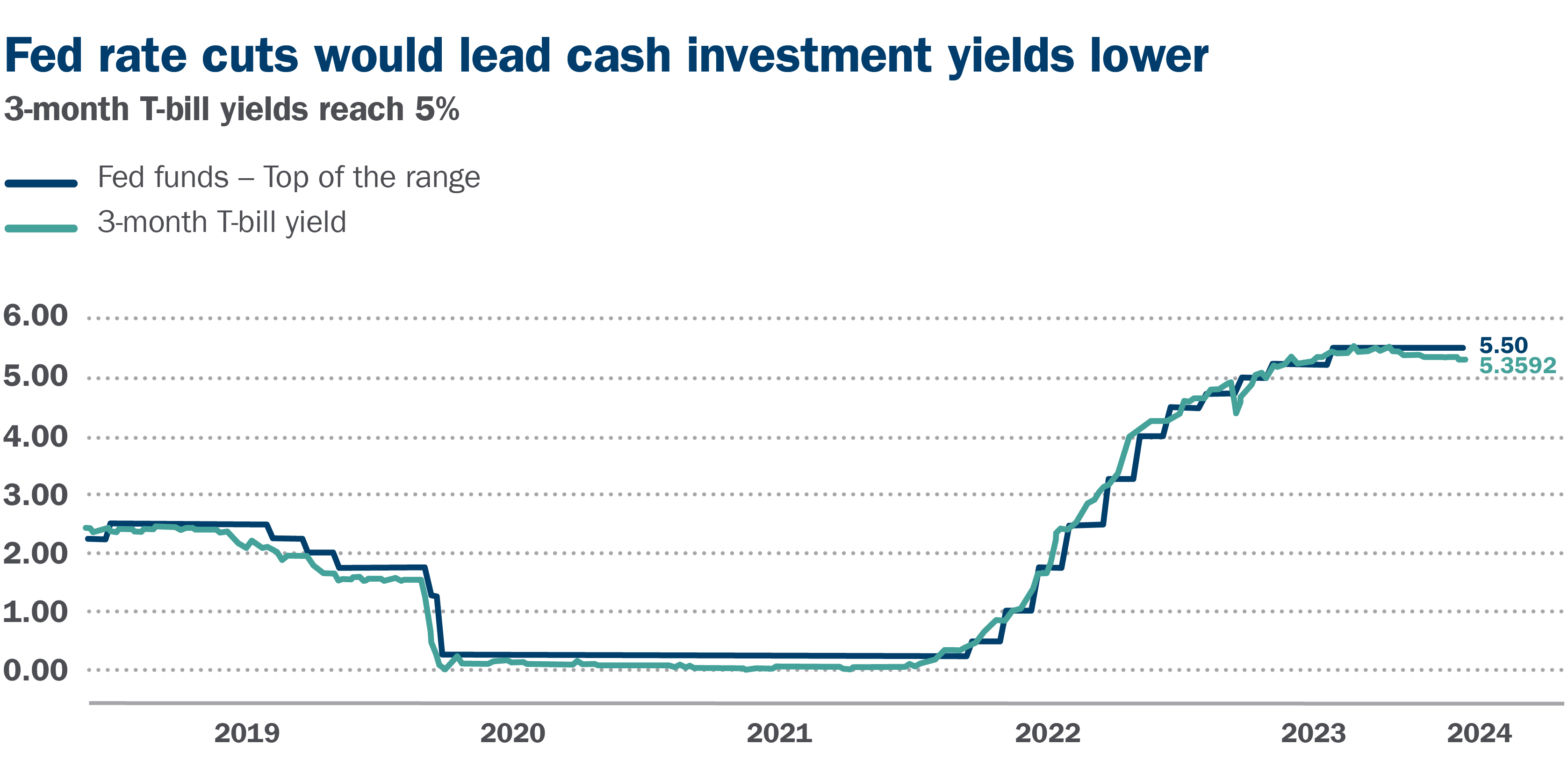

The Federal Reserve may begin cutting its rate policy in the next few months, presenting a unique opening for investors who want to lock in the elevated returns they are currently receiving from cash investments.

Here’s what you need to know about this window of opportunity:

Why fixed income may be the long-term play

If Fed rate cuts do transpire, they will likely quickly lower attractive yields on cash investments, such as money market accounts. Consequently, investors may want to consider moving excess cash investments into longer-term, fixed income investments.

Source: Bloomberg L.P.

Should your fixed-income portfolio have veered off course, whether through the excruciatingly low yields of 2021 or the bond market rout of 2022, it’s wise for investors to go back to the basics and consider rebuilding their fixed income portfolios, now, while bond yields remain elevated.

The window of opportunity may be closing

Fixed income may be an attractive opportunity as inflation continues to settle lower, compared to the past decade. The pendulum has swung from one extreme to another, from stunningly low yields in 2020 to robust inflation-adjusted yields today.

Fixed income markets will likely remain a few steps ahead of the Fed and cash investment rates. This suggests that as cash investment yields become less attractive, fixed income yields will already be lower and potentially less compelling than today.

Look for rate-sensitive fixed income

While interest rate sensitivity may have pinched fixed income investors in 2021 and 2022 as inflation soared, fixed income is poised to earn healthy total returns this year.

In general, prices rise as yields fall in fixed income. So, investing in higher-yielding fixed income today could capture yield with the potential for positive price performance should market yields continue to fall, tracking cash investment yields lower along with Fed rate cuts.

Also, investors looking for long-term income can also lock in today’s attractive yield until bonds in the portfolio mature, extending investment income generation through longer-term bond investments.

Bottom line: Cash investors should explore their options

Earning yield for a day is good, but earning today’s elevated yields for a longer time is better. Even if the yield on intermediate-term bonds is slightly lower than cash investment rates, fixed income’s longevity is a valuable feature.

Connect with your Ameriprise financial advisor to review your cash investments and bond allocation. They will help tune your portfolio, if needed, to today’s opportunity in fixed income in alignment with your long-term investment goals.

The views expressed in this material are the views of Brian Erickson through the period ended February 19, 2024 and are subject to change without notice at any time based upon market and other factors. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. This information may contain certain statements that may be deemed forward-looking. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those discussed. There is no guarantee that investment objectives will be achieved or that any particular investment will be profitable. Past performance does not guarantee future results.

This information is being provided only as a general source of information and is not a solicitation to buy or sell any securities, accounts or strategies mentioned. The information is not intended to be used as the primary basis for investment decisions, nor should it be construed as a recommendation or advice designed to meet the particular needs of an individual investor. Please consult with your financial advisor regarding your specific financial situation.

There are risks associated with fixed-income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer term securities.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.

Return to My Accounts

Return to My Accounts