Guide to investment risk tolerance

Whether you're just starting to invest for retirement, or have a substantial amount set aside, the foundation of investing is understanding your comfort with risk, adjusting the mix of assets in your portfolio and diversifying your investments within it.

As you near retirement, you may want to assess your comfort with risk, adjust the mix of assets in your portfolio accordingly and select a diverse range of investments to help protect your portfolio from market volatility and prepare you to live off your savings.

Once retired, your focus shifts from saving to generating income from your savings in retirement. You'll want to re-assess your comfort with risk, determine if a different mix of assets is appropriate, then select the investments that best align with your needs.

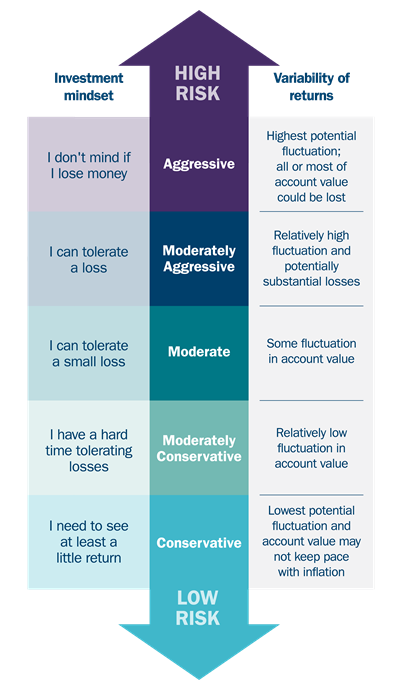

Risk tolerance categories

Conservative

I am willing to accept the lowest return potential in exchange for the lowest potential fluctuation in my account value even if it may not keep pace with inflation.

Moderately conservative

I am willing to accept a relatively low return potential in exchange for relatively low fluctuation in account value.

Moderate

I am willing to accept a moderate return potential in exchange for some fluctuation in account value.

Moderately aggressive

I am seeking a relatively high return potential and am willing to accept a relatively high fluctuation and potentially substantial loss in my account value.

Aggressive

I am seeking the highest return potential and am willing to accept the highest fluctuation and could lose most or all of my account value.

As retirement approaches, you have less time to recover from market losses. While it may be tempting to avoid risk completely, you still have time for your assets to grow, and should consider taking advantage of that potential.

Once you retire, your comfort with risk may be lower than it was during your working life. However tempting it may be to avoid risk completely, you may still need to have some assets in growth-oriented investments to give your dollars the potential needed to outpace inflation and to last throughout retirement.

To determine tolerance for risk, Ameriprise financial advisors ask investors to answer a risk tolerance questionnaire.

Investing

6 key investment principles

Learn how to become a more successful investor with the time-tested investment strategies of dollar-cost averaging, asset allocation, diversification and more.

Read MoreRevising your asset allocation

Once you understand your risk tolerance, you can construct your asset allocation strategy—the mix of investments in your portfolio. As you approach retirement, your asset allocation strategies will change, and you may want to make adjustments to help protect you from market risk while retaining potential for growth. In retirement, your asset allocation needs to generate income from your savings while growing your overall portfolio.

Diversifying your portfolio

Once you select your asset allocation, you need to choose the investments within it. The goal of diversification is to invest in a range of products such as cash vehicles, bonds and stocks, or mutual funds, so that your assets are spread over many unrelated companies, industries and regions. Diversification is an important strategy that can help reduce risk in your portfolio. While some of your investments may lose value, those losses may be offset by gains in other investments.

Determining your risk tolerance, constructing an asset allocation strategy and diversifying your underlying investments can be a complex process. An Ameriprise financial advisor can help you understand and apply these concepts and review the progress of your portfolio on a regular basis to help meet your needs.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

Return to My Accounts

Return to My Accounts