6 key investment principles for long-term investors

It’s not possible to predict what the markets will do in the future, but these investing tips may help improve your investment success over the long term.

An Ameriprise financial advisor can help you employ and balance these and other investment strategies as you work toward your long-term financial goals and manage short-term market changes.

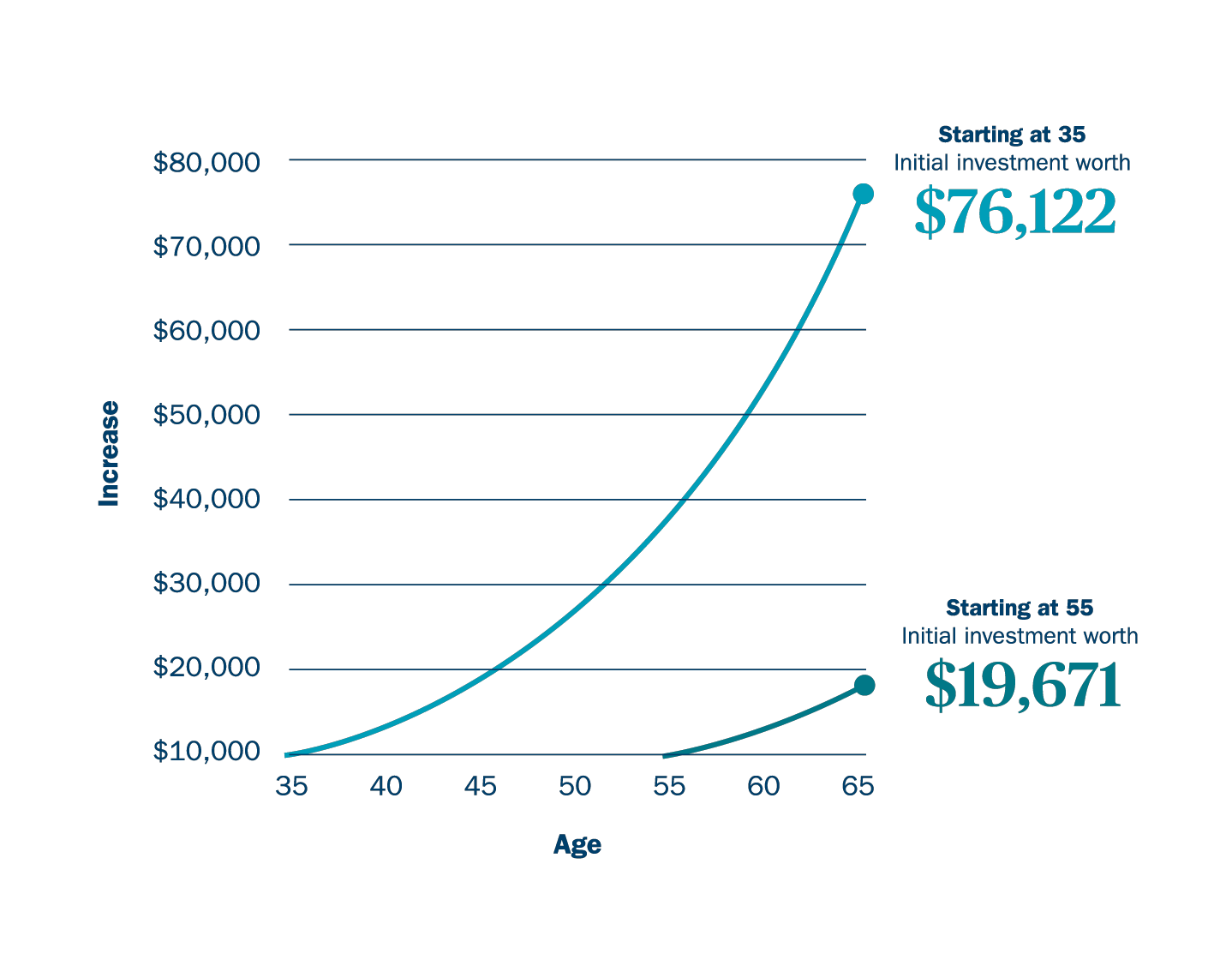

1. Leverage the power of compound returns

Over time, as your investments generate earnings, if you reinvest those earnings, you have the potential to generate even more earnings on the earnings. This is the core idea of compound growth. Without any extra effort on your part, compounding returns and time work together to potentially increase your investment returns.

If you start saving early, you take advantage of the effects of compounding returns on your investments over a long period of time. This has the potential to increase your total returns.

How compounding interest can help increase returns

Based on an initial $10,000 investment and 7% annual growth per year*

*This illustration is hypothetical and is meant to show the effects of compound interest. It is not meant to represent the past or future returns of any specific investment or investment strategy, or imply any guaranteed earnings. This illustration does not reflect sales charges or other expenses that may be required for some investments.

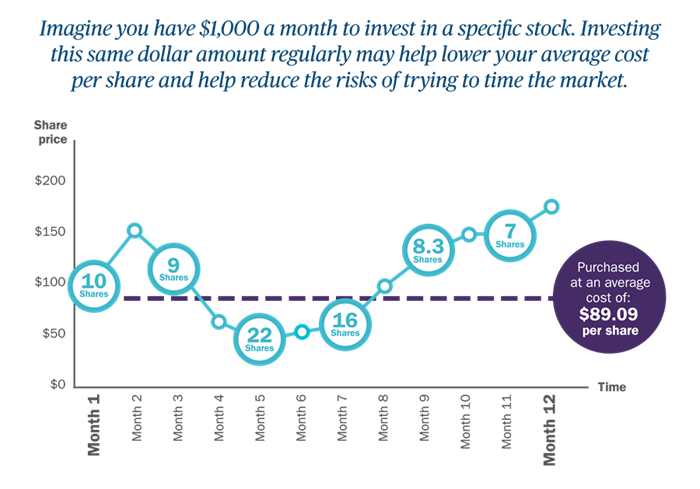

2. Use dollar-cost averaging

Sticking to the discipline of dollar-cost averaging can help you avoid making emotional decisions based on market turbulence. With dollar-cost averaging, you invest a certain amount of money at regular intervals, regardless of what the market is doing. By always investing the same dollar amount every month or other chosen period, you naturally buy fewer shares when the market is high and more shares when the market is low.

This illustration is hypothetical and is not meant to represent any specific investment or imply any guarantee.

3. Invest for the long term

It may be tempting to try and time the market — buy and sell investments based on what you believe the market is going to do in the future — but you risk losing quite a bit of money, over time. During volatility, the worst days in the market are often closely followed by some very good days. When you take money out of the market on a downturn, you may miss the subsequent upswing and recovery in prices.

Time is on the side of the investor and a buy-and-hold strategy usually produces better results in the long term.

An Ameriprise financial advisor can help you create a personalized investment plan that looks at both inflation and your long-term goals, to help you retire with more confidence.

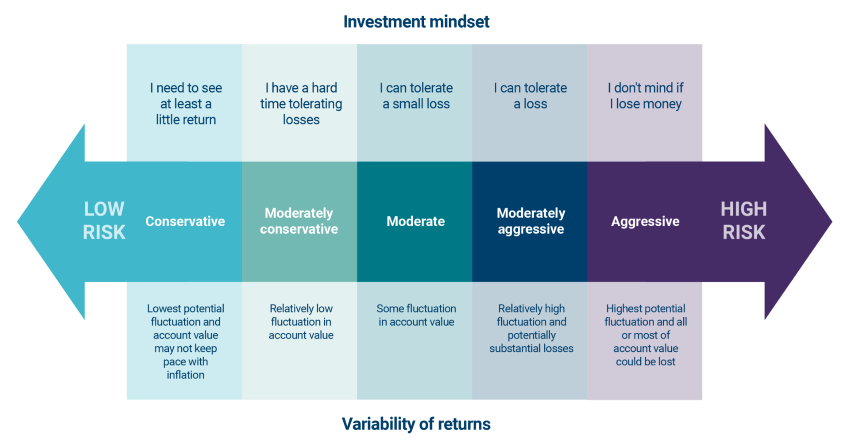

4. Take your risk tolerance level into account

What are your goals for investing? Are you comfortable losing money if the stock market performs poorly or does any sort of investment loss make you nervous? These are the types of questions to think about and discuss with an Ameriprise financial advisor to help gauge your tolerance for risk.

Investors with more time to recoup market losses may be more comfortable taking risks. However, as you near retirement or if you’re already retired, you may want to adjust your risk tolerance to make sure your investments are consistent with your goals.

Once you’ve determined how much risk you’re willing to accept and what your investing time frame is, your Ameriprise advisor can help you allocate assets and diversify your portfolio accordingly.

You can determine your risk tolerance for investing by answering a few questions.

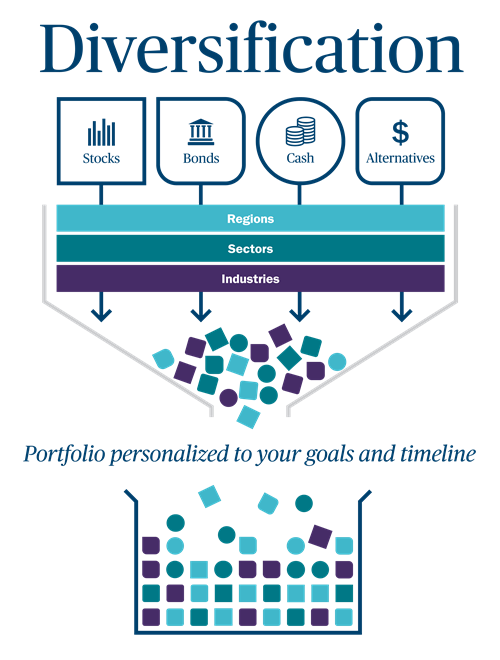

5. Benefit from diversification and strategic asset allocation

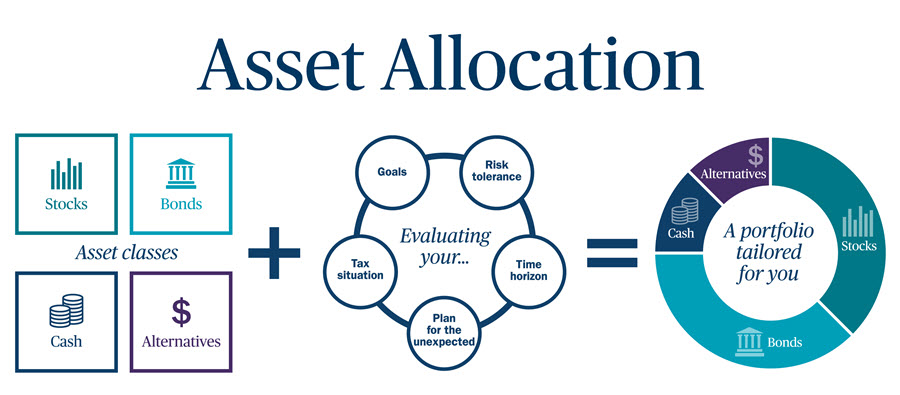

Diversification refers to the mix of investments in your portfolio, such as stocks, bonds, alternative investments and cash for the purpose of helping to mitigate risk. By including a variety of investment types, you reduce your dependence on the performance of any single investment. Think of the adage, “Don’t put all your eggs in one basket.”

Asset allocation refers to being planful about the amount you invest in each asset class. It is the nature of markets that different asset types typically react differently to changes in the market — while one class is performing poorly, another is likely doing better. The right asset allocation strategy will factor in your goals, risk tolerance, time horizon and tax sensitivity.

6. Review and rebalance your portfolio regularly

Over time, investments within your portfolio will grow at different paces. As a result, your diversification and asset allocation can become unbalanced. Add in any changes to your income, risk tolerance or family situation, and your investments may no longer reflect your goals. An annual review of your portfolio with your Ameriprise financial advisor will give you an opportunity to fine-tune and rebalance your portfolio to help you stay on track toward meeting your financial goals.

Ready to get started? We’re here to help.

These investment principles can go a long way in making your money work for you. An Ameriprise financial advisor will listen to your concerns, get to know what matters most to you and provide personalized recommendations for a diversified portfolio with solutions to help you stay on track through all types of market conditions.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.