Our approach

Navigate the present while staying focused on your financial future with our exclusive Confident Retirement® approach. Ameriprise financial advisors will guide you – first by gaining an understanding of your goals, then by providing the personalized advice to help you reach them.

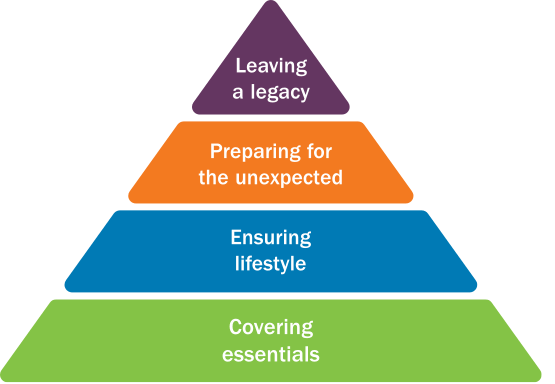

How the Confident Retirement approach works

Our Confident Retirement approach can help ensure you’re prepared for your financial future starting with your current situation. Together, you and your financial advisor identify actionable steps to help you bring your goals to life. The strategies you design together will address four key needs:

Covering Essentials

Essentials are the necessities - the monthly expenses that keep your life running. Your financial advisor helps you make the most of your income, build a cash reserve and cover essential expenses in retirement with guaranteed or stable income.

Ensuring Lifestyle

Lifestyle is about the things you want to do and how you want to live today and in the future. Your financial advisor helps you build an investment strategy based on your specific goals. In retirement, they’ll help identify a flexible and effective withdrawal plan.

Preparing for the Unexpected

The unexpected are events that could derail your plans. Your financial advisor helps you protect yourself from the certainty of uncertainty by covering the unexpected.

Leaving a Legacy

Legacy is about the impact you'll make on the people, charities, and causes that are important to you. Your financial advisor can help you plan now to maximize your giving and make your wishes known.

Prepare for your financial future no matter where you are in life

Get an idea of how a conversation with a financial advisor can help you. Check your financial confidence and see how you compare to Ameriprise clients in four key areas of your finances.

of Ameriprise clients say their advisor provided advice that addressed their needs.1

of Ameriprise clients say they now feel more confident about retirement.1

of Ameriprise clients say they now feel more confident about retirement.1

of Ameriprise clients say they now feel more confident about retirement.1

Plan for your future through personalized financial advice. Find an Ameriprise financial advisor that can help you take the first step towards a more confident financial future.

1Ameriprise Financial Goal-Based Advice Survey. Results from July 2018 through July 2023, reflecting 10,523 client responses. The percentages cited reflect those who agree or strongly agree with each statement (on a 5-point scale). Clients may complete a survey via the secure site after their goals are published online.

Ameriprise Financial cannot guarantee future financial results.

The Confident Retirement approach is not a guarantee of future financial results.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.

Return to My Accounts

Return to My Accounts