Debt often carries a negative stigma. But using debt responsibly can be an essential part of a comprehensive financial strategy — and can help you to build wealth. An Ameriprise financial advisor is prepared to help you understand how your debt fits into your overall financial picture and can affect your financial goals. As you evaluate your current debts — or are considering financing a major expense — here are some debt management tips and strategies:

Know how much debt you can afford

The key to managing debt is taking on only as much as you can afford to repay.

One way to do that is to determine your debt-to-income ratio. To calculate this metric, tally all your minimum monthly debt payments — including your mortgage or rent and student, auto and other loan payments — and divide the total by your pre-tax monthly income. The result will be in the form of a percentage.

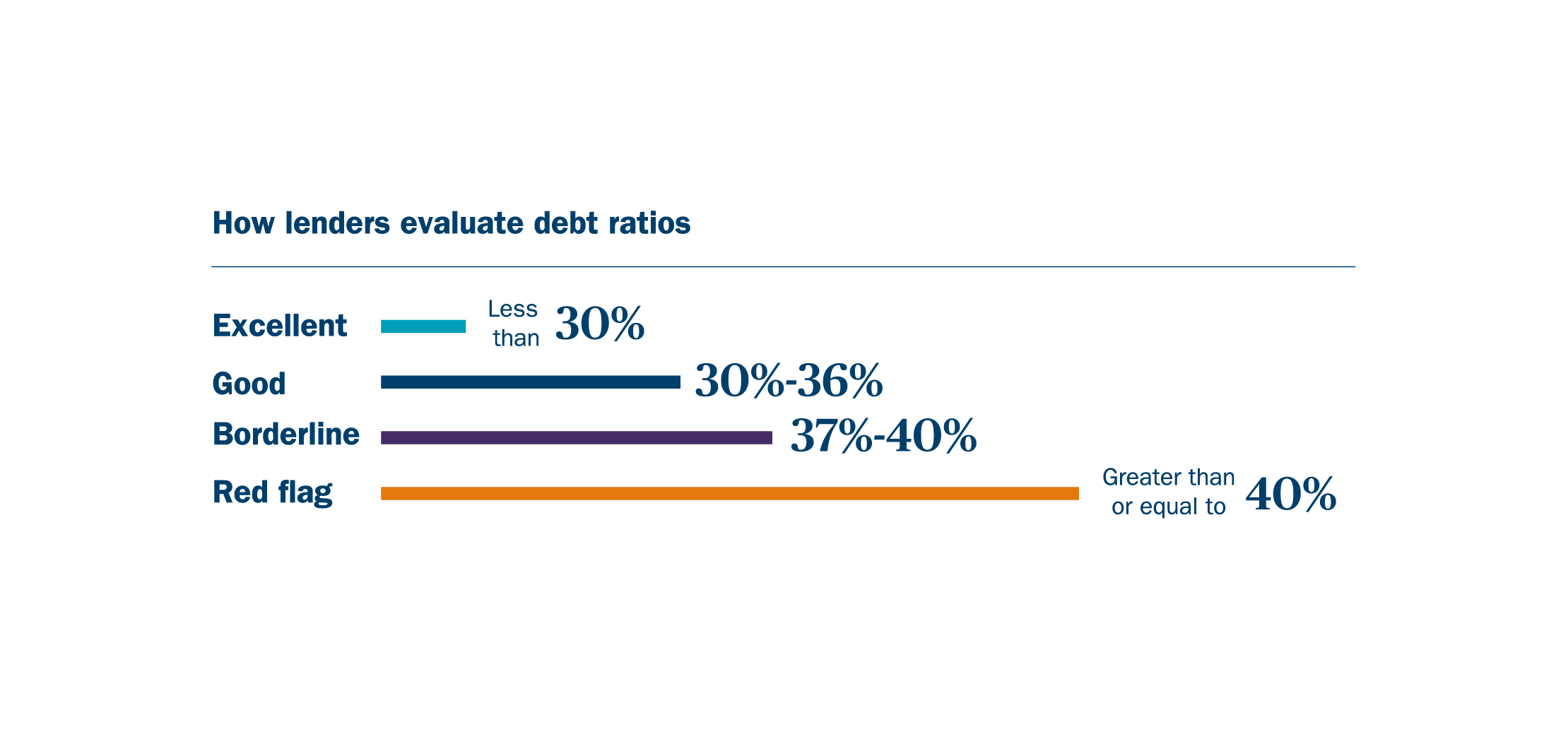

While there are no absolutes in determining desirable debt-to-income ratios, the following are general guidelines for how lenders evaluate potential borrowers:

Purchasing a home? Keep the 28/36 rule in mind

The 28/36 rule is a way that lenders calculate the debt a potential homebuyer can reasonably take on. Under this guideline, a household should spend no more than:

- 28% of their pre-tax monthly income on housing expenses (including mortgage, insurance and taxes)

- 36% of their pre-tax monthly income on all debt payments (including housing)

Understand the difference between good debt and bad debt

Like many things, debt is complicated. Too much debt can be a problem for some people, yet it can also help you reach your financial goals provided it’s managed responsibly.

- “Good” debt is characterized as low-interest debt that helps you increase your income or net worth. Examples include educational loans, a mortgage or a business loan. Debt can also be considered good if it helps you build credit.

- “Bad” debt is characterized as high-interest debt that is used to purchase depreciating assets. Examples include using credit cards to buy clothing, furniture, or other goods that immediately lose value — then not paying off the balance and building up interest charges.

Of course, too much debt can turn good debt into bad debt. And many kinds of debt don’t fall into either category and depends on your financial situation or other factors.

Learn more: How to save and pay for a big purchase

Be smart about credit cards

Credit cards offer a host of benefits. They’re convenient. They build a credit history. And they can be a helpful tool for tracking your spending. Most credit cards also provide various security features, including liability protection for fraud or even travel and rental car protection.

For all their benefits, however, credit cards are a less-than-ideal way to borrow money, as they carry high interest rates on any balances you don’t pay off right away. To avoid those high fees, here are a few debt management tips:

- Only charge what you can pay off each month.

- Keep your monthly charges to 20% or less of your maximum credit limit.

- Always pay your bill on time.

Use tried-and-true strategies to pay down debt faster

While paying off debt may seem overwhelming at times, there are practical measures to accelerate your repayment schedule or reduce the amount of interest you’re paying. Loan consolidation, the avalanche method and the snowball strategy are all approaches that can help you tackle debt effectively.

Learn more: Strategies to help pay off debt faster

Know when it makes sense to prioritize investing versus paying off debt

The psychological benefits of being debt-free are undeniable. However, if you’re behind on your retirement savings or if you have an especially low interest rate on a mortgage loan, it may not be beneficial — from a pure numbers standpoint — to prioritize paying off your debt, compared to the returns you could make in the market. Additionally, certain debts — such as mortgages, home equity loans and student loans — offer tax benefits, so be aware of how that dynamic affects your overall financial picture.

It will depend on your unique situation and goals. For some, the sense of freedom that comes from no loan balance is worth more than the potential returns had they invested. Reflect on your priorities, run the numbers and be comfortable with any tradeoffs you’re making.

Learn more: Is it better to pay off your mortgage or invest?

Make sure you have a cash reserve

Even if your priority is paying down your debt, consider setting aside a portion of your monthly income for a cash reserve or emergency fund. This pool of money can act as a cushion, potentially preventing you from getting deeper into debt if you face an unexpected expense.

Learn more: Establishing a cash reserve: How much should you have?

Build a budget to manage expenses

A big part of debt management is knowing how to avoid debt. Creating a household budget — and sticking to it — will help you stay on top of debt payments and systematically save for other goals.

Learn more: Personal budgeting strategies to help reach your goals

Balance debt with your other long-term goals

Whether you’re rethinking how to manage your current debts or considering taking on new loans, an Ameriprise financial advisor is prepared to provide personalized advice unique to your situation.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.