Establishing a cash reserve: How much should you have?

Find out what is a cash reserve and how it can help prepare you for life’s unexpected events — and keep you on track for your financial goals.

Establishing an adequate cash reserve is a key step to achieving financial wellbeing and more security, as it allows you to prepare for emergency expenses.

But how much money should you have in your cash reserve? And is it possible for your cash reserve to be too big? An Ameriprise financial advisor can help determine how much you should have and how to structure a healthy cash reserve to help your money work for you.

As you consider your options, here are answers to common questions:

In this article:

What is a cash reserve? And why is it so important?

A cash reserve is money set aside to pay for unexpected expenses such as a major home or auto repair or household needs in the event of a job loss. Instead of prematurely liquidating investments or using credit cards, a cash reserve can help ensure that your progress toward your financial goals isn’t disrupted by unexpected events.

A cash reserve can be crucial if you already have debt because it can help you avoid borrowing additional money in case of an emergency. It can also be critical for retirees, providing a buffer against unanticipated expenses in retirement, especially health care costs.

How much cash reserve should I have?

Many people plan to set aside enough money to cover three to six months of essential expenses, which includes housing, transportation, utilities, groceries and medical expenses. However, what qualifies as an adequate amount of emergency cash depends on your situation, stage of life and needs that could arise. Here are general guidelines:

- Families with two incomes may find that a cash reserve on the lower end of the three- to six-month spectrum may be adequate.

- Single-income families should consider establishing a cash reserve of six months of savings or more, as a job loss could cut off all household income.

- High-income earners and those with highly specialized jobs may want more money set aside in their reserves, as it may take longer to find a comparable employment opportunity in the event of job loss.

- People with variable incomes, such as business owners or those who work on commission or in seasonal jobs, should also consider having a larger cash reserve.

- Retirees should consider having a cash reserve to cover as much as 12 to 24 months of essential expenses — or three times the difference between annual dependable income and annual necessary expenses.

- Certain life circumstances may call for a bigger cash reserve. The following groups may want to consider saving beyond six months of expenses: Homeowners, especially those who own older homes; people who have high-deductible insurance policies; and those who would have to travel far to visit family members in an emergency.

Where should I keep my cash reserve?

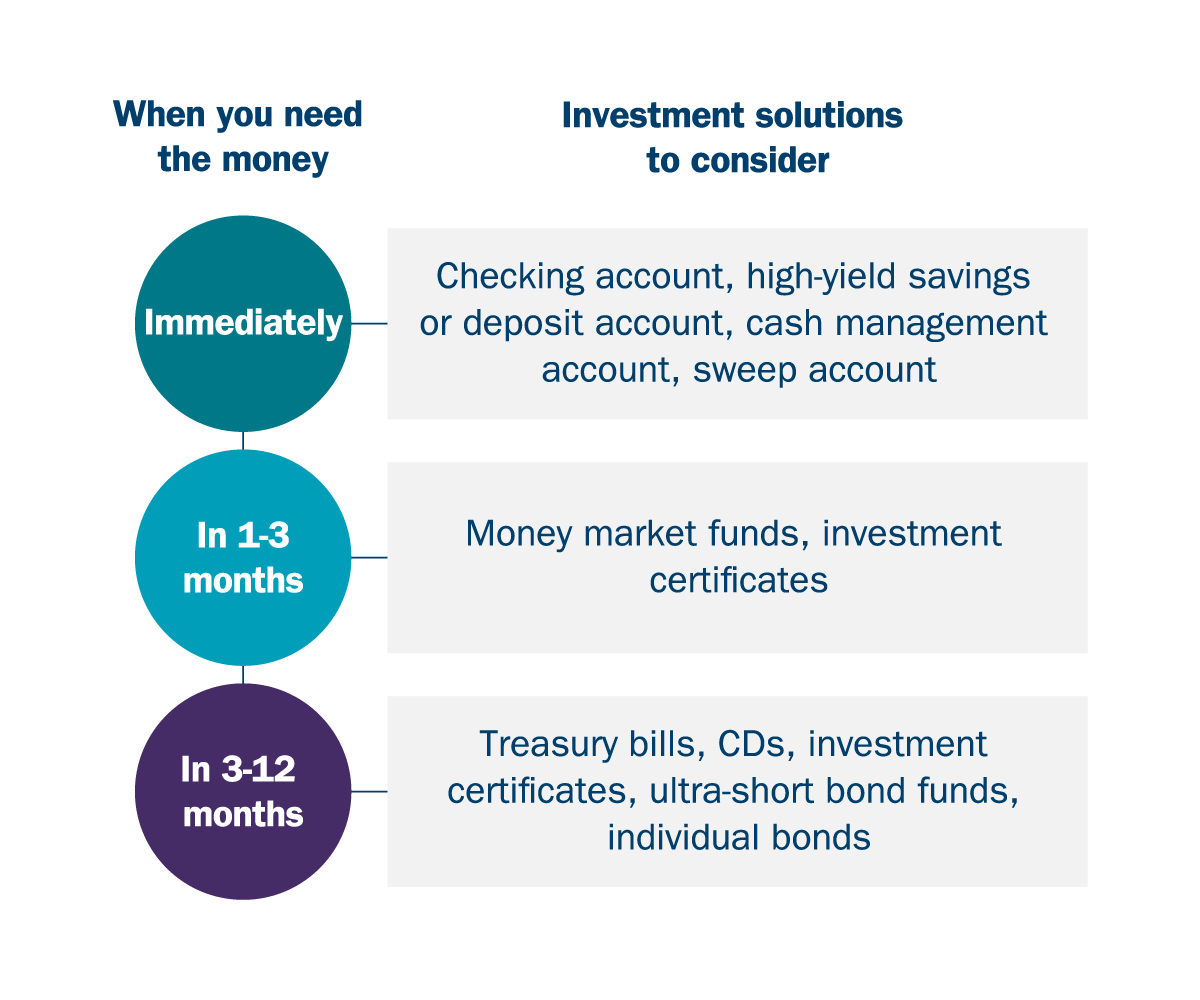

While the money in a cash reserve should be available in an emergency — whether tomorrow, in a month or a year — you also want your money to work for you. To do that, consider a three-tiered structure for your emergency fund, which can provide liquidity and the potential to outpace inflation:

How do I build a cash reserve?

Consider a systematic saving plan, in which you automatically set aside a specific amount of your income at regular intervals to build your savings.

Learn more: How a systematic savings plan can help you reach your goals

What are my other options for accessing money in case of an emergency?

If you want to pay for unexpected expenses without using a cash reserve or liquidating investments, a line of credit may be an option. However, talk to us about the advantages and risks before pursuing these possibilities:

- Home equity lines of credit (HELOC) allow you to take a loan against the equity in your house, often at rates much lower than other lending options. You may choose to open a HELOC at any time to provide an option in case funds are needed, provided you have sufficient equity in your home.

- Securities-based lines of credit allow you to borrow against the value of your nonqualified investment portfolio. It can provide a flexible lending solution to cover unplanned expenses.

Learn more: How to save and pay for a big purchase

Plan for the unexpected

Your Ameriprise financial advisor can help you build your cash reserve to prepare for unexpected expenses while keeping you on track for your financial goals.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.