Retirement looks different for everyone. Some want to spend their post-working years traveling, while others hope to master a new skill, spend more time with loved ones or volunteer for a cause close to their heart.

Whatever your retirement goals, you need a plan to get there. An Ameriprise financial advisor can help you prepare for this important milestone, while balancing the need to save for retirement with other important financial priorities.

Here are seven key steps as you start saving for retirement.

1. Have a clear retirement vision

It’s hard to reach a goal if you don’t define it. Envisioning your post-work life and being clear about your retirement goals will help you plan for other financial needs and priorities. And while your plan will depend on your unique circumstances — including your income, family situation and time horizon — there are universal questions you’ll want to ask yourself:

-

When do you want to retire? For example, if you plan to retire early, you may choose to save more aggressively and consider saving outside of traditional retirement investment vehicles so that you can access your funds at an earlier age, without penalty.

-

What lifestyle do you want in retirement? Think about what you’d like to do when you’re no longer working. How do you envision your life? Give some thought to your ideal retirement.

-

How long do you expect your retirement to last? As the average life expectancy rises, it’s prudent to plan for a retirement that could last decades. Consider your life expectancy, family history and current health when thinking about how much you’ll realistically need to save.

2. Identify your retirement number

A common guideline in retirement planning is to save enough money to generate an annual income of 70-80% of your pre-retirement income. This can be a good place to start when identifying an approximate retirement savings number because it can give you a sense of how much you’ll need to start saving over time. But know that it’s just an estimate: Your income will change over the years, and inflation will factor into the calculation too.

Learn more: How much do I need to retire?

Retirement planner calculator

Use this calculator to gain insights into what your financial picture could look like in retirement.

3. Start early

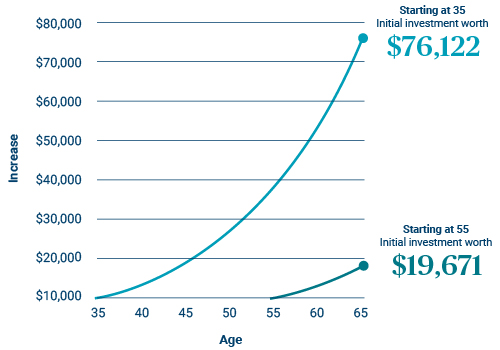

The earlier you start investing, the more you can benefit from the power of compounding growth, an investing principle that demonstrates the snowball effect your investments can experience over a long time horizon. Over time, as you reinvest the earnings on your investments, you can earn returns on your returns. Without any extra effort on your part, the power of compounding and time work together. Overall, when invested over decades, small contributions can grow into a significant sum.

How the power of compounding can help increase returns

Based on an initial $10,000 investment and 7% annual growth per year

This illustration is hypothetical and is meant to show the effects of compound returns. It is not meant to represent the past or future returns of any specific investment or investment strategy, or imply any guaranteed earnings. This illustration does not reflect sales charges or other expenses that may be required for some investments.

4. Save and invest systematically

Saving systematically is the practice of setting aside a specific amount of your income at regular intervals for a particular savings goal. For many investors, it’s foundational to their retirement investment strategy as it offers a simple way to incrementally set aside money for one of life’s largest financial goals.

Regularly saving and investing a portion of your income — through automatic transfers to a 401(k) or IRA, for example — makes it easier to stick to your savings plan because you don’t have to make a conscious effort to save, manually move the money or initiate a trade. It also mitigates the temptation to use those funds for a more immediate need or want.

By saving and investing systematically, you use a strategy known as dollar-cost averaging. With dollar-cost averaging, you consistently invest a fixed amount of money in the market at regular intervals — no matter what the market is doing. That means you diversify the prices at which you buy, naturally acquiring fewer shares when the market is high and more shares when the market is low. This approach can help you remain invested even when markets become volatile and help you build wealth over time.

5. Take advantage of tax-advantaged accounts

Regulated by the federal government, tax-advantaged accounts are designated savings or investment accounts that offer special tax benefits to save for certain priorities, such as retirement. While there are limitations on how much you can contribute to these accounts and when you can withdraw the funds, it’s generally smart to focus on saving in tax-advantaged accounts first. The most popular tax-advantaged accounts are 401(k) plans, IRAs and health savings accounts (HSAs).

Learn more: How to make the most of your retirement savings

6. Remember the impact of taxes

Taxes can be complicated — and in retirement, they can be even more challenging to manage since you’ll likely be drawing from multiple income sources. To help mitigate the impact of taxes on your overall retirement savings, consider how tax diversification may help you. Tax diversification is a strategy that accounts for the tax implications of the assets you will eventually use for retirement income. Because different types of accounts and investments offer different tax advantages, you can gain more flexibility and control over your money by using such a strategy. When coupled with a tax-efficient withdrawal strategy, tax diversification may help your retirement assets last longer.

Learn more: Tax diversification: A strategy to help your retirement assets last

7. Review your plan regularly

Knowing how to start saving for retirement is just the first step — ongoing adjustments are key to staying on track. Regularly review your plan to ensure it continues to reflect your priorities and current income levels. This allows you to account for changes in your lifestyle and adjust your retirement contributions accordingly. For example, maybe you’ve received an unexpected bonus? Or perhaps your cash flow has increased because you no longer have daycare expenses? Both scenarios are ideal opportunities to revisit your plan and determine whether to re-allocate those funds to your retirement savings.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.