Why this may be the right time to sell your practice

You've put off succession planning for years. But when you talk to the industry experts, it's clear 2017 presents a unique opportunity.

There’s no more daunting task than creating a succession plan for your practice. You’re busy. You’d rather be serving clients. Adding to the challenge, it feels more complicated the more successful and sophisticated your business becomes. It’s no wonder most advisors within five years of retirement haven’t identified a successor or succession plan1.

“Many advisors I talk to are surprised just how easy succession planning is when they work with the right firm,” says Pat O’Connell, Executive Vice President, Ameriprise Advisor Group. “At Ameriprise, we offer advisors a unique combination of strategic resources and a ready market for transition.”

The result, O’Connell says, is that Ameriprise allows advisors to retire in their own way while ensuring their practice continues to make a difference in their clients’ lives.

If you know you need a plan but are having trouble getting motivated, here are four reasons why right now may be the ideal time to tackle succession planning.

-

It can add strength and stability to your practice. Interested in finding help navigating a more complex regulatory environment? Hungry for broader access to training, products, services? Need new technology to satisfy consumer demand and mitigate risk? Selling your practice can accomplish all of these things — even in an arrangement where you stay on.

The result: You gain more freedom and time to spend on advising clients. When you do retire, you gain peace of mind, knowing they’ll be well served.

"It’s a big decision, one that’s about more than just you and your retirement," O’Connell says. "It’s about taking care of your clients and associates. The surprising news to many advisors is that a succession plan can actually make a practice stronger. It gives you peace of mind knowing that you have planned for your family, employees and clients.”

-

It’s a great time to get ahead of the retirement curve. The financial advisor community is trending older every year. Nearly half of advisors are now 46 or older, according to a recent Accenture survey, with a significant wave approaching retirement. Industry watchers continue to draw a circle around the large number of business transfers that will need to take place in the next five to 15 years.

For any advisor motivated to avoid the backside of the market, now is the time. You’ve been practicing long enough to build substantial AUM. You’ve survived the Great Recession to see the S&P 500 rise more than 1,400 points since the low point of 2009. Your client base may be in or near its peak earning years. When it comes to practice valuation, will things ever look as good on paper as they do now?

-

The sooner you act, the more likely you can retire on your terms. Not ready to hand over the keys to your practice and walk away? Don’t worry: You don’t have to. Maybe you want to take a step back while someone new takes the reins. Maybe you already have a trusted associate chosen as your successor. Or maybe you really do want to transition your practice and walk away. No matter the scenario, you can structure a deal that works for you and retire your way.

-

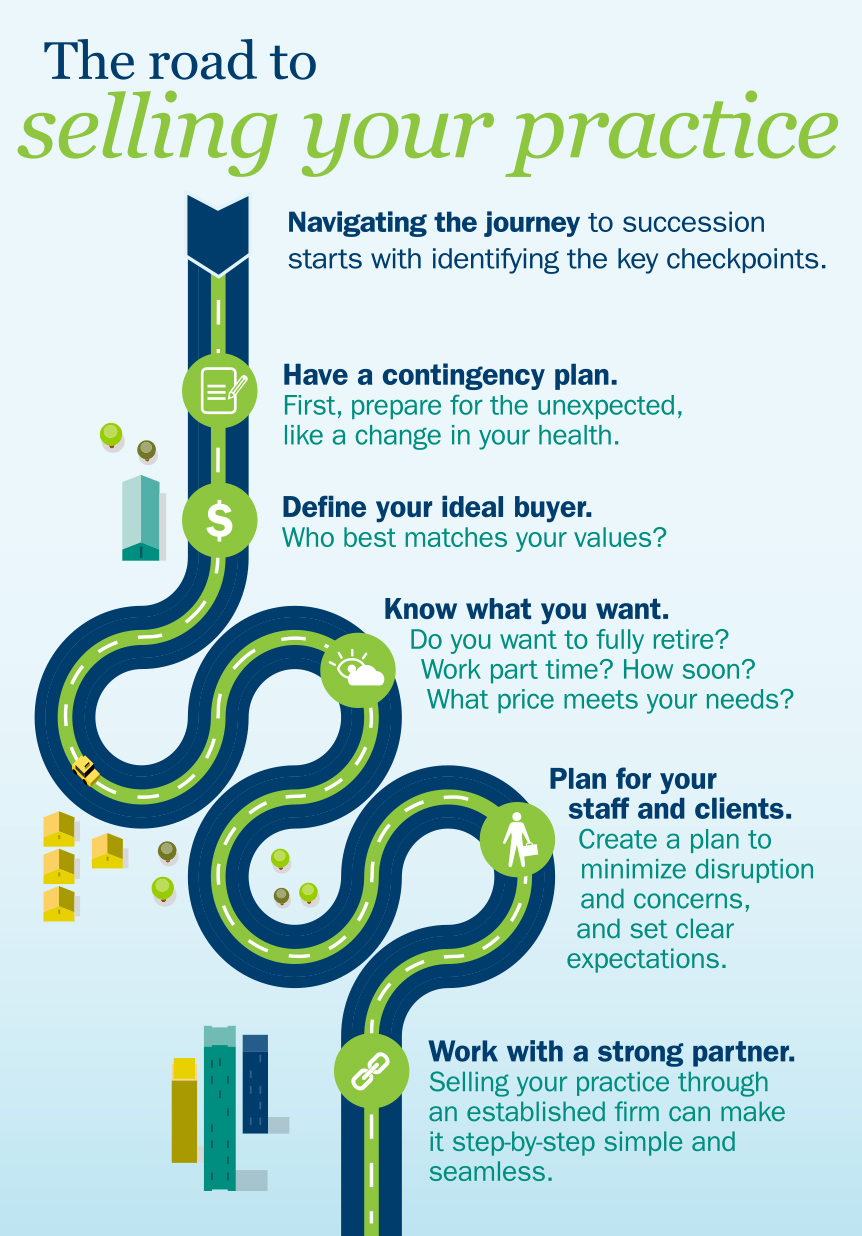

Last but not least, the right firm makes it easier than you think. Many advisors procrastinate succession planning because they fear it will be too time consuming, too painful, and too disruptive to clients. Working with a reputable, full-service firm can mitigate those concerns.

From getting your practice on the market to valuation and due diligence to full-service integration planning, a trusted, established firm can provide a proven path and time-tested methodology that make it possible to get what you want.

“Not only is now an ideal time to tackle your succession plan, now is a really good time to consider working with a firm that can give you access to a bigger, better toolbox,” O’Connell says. “When it’s important to you to structure your sale to serve both your retirement needs and your clients’ long-term financial success, a solid firm with a team of specialists dedicated to support and help manage your transition can make that happen — and make it easier.”

If now is the time to start building your succession plan and finding your successor, look for a broker-dealer that can truly support you, like Ameriprise Financial. Visit ameriprise.com/sell to learn more.